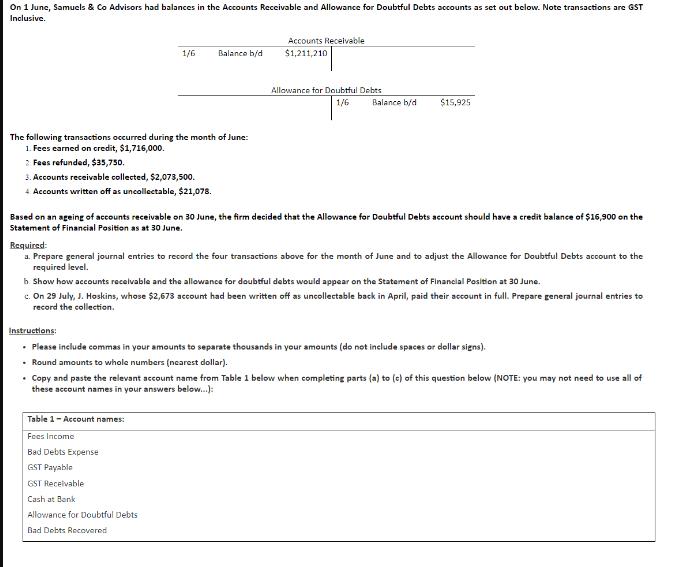

On 1 June, Samuels & Co Advisors had balances in the Accounts Receivable and Allowance for Doubtful Debts accounts as set out below. Note

On 1 June, Samuels & Co Advisors had balances in the Accounts Receivable and Allowance for Doubtful Debts accounts as set out below. Note transactions are GST Inclusive. 1/6 Balance b/d The following transactions occurred during the month of June: 1. Fees earned on credit, $1,716,000. > Fees refunded, $35,750. 3. Accounts receivable collected, $2,073,500. 4 Accounts written off as uncollectable, $21,078. Accounts Receivable $1,211,210 Allowance for Doubtful Debts 1/6 Balance b/d Table 1- Account names: Fees Income Bad Debts Expense GST Payable GST Receivable Cash at Bank Allowance for Doubtful Debts Bad Debts Recovered $15,925 Based on an ageing of accounts receivable on 30 June, the firm decided that the Allowance for Doubtful Debts account should have a credit balance of $16,900 on the Statement of Financial Position as at 30 June. Required: a. Prepare general journal entries to record the four transactions above for the month of June and to adjust the Allowance for Doubtful Debts account to the required level. h. Show how accounts receivable and the allowance for doubtful debts would appear on the Statement of Financial Position at 30 June. c. On 29 July, J. Hoskins, whose $2,673 account had been written off as uncollectable back in April, paid their account in full. Prepare general journal entries to record the collection. Instructions: . Please include commas in your amounts to separate thousands in your amounts (do not include spaces or dollar signs). Round amounts to whole numbers (nearest dollar). Copy and paste the relevant account name from Table 1 below when completing parts (a) to (c) of this question below (NOTE: you may not need to use all of these account names in your answers below...): (a) Accounts Receivable (???) (???) (To record Fee Income earned during the month of June) (???) (???) Accounts Receivable (To record fees refunded during June) (???) Accounts Receivable (Cash collected from debtors during June) (???) (???) Accounts Receivable (???) (???) (???) (Increase Allowance for Doubtful Debts to $16 900) (???) (???) (???) (Account receivable written off as uncollectible at 30 June) (???) (???) (???) (???) (???) (???) (???) (???) (???) (b) Samuels & Co Advisors Statement of Financial Position as at 30 June (extract) Accounts receivable* Less: Allowance for doubtful debts (note: include minus amount in brackets) *Workings: Accounts Receivable = Opening Balance $1,211,210 + Fee Income - Returns - Cash Collected - Debts Written Off = Closing Balance (reported in Statement of Financial Position) (???) (???) (???) (C) July 29 Accounts Receivable J. (???) Hoskins (???) Allowance for (???) Doubtful Debts/Bad Debts Recovered (Reinstate amount owing by J. Hoskins previously written off as bad) Accounts Receivable (J. Hoskins paid account in full) (???) (???) (???) (???)

Step by Step Solution

3.55 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started