Question

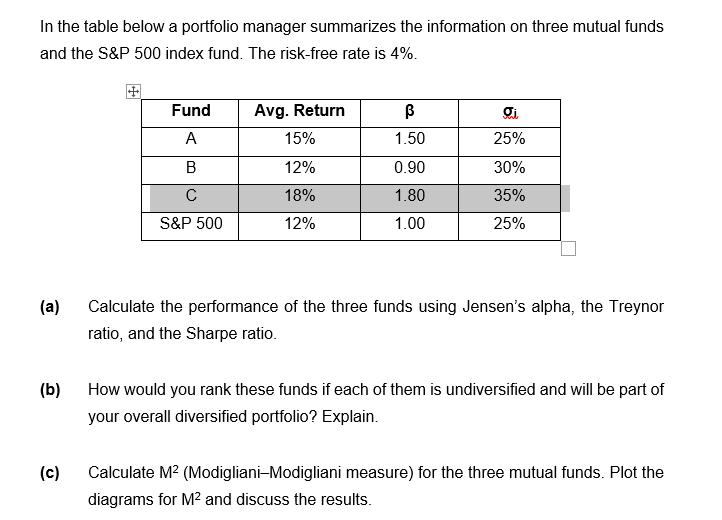

In the table below a portfolio manager summarizes the information on three mutual funds and the S&P 500 index fund. The risk-free rate is

In the table below a portfolio manager summarizes the information on three mutual funds and the S&P 500 index fund. The risk-free rate is 4%. (a) Fund Avg. Return i A 15% 1.50 25% B 12% 0.90 30% C 18% 1.80 35% S&P 500 12% 1.00 25% Calculate the performance of the three funds using Jensen's alpha, the Treynor ratio, and the Sharpe ratio. (b) How would you rank these funds if each of them is undiversified and will be part of your overall diversified portfolio? Explain. (c) Calculate M (Modigliani-Modigliani measure) for the three mutual funds. Plot the diagrams for M and discuss the results.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Income Tax Fundamentals 2013

Authors: Gerald E. Whittenburg, Martha Altus Buller, Steven L Gill

31st Edition

1111972516, 978-1285586618, 1285586611, 978-1285613109, 978-1111972516

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App