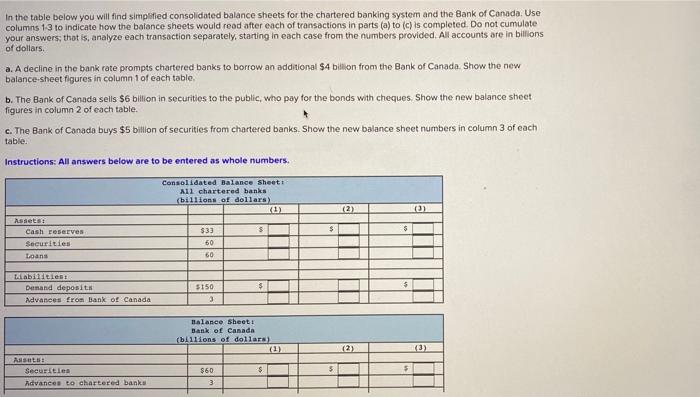

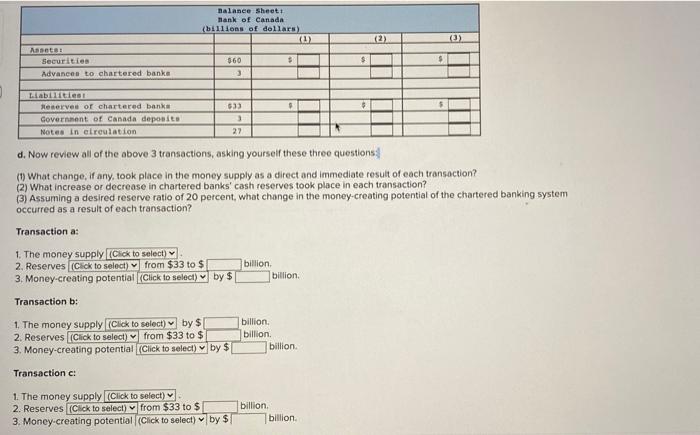

In the table below you will find simplified consolidated balance sheets for the chartered banking system and the Bank of Canada. Use columns 13 to indicate how the balance sheets would read after each of transactions in parts (a) to (c) is completed. Do not cumulate your answers; that is, analyze each transaction separately, starting in each case from the numbers provided. All accounts are in billions of dollars. a. A decline in the bank rate prompts chartered banks to borrow an additional $4 billion from the Bank of Canada Show the new balance sheet figures in column 1 of each table b. The Bank of Canada sells $6 billion in securities to the public, who pay for the bonds with cheques. Show the new balance sheet figures in column 2 of each table. c. The Bank of Canada buys $5 billion of securities from chartered banks. Show the new balance sheet numbers in column 3 of each table. Instructions: All answers below are to be entered as whole numbers. Consolidated Balance sheett All chartered banks (billions of dollars) (2) (2) ) $33 $ Assets Cash reserves Securities $ 60 Loans 60 Tbilitet Demand deposits Advances from Bank of Canada $150 $ 3 Balance sheet: Bank of Canada (billions of dollars) (1) (2) Assets: Securities Advances to chartered banks $60 $ 5 3 Balance Sheet Tank of Canada (billions of dollars) (1) (2) () Assets Securities Advances to chartered banka $ $ $ $60 3 3 Liabilities Reserves or chartered banka 533 Government of Canada deposite Notes in circulation 27 d. Now review all of the above 3 transactions, asking yourself these three questions 3 (1) What change, if any, took place in the money supply as a direct and immediate result of each transaction? (2) What increase or decrease in chartered banks' cash reserves took place in each transaction? (3) Assuming a desired reserve ratio of 20 percent, what change in the money-creating potential of the chartered banking system occurred as a result of each transaction? Transaction a: billion 1. The money supply (Click to select) 2. Reserves (Click to select from $33 to $ 3. Money-creating potential (Click to select) by $ billion. Transaction b: 1. The money supply (Click to select) by $ 2. Reserves (Click to select from $33 to $ 3. Money-creating potential (Click to select) by $ billion billion. billion Transaction c: 1. The money supply (Click to select) 2. Reserves (Click to select from $33 to $ 3. Money creating potential (Click to select) by $ billion billion In the table below you will find simplified consolidated balance sheets for the chartered banking system and the Bank of Canada. Use columns 13 to indicate how the balance sheets would read after each of transactions in parts (a) to (c) is completed. Do not cumulate your answers; that is, analyze each transaction separately, starting in each case from the numbers provided. All accounts are in billions of dollars. a. A decline in the bank rate prompts chartered banks to borrow an additional $4 billion from the Bank of Canada Show the new balance sheet figures in column 1 of each table b. The Bank of Canada sells $6 billion in securities to the public, who pay for the bonds with cheques. Show the new balance sheet figures in column 2 of each table. c. The Bank of Canada buys $5 billion of securities from chartered banks. Show the new balance sheet numbers in column 3 of each table. Instructions: All answers below are to be entered as whole numbers. Consolidated Balance sheett All chartered banks (billions of dollars) (2) (2) ) $33 $ Assets Cash reserves Securities $ 60 Loans 60 Tbilitet Demand deposits Advances from Bank of Canada $150 $ 3 Balance sheet: Bank of Canada (billions of dollars) (1) (2) Assets: Securities Advances to chartered banks $60 $ 5 3 Balance Sheet Tank of Canada (billions of dollars) (1) (2) () Assets Securities Advances to chartered banka $ $ $ $60 3 3 Liabilities Reserves or chartered banka 533 Government of Canada deposite Notes in circulation 27 d. Now review all of the above 3 transactions, asking yourself these three questions 3 (1) What change, if any, took place in the money supply as a direct and immediate result of each transaction? (2) What increase or decrease in chartered banks' cash reserves took place in each transaction? (3) Assuming a desired reserve ratio of 20 percent, what change in the money-creating potential of the chartered banking system occurred as a result of each transaction? Transaction a: billion 1. The money supply (Click to select) 2. Reserves (Click to select from $33 to $ 3. Money-creating potential (Click to select) by $ billion. Transaction b: 1. The money supply (Click to select) by $ 2. Reserves (Click to select from $33 to $ 3. Money-creating potential (Click to select) by $ billion billion. billion Transaction c: 1. The money supply (Click to select) 2. Reserves (Click to select from $33 to $ 3. Money creating potential (Click to select) by $ billion billion