Answered step by step

Verified Expert Solution

Question

1 Approved Answer

In the table below, for each of the independent situations listed, indicate whether the S corporation's S status would be terminated by clicking in the

In the table below, for each of the independent situations listed, indicate whether the S corporation's S status would be terminated by clicking in the associated cell and selecting "Terminated" or "Not terminated" as appropriate.

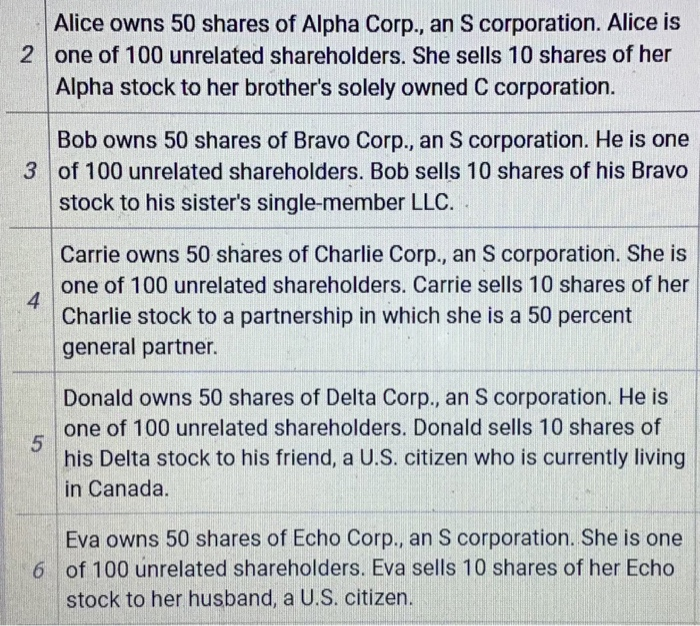

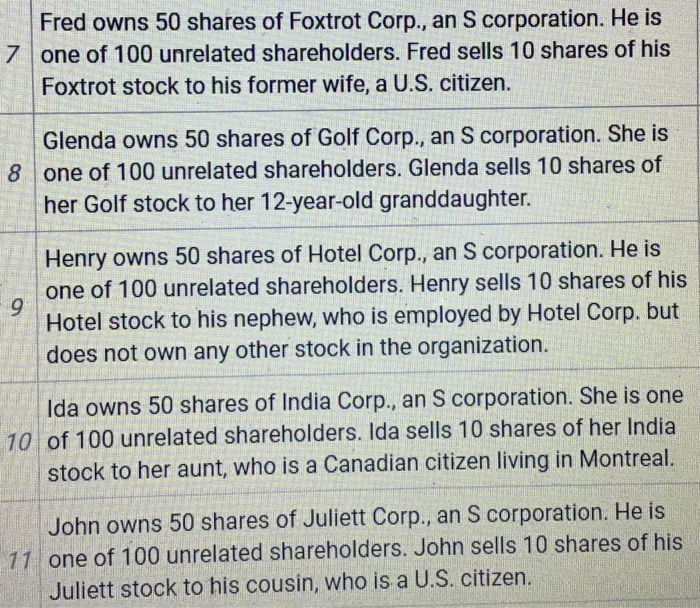

Alice owns 50 shares of Alpha Corp., an S corporation. Alice is Alpha stock to her brother's solely owned C corporation. Bob owns 50 shares of Bravo Corp, an S corporation. He is one stock to his sister's single-member LLC. 2 one of 100 unrelated shareholders. She sells 10 shares of her 3 of 100 unrelated shareholders. Bob sells 10 shares of his Bravo Carrie owns 50 shares of Charlie Corp., an S corporation. She is one of 100 unrelated shareholders. Carrie sells 10 shares of her Charlie stock to a partnership in which she is a 50 percent general partner. 4 Donald owns 50 shares of Delta Corp., an S corporation. He is one of 100 unrelated shareholders. Donald sells 10 shares of his Delta stock to his friend, a U.S. citizen who is currently living in Canada 5 Eva owns 50 shares of Echo Corp., an S corporation. She is one of 100 unrelated shareholders. Eva sells 10 shares of her Echo stock to her husband, a U.S. citizen. 6 Fred owns 50 shares of Foxtrot Corp., an S corporation. He is 7 one of 100 unrelated shareholders. Fred sells 10 shares of his Foxtrot stock to his former wife, a U.S. citizen. Glenda owns 50 shares of Golf Corp,, an S corporation. She is one of 100 unrelated shareholders. Glenda sells 10 shares of her Golf stock to her 12-year-old granddaughter. 8 Henry owns 50 shares of Hotel Corp, an S corporation. He is one of 100 unrelated shareholders. Henry sells 10 shares of his Hotel stock to his nephew, who is employed by Hotel Corp. but does not own any other stock in the organization. Ida owns 50 shares of India Corp., an S corporation. She is one stock to her aunt, who is a Canadian citizen living in Montreal. John owns 50 shares of Juliett Corp., an S corporation. He is Juliett stock to his cousin, who is a U.S. citizen. 10 of 100 unrelated shareholders. Ida sells 10 shares of her India 11 one of 100 unrelated shareholders. John sells 10 shares of his

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started