Answered step by step

Verified Expert Solution

Question

1 Approved Answer

In the second part, you are given the company list of S&P 500 and BIST stock indexes in index_list.xlsx. These lists are provided to

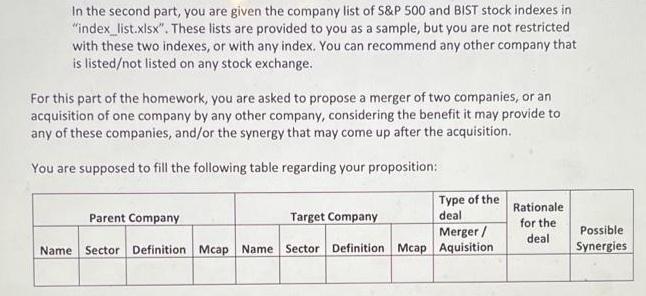

In the second part, you are given the company list of S&P 500 and BIST stock indexes in "index_list.xlsx". These lists are provided to you as a sample, but you are not restricted with these two indexes, or with any index. You can recommend any other company that is listed/not listed on any stock exchange. For this part of the homework, you are asked to propose a merger of two companies, or an acquisition of one company by any other company, considering the benefit it may provide to any of these companies, and/or the synergy that may come up after the acquisition. You are supposed to fill the following table regarding your proposition: Parent Company Target Company Type of the deal Merger / Name Sector Definition Mcap Name Sector Definition Mcap Aquisition Rationale for the deal Possible Synergies In the second part, you are given the company list of S&P 500 and BIST stock indexes in "index_list.xlsx". These lists are provided to you as a sample, but you are not restricted with these two indexes, or with any index. You can recommend any other company that is listed/not listed on any stock exchange. For this part of the homework, you are asked to propose a merger of two companies, or an acquisition of one company by any other company, considering the benefit it may provide to any of these companies, and/or the synergy that may come up after the acquisition. You are supposed to fill the following table regarding your proposition: Parent Company Target Company Type of the deal Merger / Name Sector Definition Mcap Name Sector Definition Mcap Aquisition Rationale for the deal Possible Synergies

Step by Step Solution

★★★★★

3.45 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

Answer Total answers posted by the expert is 169 PARENT COMPANY NAME SHOPIFY TARGET COMPANY SECTOR E...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started