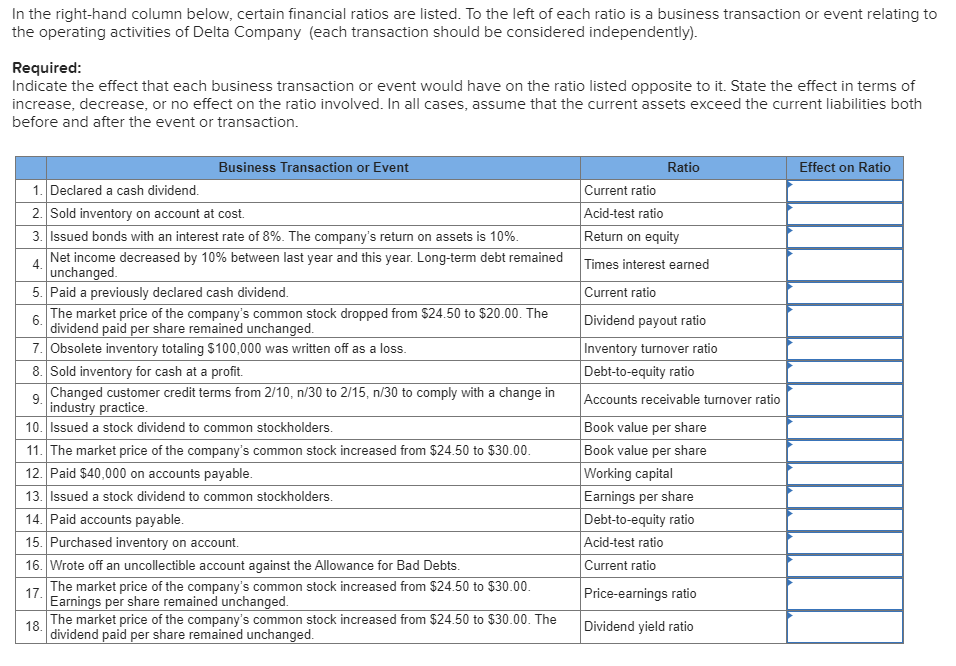

In the right-hand column below, certain financial ratios are listed. To the left of each ratio is a business transaction or event relating to the operating activities of Delta Company (each transaction should be considered independently). Required: Indicate the effect that each business transaction or event would have on the ratio listed opposite to it. State the effect in terms of increase, decrease, or no effect on the ratio involved. In all cases, assume that the current assets exceed the current liabilities both before and after the event or transaction. Effect on Ratio Ratio Current ratio Acid-test ratio Return on equity Times interest earned Current ratio Dividend payout ratio Business Transaction or Event 1. Declared a cash dividend. 2. Sold inventory on account at cost. 3. Issued bonds with an interest rate of 8%. The company's return on assets is 10%. Net income decreased by 10% between last year and this year. Long-term debt remained unchanged. 5. Paid a previously declared cash dividend. The market price of the company's common stock dropped from $24.50 to $20.00. The dividend paid per share remained unchanged. 7. Obsolete inventory totaling $100,000 was written off as a loss. 8. Sold inventory for cash at a profit. Changed customer credit terms from 2/10, n/30 to 2/15, n/30 to comply with a change in industry practice 10. Issued a stock dividend to common stockholders. 11. The market price of the company's common stock increased from $24.50 to $30.00 12. Paid $40,000 on accounts payable. 13. Issued a stock dividend to common stockholders. 14. Paid accounts payable. 15. Purchased inventory on account 16. Wrote off an uncollectible account against the Allowance for Bad Debts. The market price of the company's common stock increased from $24.50 to $30.00 Earnings per share remained unchanged. 18 The market price of the company's common stock increased from $24.50 to $30.00. The dividend paid per share remained unchanged. Inventory turnover ratio Debt-to-equity ratio Accounts receivable turnover ratio Book value per share Book value per share Working capital Earnings per share Debt-to-equity ratio Acid-test ratio Current ratio Price-earnings ratio Dividend yield ratio