Question

In the spring of 2015, Jemison Electric was consider-ing an investment in a new distribution center. Jemisons CFO anticipates additional earnings before interest and taxes

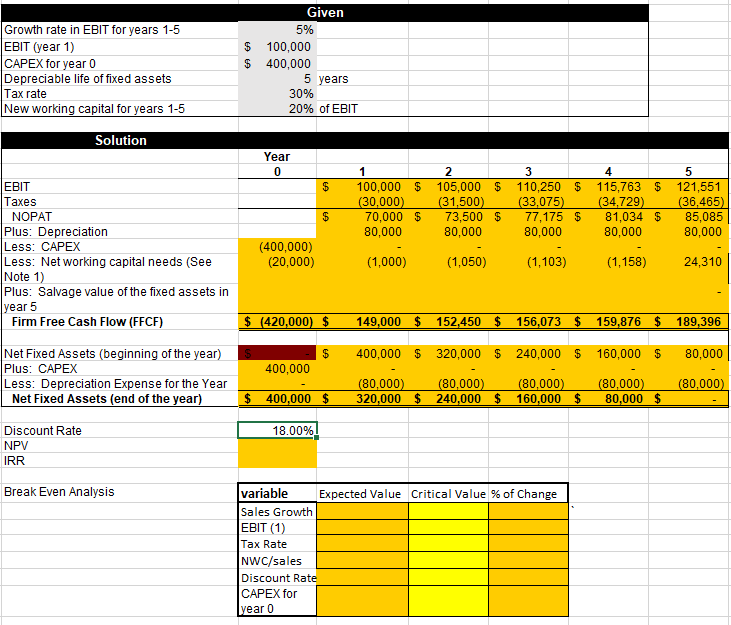

In the spring of 2015, Jemison Electric was consider-ing an investment in a new distribution center. Jemisons CFO anticipates additional earnings before interest and taxes (EBIT) of $100,000 for the first year of operation of the center, and, over the next five years, the firm estimates that this amount will grow at a rate of 5% per year. The distribution center will require an initial investment of $400,000 that will be depreciated over a five-year period toward a zero salvage value using straight-line depreciation of $80,000 per year. Jemisons CFO estimates that the distribution center will need operating net working capital equal to 20% of EBIT to support operation. Assuming the firm faces a 30% tax rate, calculate the projects annual project free cash flows (FCFs) for each of the next five years where the salvage value of operating network-ing capital and fixed assets is assumed to equal their book values, respectively.

- If the discount rate is 18%, what is the NPV of this project? What is the IRR?

- Conduct a break-even sensitivity analysis and identify the top 3 value drivers

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started