Answered step by step

Verified Expert Solution

Question

1 Approved Answer

In the worksheet lease amortization schedule, you will find information about a three - year lease initiated on Jan. 1 , Year 1 . This

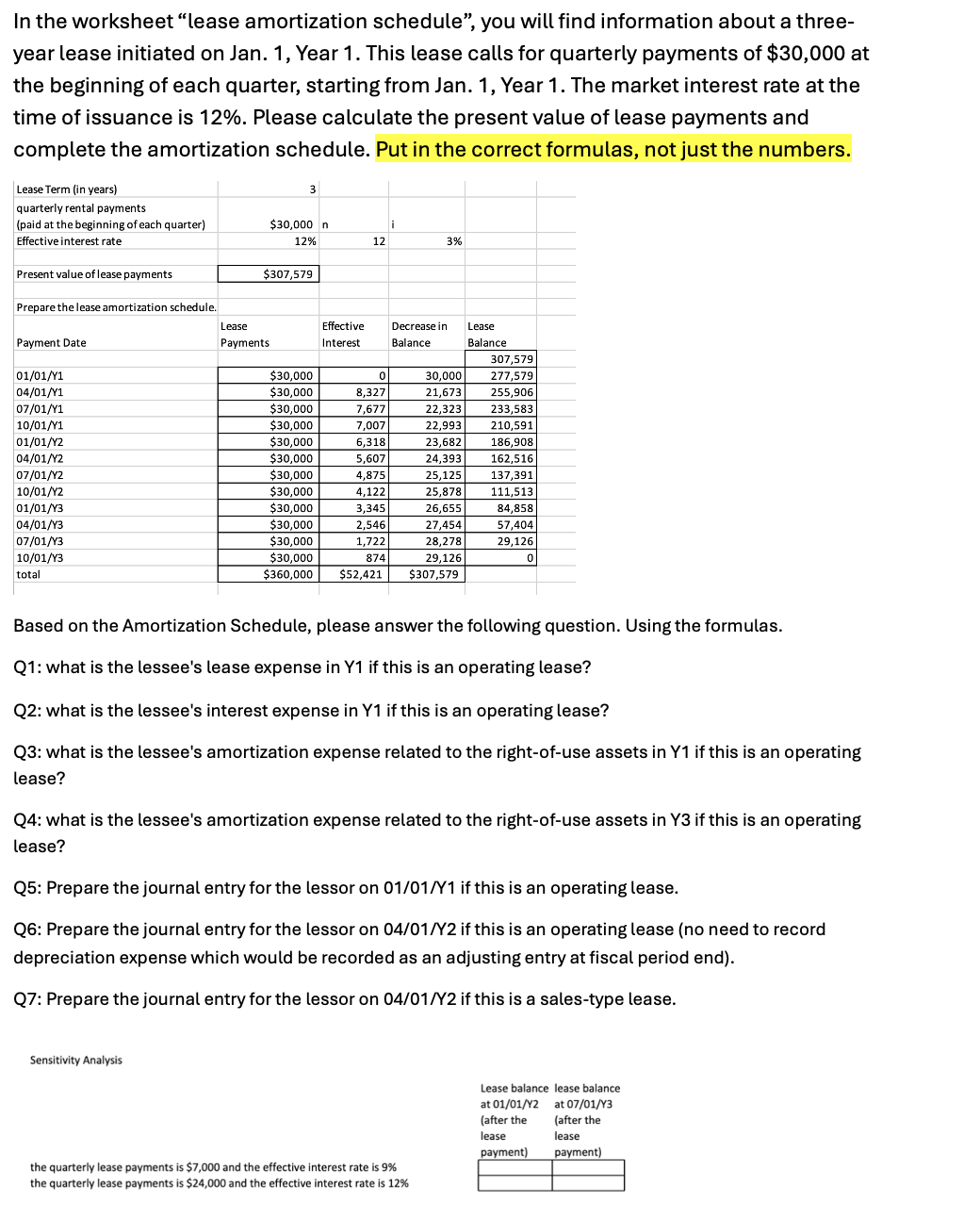

In the worksheet "lease amortization schedule", you will find information about a three

year lease initiated on Jan. Year This lease calls for quarterly payments of $ at

the beginning of each quarter, starting from Jan. Year The market interest rate at the

time of issuance is Please calculate the present value of lease payments and

complete the amortization schedule. Put in the correct formulas, not just the numbers.

Based on the Amortization Schedule, please answer the following question. Using the formulas.

Q: what is the lessee's lease expense in Y if this is an operating lease?

Q: what is the lessee's interest expense in Y if this is an operating lease?

Q: what is the lessee's amortization expense related to the rightofuse assets in Y if this is an operating

lease?

Q: what is the lessee's amortization expense related to the rightofuse assets in Y if this is an operating

lease?

Q: Prepare the journal entry for the lessor on Y if this is an operating lease.

Q: Prepare the journal entry for the lessor on if this is an operating lease no need to record

depreciation expense which would be recorded as an adjusting entry at fiscal period end

Q: Prepare the journal entry for the lessor on Y if this is a salestype lease.

Sensitivity Analysis

Q The quarterly lease payments is $ and the effective interest rate is

Q The quarterly lease payments is $ and the effective interest rate is

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started