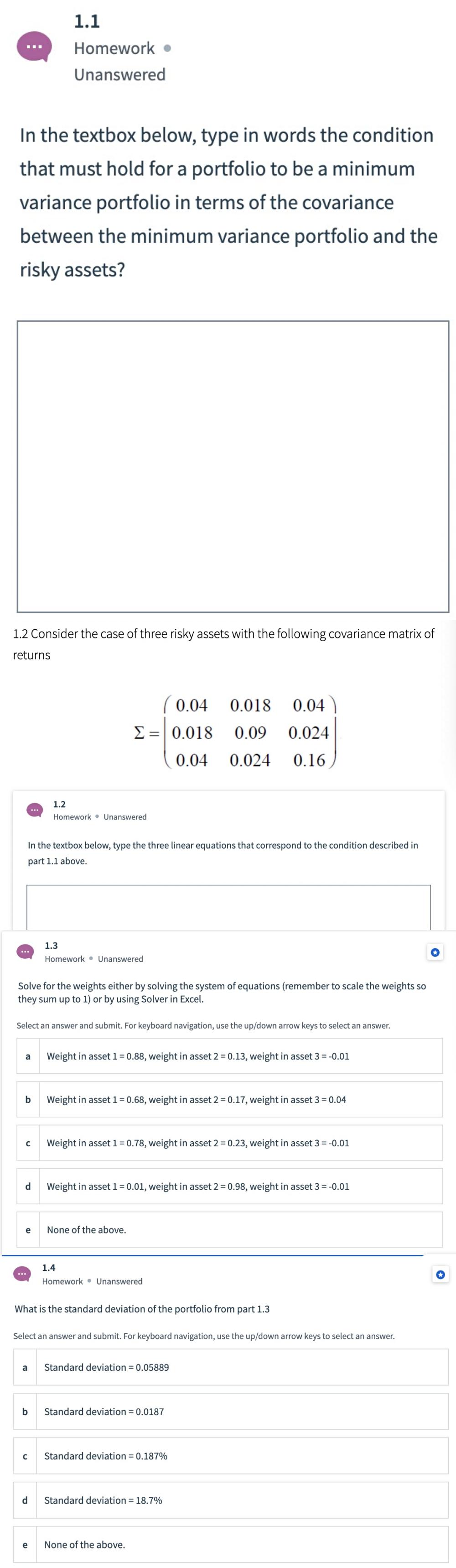

In the textbox below, type in words the condition that must hold for a portfolio to be a minimum variance portfolio in terms of the covariance between the minimum variance portfolio and the risky assets?

