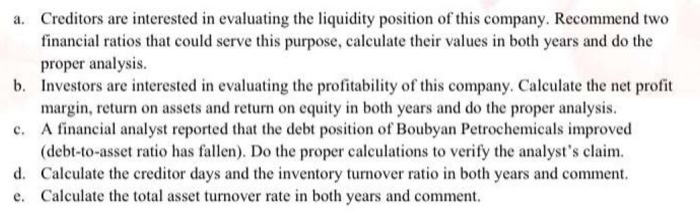

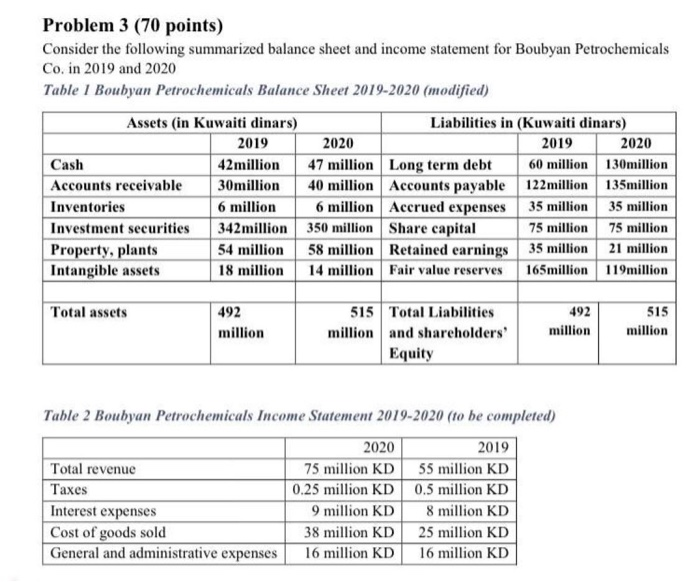

In the questions below, you are expected to: 1. Calculate financial ratios in both years 2. Comment the financial ratios in 2020 only. 3. Comment the change occurred from one year to the next. Questions are on the next page: a. Creditors are interested in evaluating the liquidity position of this company. Recommend two financial ratios that could serve this purpose, calculate their values in both years and do the proper analysis. b. Investors are interested in evaluating the profitability of this company. Calculate the net profit margin, return on assets and return on equity in both years and do the proper analysis. c. A financial analyst reported that the debt position of Boubyan Petrochemicals improved (debt-to-asset ratio has fallen). Do the proper calculations to verify the analyst's claim. d. Calculate the creditor days and the inventory turnover ratio in both years and comment. e. Calculate the total asset turnover rate in both years and comment Problem 3 (70 points) Consider the following summarized balance sheet and income statement for Boubyan Petrochemicals Co. in 2019 and 2020 Table 1 Boubyan Petrochemicals Balance Sheet 2019-2020 (modified) Assets in Kuwaiti dinars) Liabilities in (Kuwaiti dinars) 2019 2020 2019 2020 Cash 42 million 47 million Long term debt 60 million 130million Accounts receivable 30million 40 million Accounts payable 122 million 135million Inventories 6 million 6 million Accrued expenses 35 million 35 million Investment securities 342 million 350 million Share capital 75 million 75 million Property, plants 54 million 58 million Retained earnings 35 million 21 million Intangible assets 18 million 14 million Fair value reserves 165million 119million Total assets 492 million 515 Total Liabilities million and shareholders' Equity 492 million 515 million Table 2 Boubyan Petrochemicals Income Statement 2019-2020 (to be completed) 2020 2019 Total revenue 75 million KD 55 million KD Taxes 0.25 million KD 0.5 million KD Interest expenses 9 million KD 8 million KD Cost of goods sold 38 million KD 25 million KD General and administrative expenses 16 million KD 16 million KD