Answered step by step

Verified Expert Solution

Question

1 Approved Answer

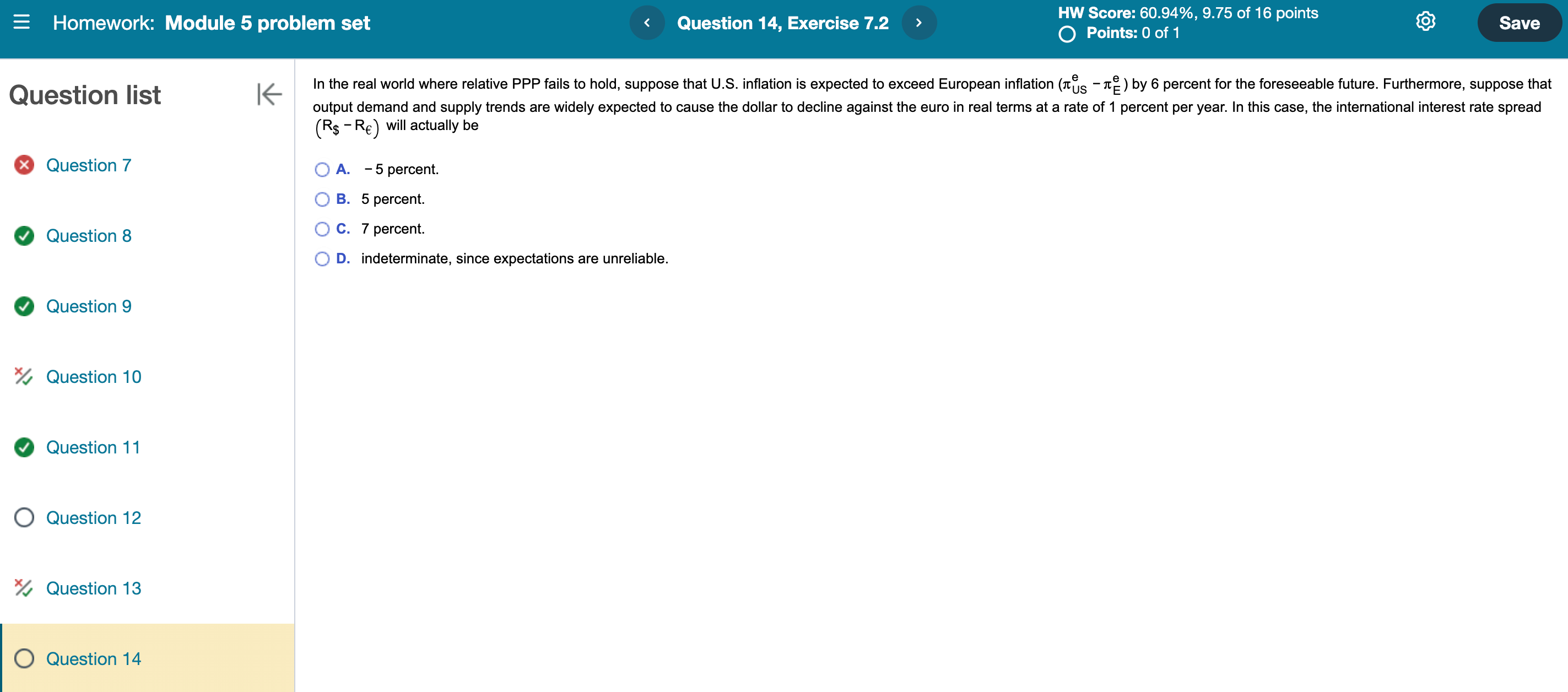

In the real world where relative PPP fails to hold, suppose that U . S . inflation is expected to exceed European inflation ( U

In the real world where relative PPP fails to hold, suppose that US inflation is expected to exceed European inflation by percent for the foreseeable future. Furthermore, suppose that

output demand and supply trends are widely expected to cause the dollar to decline against the euro in real terms at a rate of percent per year. In this case, the international interest rate spread

will actually be

A percent.

B percent.

C percent.

D indeterminate, since expectations are unreliable.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started