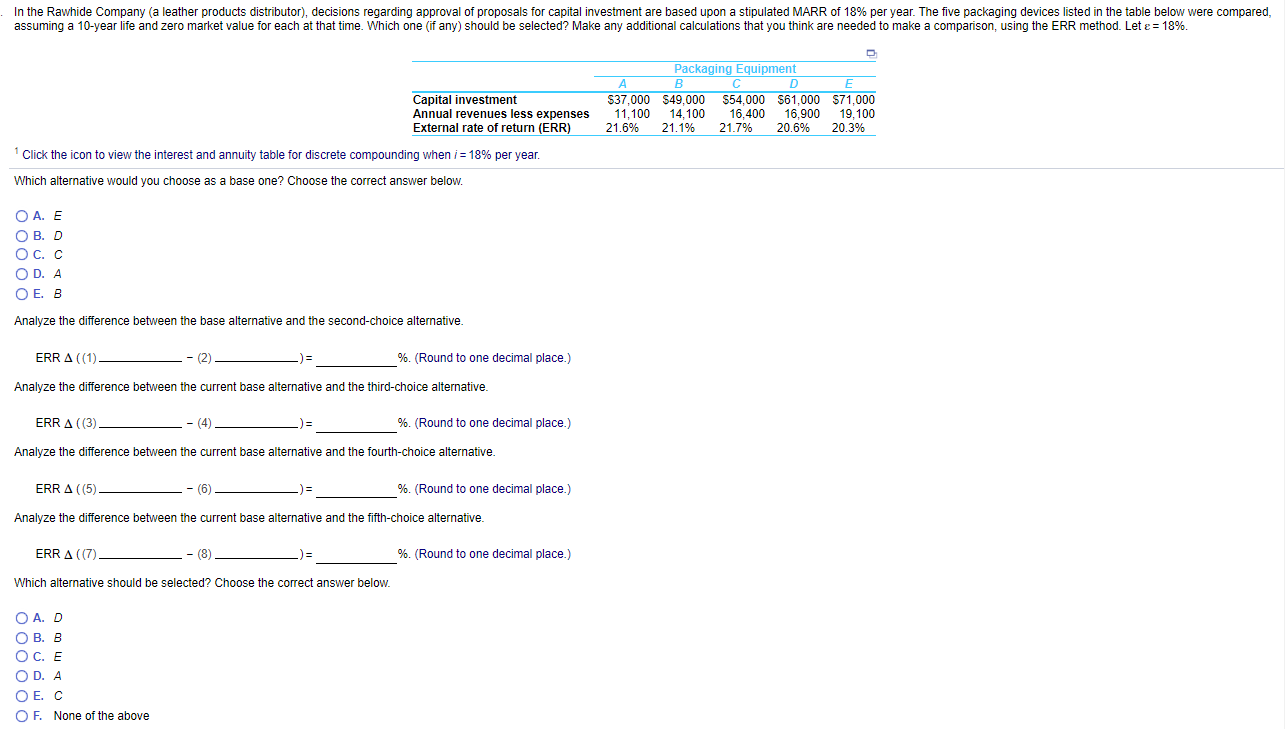

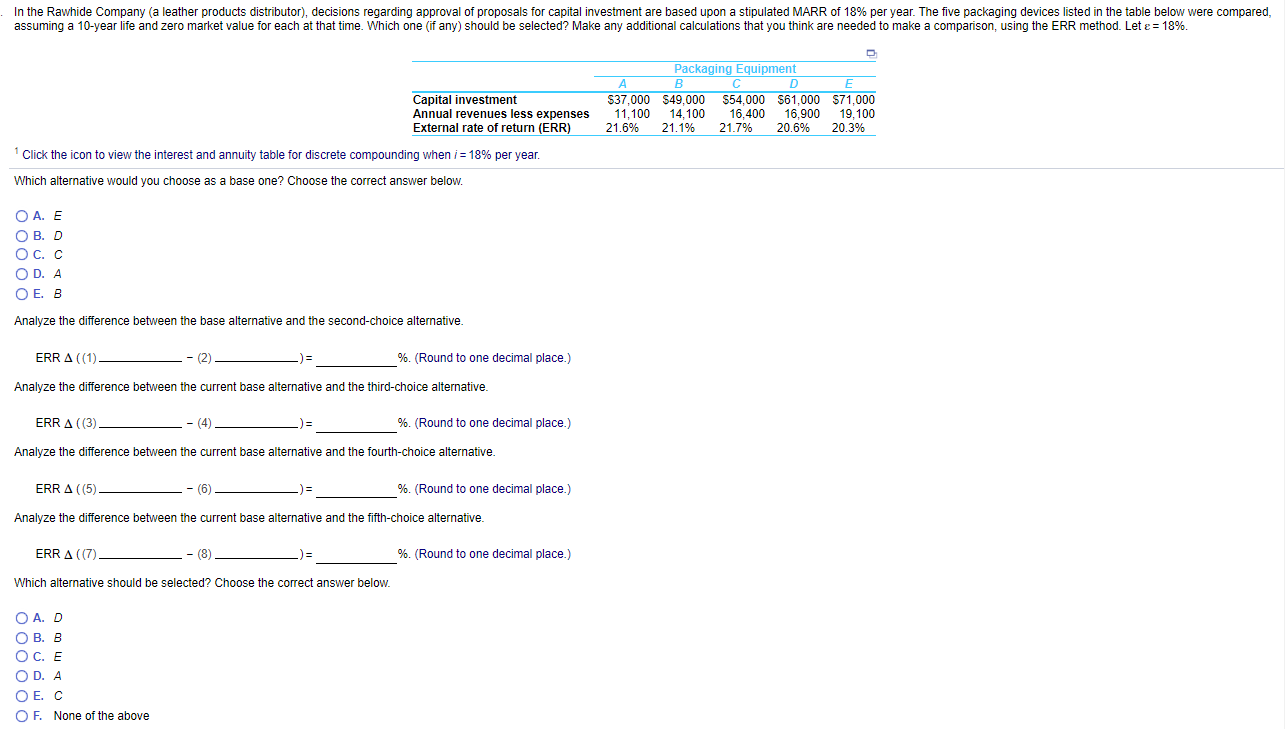

. In the Rawhide Company (a leather products distributor), decisions regarding approval of proposals for capital investment are based upon a stipulated MARR of 18% per year. The five packaging devices listed in the table below were compared, assuming a 10-year life and zero market value for each at that time. Which one (if any) should be selected? Make any additional calculations that you think are needed to make a comparison, using the ERR method. Let e = 18%. Capital investment Annual revenues less expenses External rate of return (ERR) Packaging Equipment A B C D E $37,000 $49,000 $54,000 $61,000 $71,000 11,100 14,100 16,400 16,900 19,100 21.6% 21.1% 21.7% 20.6% 20.3% Click the icon to view the interest and annuity table for discrete compounding when i = 18% per year Which alternative would you choose as a base one? Choose the correct answer below. . OB.D OC.C ODA O E. B Analyze the difference between the base alternative and the second-choice alternative. ERRA ((1) -(2) )= __ %. (Round to one decimal place.) Analyze the difference between the current base alternative and the third-choice alternative. ERRA ((3). - (4) %. (Round to one decimal place.) Analyze the difference between the current base alternative and the fourth-choice alternative ERRA ((5) -6 )= __ _%. (Round to one decimal place.) Analyze the difference between the current base alternative and the fifth-choice alternative. ERRA ((7). - (8) %. (Round to one decimal place.) Which alternative should be selected? Choose the correct answer below. O A. D