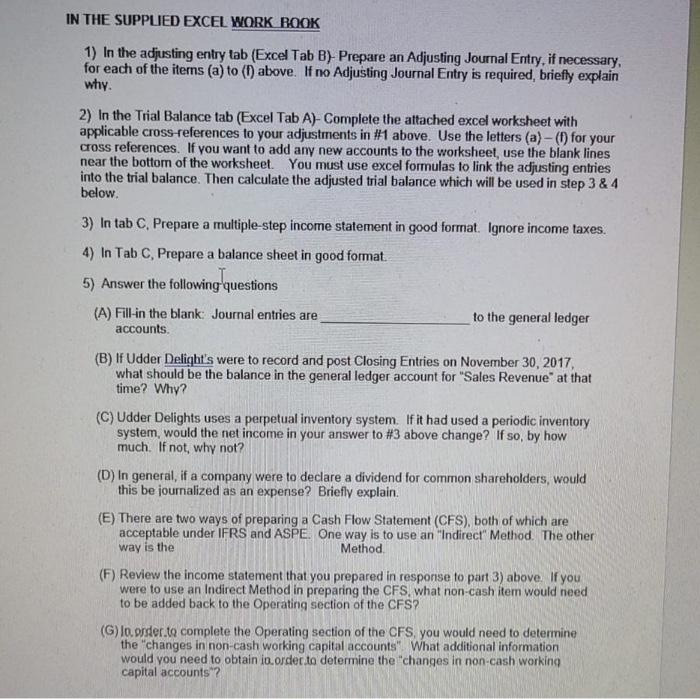

IN THE SUPPLIED EXCEL WORK ROOK 1) In the adjusting entry tab (Excel Tab B)- Prepare an Adjusting Journal Entry, if necessary, for each of the items (a) to (1) above. If no Adjusting Journal Entry is required, briefly explain why. 2) In the Trial Balance tab (Excel Tab A)- Complete the attached excel worksheet with applicable cross-references to your adjustments in #1 above. Use the letters (a)-() for your cross references. If you want to add any new accounts to the worksheet, use the blank lines near the bottom of the worksheet. You must use excel formulas to link the adjusting entries into the trial balance. Then calculate the adjusted trial balance which will be used in step 3 & 4 below. 3) In tab C. Prepare a multiple-step income statement in good format. Ignore income taxes. 4) In Tab C. Prepare a balance sheet in good format. 5) Answer the following questions (A) Fill-in the blank: Journal entries are accounts to the general ledger (B) If Udder Delight's were to record and post Closing Entries on November 30, 2017, what should be the balance in the general ledger account for "Sales Revenue at that time? Why? (C) Udder Delights uses a perpetual inventory system. If it had used a periodic inventory system, would the net income in your answer to #3 above change? If so, by how much. If not, why not? (D) In general, if a company were to declare a dividend for common shareholders, would this be journalized as an expense? Briefly explain. (E) There are two ways of preparing a Cash Flow Statement (CFS), both of which are acceptable under IFRS and ASPE. One way is to use an "Indirect Method. The other way is the Method (F) Review the income statement that you prepared in response to part 3) above. If you were to use an Indirect Method in preparing the CFS, what non-cash item would need to be added back to the Operating section of the CFS? (6) lo. order to complete the Operating section of the CFS you would need to determine the "changes in non-cash working capital accounts" What additional information would you need to obtain in order to determine the changes in non-cash working capital accounts"? IN THE SUPPLIED EXCEL WORK ROOK 1) In the adjusting entry tab (Excel Tab B)- Prepare an Adjusting Journal Entry, if necessary, for each of the items (a) to (1) above. If no Adjusting Journal Entry is required, briefly explain why. 2) In the Trial Balance tab (Excel Tab A)- Complete the attached excel worksheet with applicable cross-references to your adjustments in #1 above. Use the letters (a)-() for your cross references. If you want to add any new accounts to the worksheet, use the blank lines near the bottom of the worksheet. You must use excel formulas to link the adjusting entries into the trial balance. Then calculate the adjusted trial balance which will be used in step 3 & 4 below. 3) In tab C. Prepare a multiple-step income statement in good format. Ignore income taxes. 4) In Tab C. Prepare a balance sheet in good format. 5) Answer the following questions (A) Fill-in the blank: Journal entries are accounts to the general ledger (B) If Udder Delight's were to record and post Closing Entries on November 30, 2017, what should be the balance in the general ledger account for "Sales Revenue at that time? Why? (C) Udder Delights uses a perpetual inventory system. If it had used a periodic inventory system, would the net income in your answer to #3 above change? If so, by how much. If not, why not? (D) In general, if a company were to declare a dividend for common shareholders, would this be journalized as an expense? Briefly explain. (E) There are two ways of preparing a Cash Flow Statement (CFS), both of which are acceptable under IFRS and ASPE. One way is to use an "Indirect Method. The other way is the Method (F) Review the income statement that you prepared in response to part 3) above. If you were to use an Indirect Method in preparing the CFS, what non-cash item would need to be added back to the Operating section of the CFS? (6) lo. order to complete the Operating section of the CFS you would need to determine the "changes in non-cash working capital accounts" What additional information would you need to obtain in order to determine the changes in non-cash working capital accounts