Answered step by step

Verified Expert Solution

Question

1 Approved Answer

In the spring of 2 0 2 2 , you and your family were looking for the house of your dreams. Given your household income

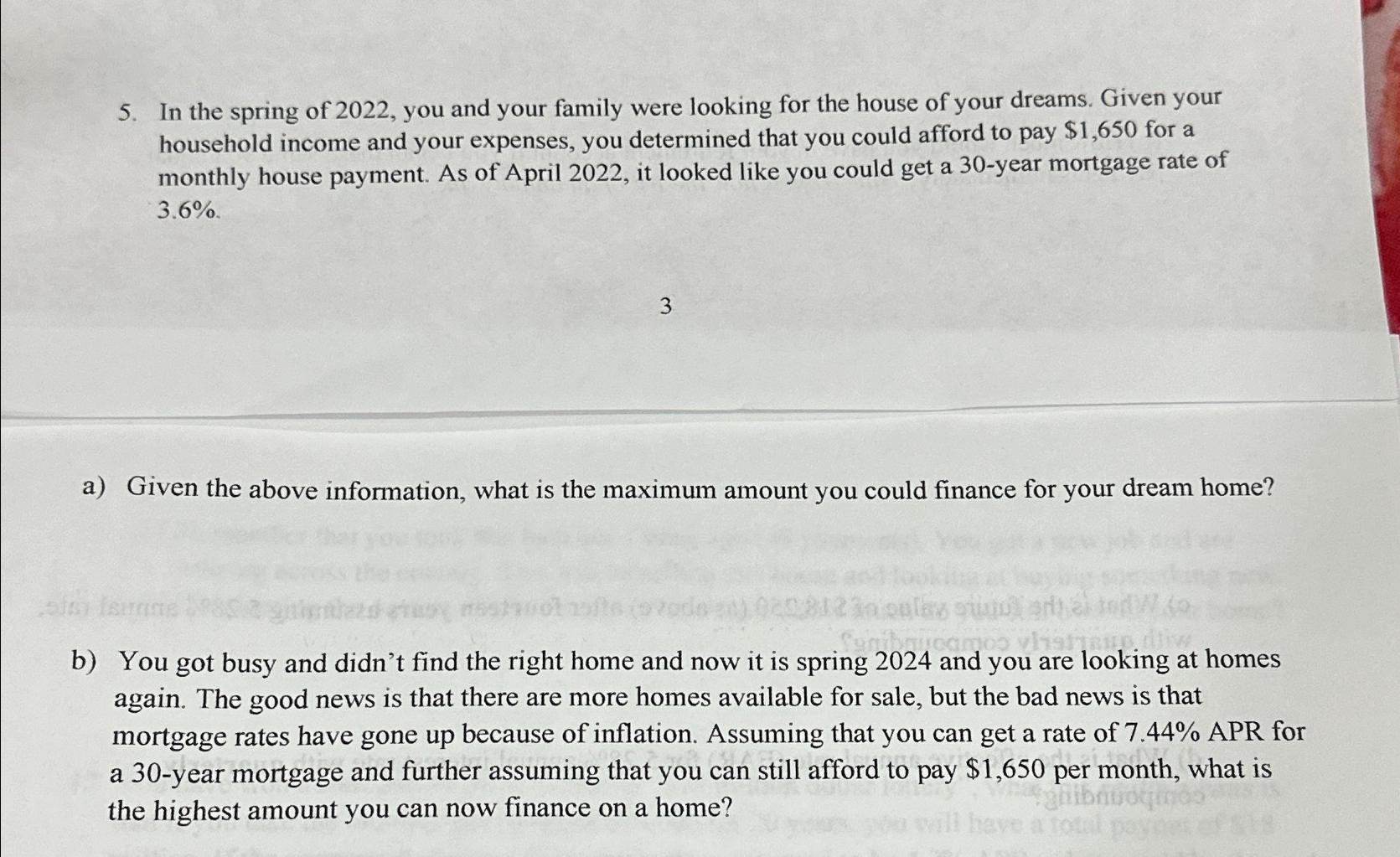

In the spring of you and your family were looking for the house of your dreams. Given your household income and your expenses, you determined that you could afford to pay $ for a monthly house payment. As of April it looked like you could get a year mortgage rate of

a Given the above information, what is the maximum amount you could finance for your dream home?

b You got busy and didn't find the right home and now it is spring and you are looking at homes again. The good news is that there are more homes available for sale, but the bad news is that mortgage rates have gone up because of inflation. Assuming that you can get a rate of APR for a year mortgage and further assuming that you can still afford to pay $ per month, what is the highest amount you can now finance on a home?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started