OB. B OC. E ODA OE. OF. None of the above . In the Rawhide Company (a leather products distributor), decisions regarding approval of proposals for capital investment are based upon a stipulated MARR of 18% per year. The five packaging devices listed in the table below were compared, assuming a 10-year life and zero market value for each at that time. Which one (if any) should be selected? Make any additional calculations that you think are needed to make a comparison, using the ERR method. Let e = 18%. Capital investment Annual revenues less expenses External rate of return (ERR) Packaging Equipment A B C D E $37,000 $49,000 $54,000 $61,000 $71,000 11,100 14,100 16,400 16,900 19,100 21.6% 21.1% 21.7% 20.6% 20.3% Click the icon to view the interest and annuity table for discrete compounding when i = 18% per year Which alternative would you choose as a base one? Choose the correct answer below. . OB.D OC.C ODA O E. B Analyze the difference between the base alternative and the second-choice alternative. ERRA ((1) -(2) )= __ %. (Round to one decimal place.) Analyze the difference between the current base alternative and the third-choice alternative. ERRA ((3). - (4) %. (Round to one decimal place.) Analyze the difference between the current base alternative and the fourth-choice alternative ERRA ((5) -6 )= __ _%. (Round to one decimal place.) Analyze the difference between the current base alternative and the fifth-choice alternative. ERRA ((7). - (8) %. (Round to one decimal place.) Which alternative should be selected? Choose the correct answer below. O A. D OB. B OC. E ODA OE. OF. None of the above