Answered step by step

Verified Expert Solution

Question

1 Approved Answer

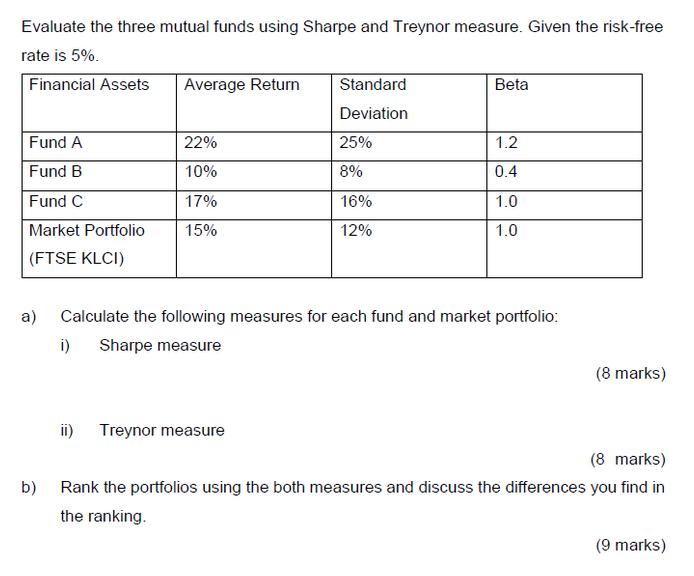

Evaluate the three mutual funds using Sharpe and Treynor measure. Given the risk-free rate is 5%. Financial Assets Average Return Standard Beta Deviation Fund

Evaluate the three mutual funds using Sharpe and Treynor measure. Given the risk-free rate is 5%. Financial Assets Average Return Standard Beta Deviation Fund A 22% 25% 1.2 Fund B 10% 8% 0.4 Fund C 17% 16% 1.0 Market Portfolio 15% 12% 1.0 (FTSE KLCI) Calculate the following measures for each fund and market portfolio: Sharpe measure a) i) ii) Treynor measure (8 marks) (8 marks) b) Rank the portfolios using the both measures and discuss the differences you find in the ranking. (9 marks)

Step by Step Solution

★★★★★

3.33 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

a i Sharpe Measure Calculation The Sharpe Ratio is calculated as Average Return RiskFree Rate Standa...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started