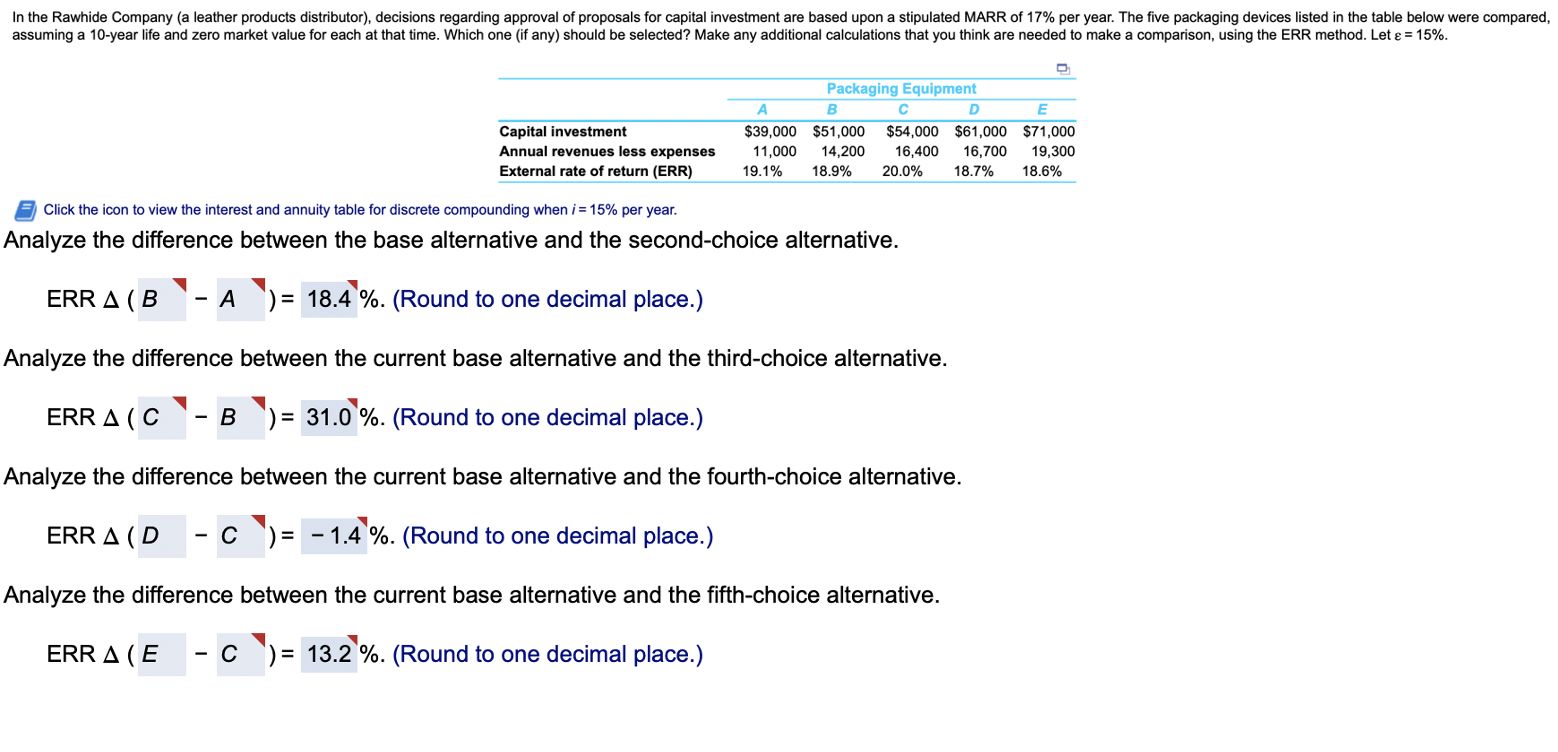

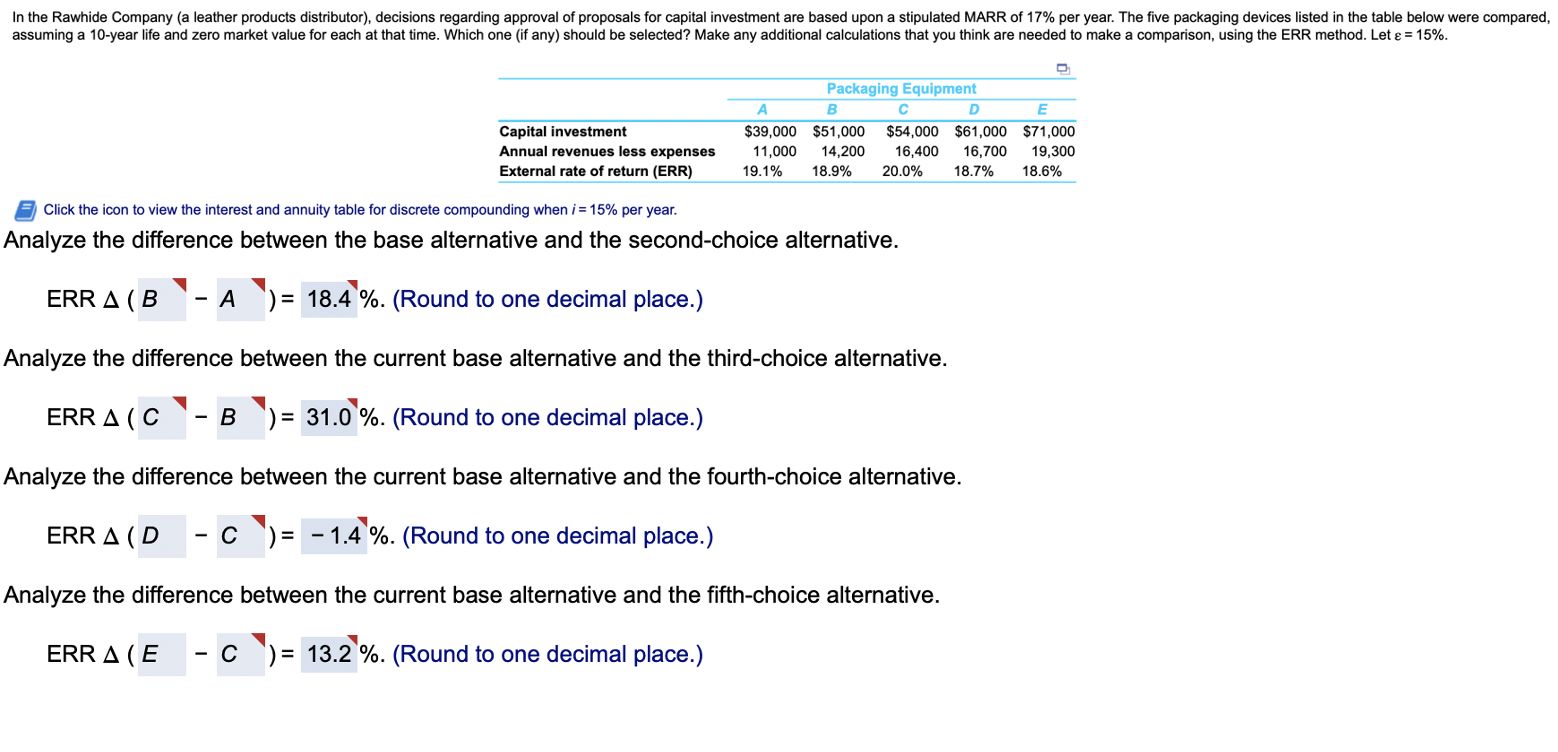

In the Rawhide Company (a leather products distributor), decisions regarding approval of proposals for capital investment are based upon a stipulated MARR of 17% per year.

The five packaging devices listed in the table below were compared, assuming a 10-year life and zero market value for each at that time. Which one (if any) should be selected? Make any additional calculations that you think are needed to make a comparison, using the ERR method. Let =15%.

Which alternative would you choose as a base one? Which alternative should be selected? Fill out the Table below to analyze the difference between alternatives. The table we need to fill out below, that has red tags on the corners of the boxes has wrong answers in it, we need to find the correct ones.

In the Rawhide Company (a leather products distributor), decisions regarding approval of proposals for capital investment are based upon a stipulated MARR of 17% per year. The five packaging devices listed in the table below were compared, assuming a 10-year life and zero market value for each at that time. Which one (if any) should be selected? Make any additional calculations that you think are needed to make a comparison, using the ERR method. Let e = 15%. Capital investment Annual revenues less expenses External rate of return (ERR) Packaging Equipment A B D E $39,000 $51,000 $54,000 $61,000 $71,000 11,000 14,200 16,400 16,700 19,300 19.1% 18.9% 20.0% 18.7% 18.6% Click the icon to view the interest and annuity table for discrete compounding when i = 15% per year. Analyze the difference between the base alternative and the second-choice alternative. ERR A(B - A ) = 18.4%. (Round to one decimal place.) Analyze the