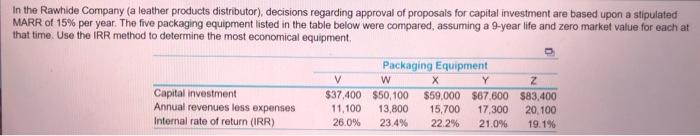

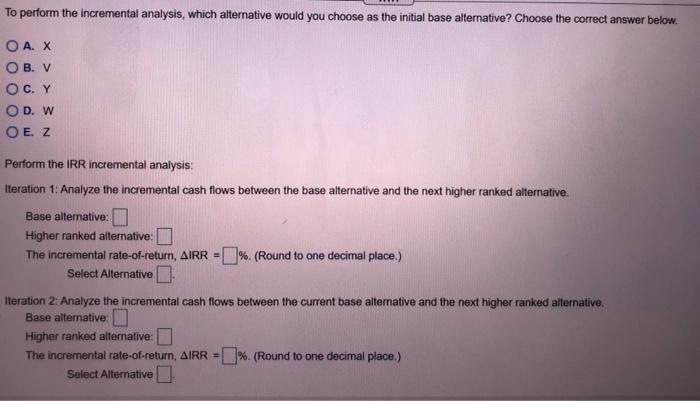

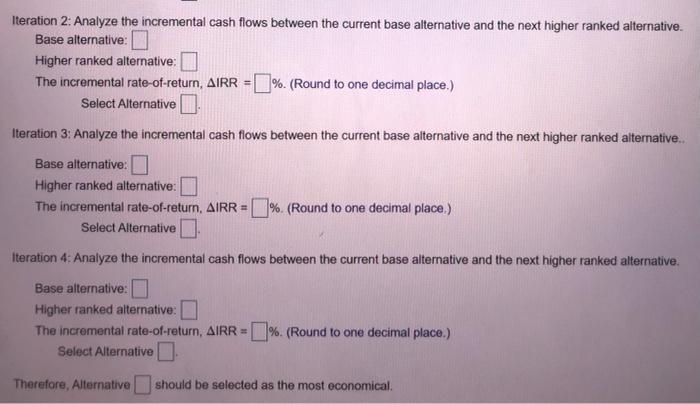

In the Rawhide Company (a leather products distributor), decisions regarding approval of proposals for capital investment are based upon a stipulated MARR of 15% per year. The five packaging equipment listed in the table below were compared, assuming a 9-year life and zero market value for each at that time. Use the IRR method to determine the most economical equipment, Capital investment Annual revenues less expenses Internal rate of return (IRR) Packaging Equipment V w X Y Z $37.400 $50, 100 $59,000 $67,800 $83,400 11,100 13,800 15,700 17,300 20.100 26.0% 23.4% 22.2% 21.0% 19.1% To perform the incremental analysis, which alternative would you choose as the initial base alternative? Choose the correct answer below. . OBV OC. Y OD. W O E. Z Perform the IRR incremental analysis: Iteration 1: Analyze the incremental cash flows between the base alternative and the next higher ranked alternative. Base alternative: Higher ranked alternative: The incremental rate-of-return, AIRR = 0% (Round to one decimal place.) Select Alternative Iteration 2: Analyze the incremental cash flows between the current base alternative and the next higher ranked alternative. Base alternative: Higher ranked alternative: The incremental rate-of-return, AIRR=%. (Round to one decimal place.) Select Alternative Iteration 2: Analyze the incremental cash flows between the current base alternative and the next higher ranked alternative. Base alternative: Higher ranked alternative: The incremental rate-of-return, AIRR =%. (Round to one decimal place.) Select Alternative - Iteration 3: Analyze the incremental cash flows between the current base alternative and the next higher ranked alternative.. Base alternative: Higher ranked alternative: The incremental rate-of-return, AIRR=% (Round to one decimal place.) Select Alternative Iteration 4: Analyze the incremental cash flows between the current base alternative and the next higher ranked alternative. Base alternative: Higher ranked alternative: The incremental rate-of-return, AIRR = %. (Round to one decimal place.) Select Alternative Therefore, Alternative should be selected as the most economical