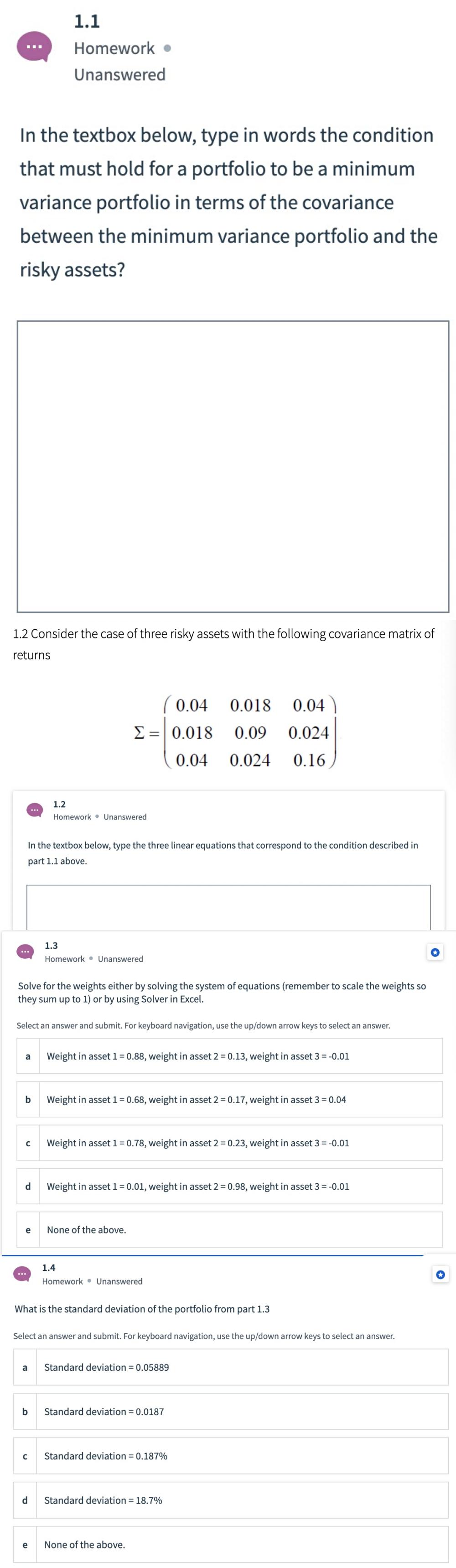

1.1 Homework Unanswered In the textbox below, type in words the condition that must hold for a portfolio to be a minimum variance portfolio in terms of the covariance between the minimum variance portfolio and the risky assets? 1.2 Consider the case of three risky assets with the following covariance matrix of returns (0.04 = 0.018 0.018 0.04 ) 0.09 0.024 0.04 0.024 0.16 1.2 Homework. Unanswered In the textbox below, type the three linear equations that correspond to the condition described in part 1.1 above. 1.3 Homework. Unanswered Solve for the weights either by solving the system of equations (remember to scale the weights so they sum up to 1) or by using Solver in Excel. Select an answer and submit. For keyboard navigation, use the up/down arrow keys to select an answer. a Weight in asset 1 = 0.88, weight in asset 2 = 0.13, weight in asset 3 = -0.01 b Weight in asset 1 = 0.68, weight in asset 2 = 0.17, weight in asset 3 = 0.04 Weight in asset 1 = 0.78, weight in asset 2 = 0.23, weight in asset 3 = -0.01 d Weight in asset 1 = 0.01, weight in asset 2 = 0.98, weight in asset 3 = -0.01 e None of the above. 1.4 Homework Unanswered What is the standard deviation of the portfolio from part 1.3 Select an answer and submit. For keyboard navigation, use the up/down arrow keys to select an answer. a Standard deviation = 0.05889 b Standard deviation = 0.0187 Standard deviation = 0.187% d Standard deviation = 18.7% e None of the above. 1.1 Homework Unanswered In the textbox below, type in words the condition that must hold for a portfolio to be a minimum variance portfolio in terms of the covariance between the minimum variance portfolio and the risky assets? 1.2 Consider the case of three risky assets with the following covariance matrix of returns (0.04 = 0.018 0.018 0.04 ) 0.09 0.024 0.04 0.024 0.16 1.2 Homework. Unanswered In the textbox below, type the three linear equations that correspond to the condition described in part 1.1 above. 1.3 Homework. Unanswered Solve for the weights either by solving the system of equations (remember to scale the weights so they sum up to 1) or by using Solver in Excel. Select an answer and submit. For keyboard navigation, use the up/down arrow keys to select an answer. a Weight in asset 1 = 0.88, weight in asset 2 = 0.13, weight in asset 3 = -0.01 b Weight in asset 1 = 0.68, weight in asset 2 = 0.17, weight in asset 3 = 0.04 Weight in asset 1 = 0.78, weight in asset 2 = 0.23, weight in asset 3 = -0.01 d Weight in asset 1 = 0.01, weight in asset 2 = 0.98, weight in asset 3 = -0.01 e None of the above. 1.4 Homework Unanswered What is the standard deviation of the portfolio from part 1.3 Select an answer and submit. For keyboard navigation, use the up/down arrow keys to select an answer. a Standard deviation = 0.05889 b Standard deviation = 0.0187 Standard deviation = 0.187% d Standard deviation = 18.7% e None of the above