Answered step by step

Verified Expert Solution

Question

1 Approved Answer

In the U.S., firms are subject to progressive corporate tax. Consider XYZ Inc., an exporting firm, which expects to earn $20 million if the

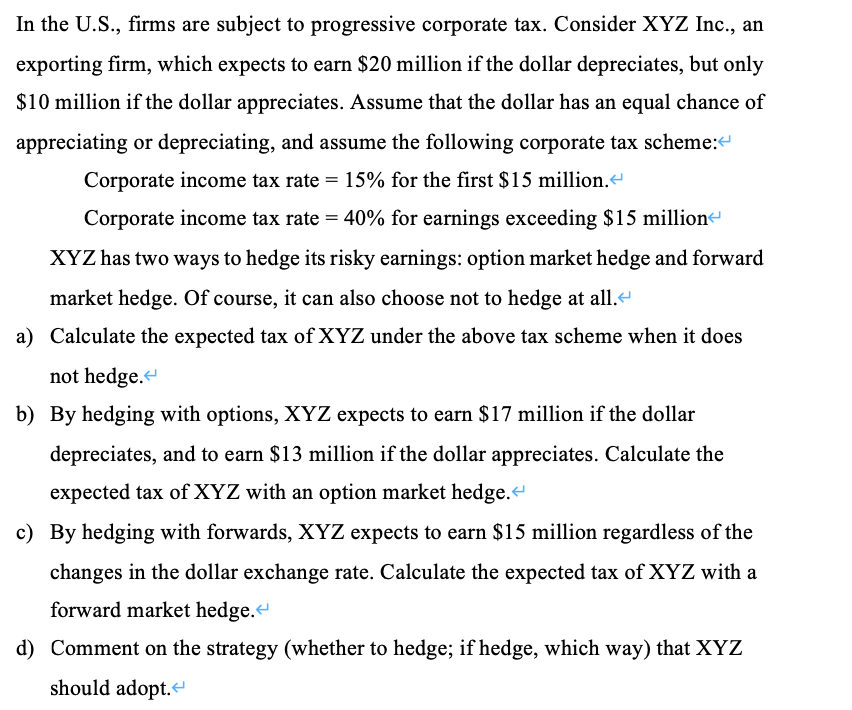

In the U.S., firms are subject to progressive corporate tax. Consider XYZ Inc., an exporting firm, which expects to earn $20 million if the dollar depreciates, but only $10 million if the dollar appreciates. Assume that the dollar has an equal chance of appreciating or depreciating, and assume the following corporate tax scheme: < Corporate income tax rate = 15% for the first $15 million. < Corporate income tax rate = 40% for earnings exceeding $15 million XYZ has two ways to hedge its risky earnings: option market hedge and forward market hedge. Of course, it can also choose not to hedge at all. < a) Calculate the expected tax of XYZ under the above tax scheme when it does not hedge. < b) By hedging with options, XYZ expects to earn $17 million if the dollar depreciates, and to earn $13 million if the dollar appreciates. Calculate the expected tax of XYZ with an option market hedge. < c) By hedging with forwards, XYZ expects to earn $15 million regardless of the changes in the dollar exchange rate. Calculate the expected tax of XYZ with a forward market hedge. < d) Comment on the strategy (whether to hedge; if hedge, which way) that XYZ should adopt.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer a When XYZ Inc does not hedge the expected earnings are calculated as Expected Earnings Earni...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started