Answered step by step

Verified Expert Solution

Question

1 Approved Answer

In the trendsetter.com, the company received two term sheets from Alpha and Mega venture funds. For the purposes of this exercise, let's assume that the

In the trendsetter.com, the company received two term sheets from Alpha and Mega venture funds.

For the purposes of this exercise, let's assume that the two term sheets were equivalent except for antidilution protection. In other words, let's say that the investment in each case was $ at $ per share of Series A preferred stock.

Post Series A financing, the company had a valuation of $ and the following cap table:

Common stock shares

Series A shares

Total shares

Question #

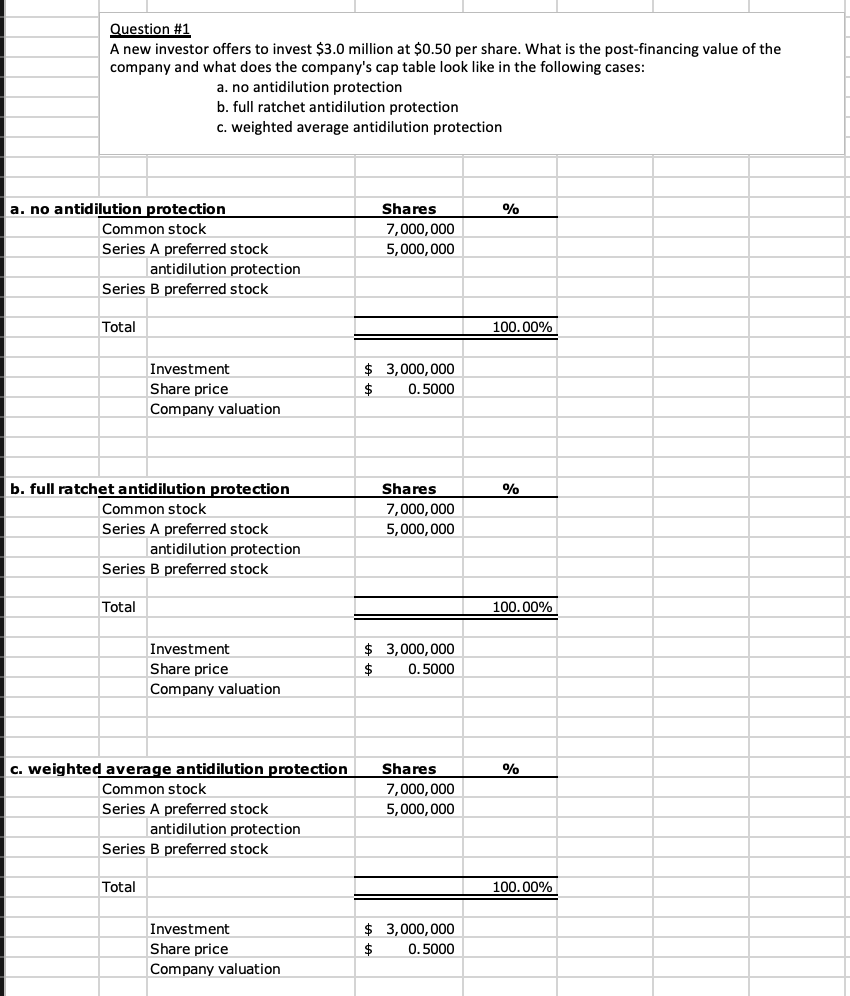

A new investor offers to invest $ million at $ per share. What is the postfinancing value of the

company and what does the company's cap table look like in the following cases:

a no antidilution protection

b full ratchet antidilution protection

c weighted average antidilution protection

NCP OCP OBNM OCPOB SI

NCP new conversion price

OCP old conversion price

OB number of shares outstanding before this round

NM new money being invested in this round

SI new shares issued in this round

ADP OBAOCPNCPOBA

ADP antidilution protection

OBA number of Series A shares outstanding before this round

NCP new conversion price

OCP old conversion price

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started