Answered step by step

Verified Expert Solution

Question

1 Approved Answer

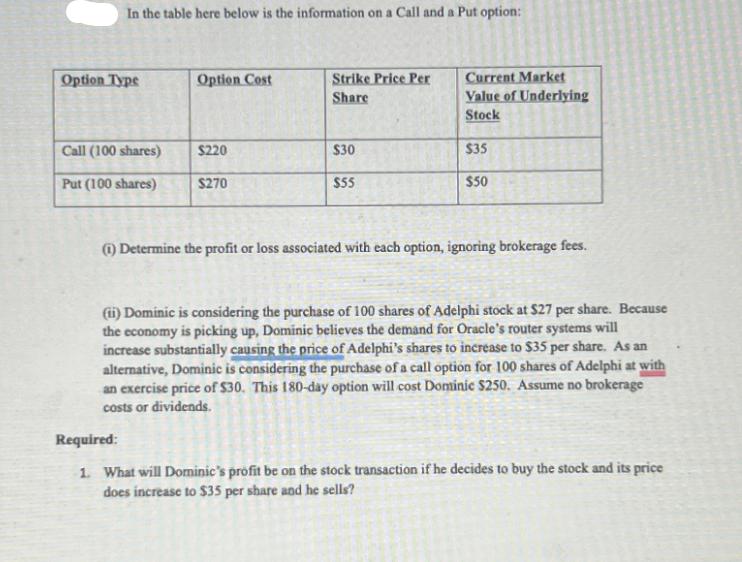

In the table here below is the information on a Call and a Put option: Option Type Option Cost Strike Price Per Share Current

In the table here below is the information on a Call and a Put option: Option Type Option Cost Strike Price Per Share Current Market Value of Underlying Stock Call (100 shares) $220 $30 $35 Put (100 shares) $270 $55 $50 (i) Determine the profit or loss associated with each option, ignoring brokerage fees. (ii) Dominic is considering the purchase of 100 shares of Adelphi stock at $27 per share. Because the economy is picking up, Dominic believes the demand for Oracle's router systems will increase substantially causing the price of Adelphi's shares to increase to $35 per share. As an alternative, Dominic is considering the purchase of a call option for 100 shares of Adelphi at with an exercise price of $30. This 180-day option will cost Dominic $250. Assume no brokerage costs or dividends. Required: 1. What will Dominic's profit be on the stock transaction if he decides to buy the stock and its price does increase to $35 per share and he sells?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started