difference between the current base alternative and the third-choice alternative. ERRA (C'- B ) = 31.0%. (Round to one decimal place.) Analyze the difference between the current base alternative and the fourth-choice alternative. ERRA (D-C)= -1.4 %. (Round to one decimal place.) Analyze the difference between the current base alternative and the fifth-choice alternative. ERRA (E c ) = 13.2%. (Round to one decimal place.) In the Rawhide Company (a leather products distributor), decisions regarding approval of proposals for capital investment are based upon a stipulated MARR of 17% per year. The five packaging devices listed in the table below were compared, assuming a 10-year life and zero market value for each at that time. Which one (if any) should be selected? Make any additional calculations that you think are needed to make a comparison, using the ERR method. Let e = 15%. Capital investment Annual revenues less expenses External rate of return (ERR) Packaging Equipment A B D E $39,000 $51,000 $54,000 $61,000 $71,000 11,000 14,200 16,400 16,700 19,300 19.1% 18.9% 20.0% 18.7% 18.6% Click the icon to view the interest and annuity table for discrete compounding when i = 15% per year. Analyze the difference between the base alternative and the second-choice alternative. ERR A(B - A ) = 18.4%. (Round to one decimal place.) Analyze the difference between the current base alternative and the third-choice alternative. ERRA (C'- B ) = 31.0%. (Round to one decimal place.) Analyze the difference between the current base alternative and the fourth-choice alternative. ERRA (D-C)= -1.4 %. (Round to one decimal place.) Analyze the difference between the current base alternative and the fifth-choice alternative. ERRA (E c ) = 13.2%. (Round to one decimal place.)