Answered step by step

Verified Expert Solution

Question

1 Approved Answer

In the years 20X4 through 20X6, Leader Corp. reported a total of $450,000 of taxable income. The enacted tax rate during those years was

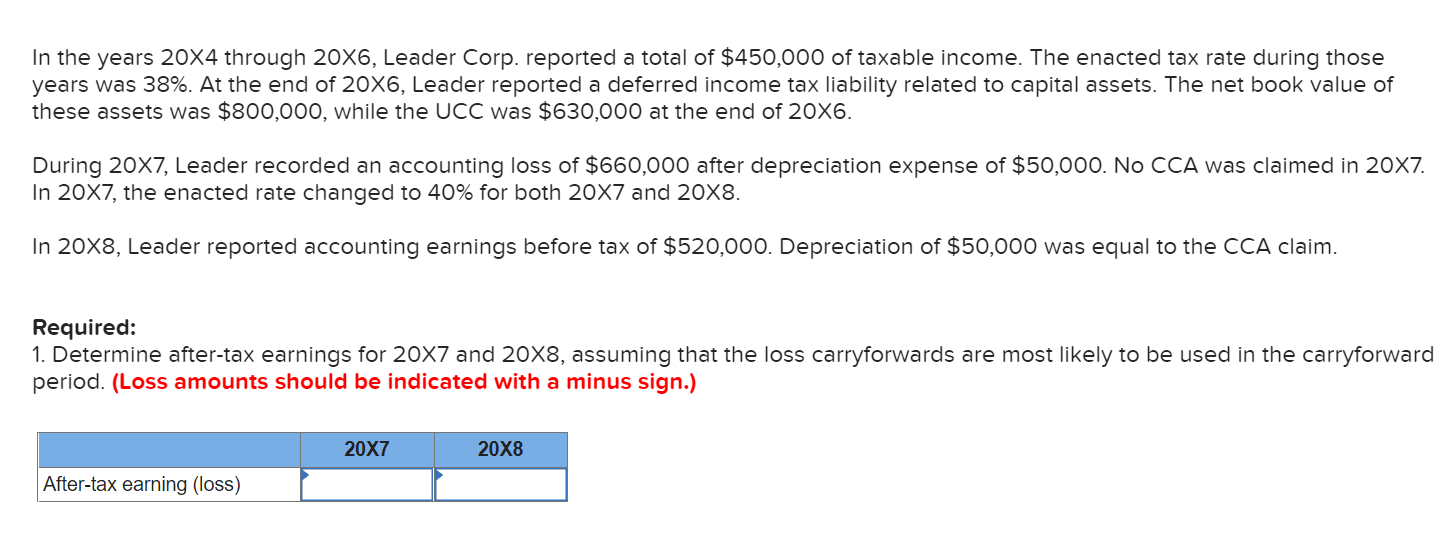

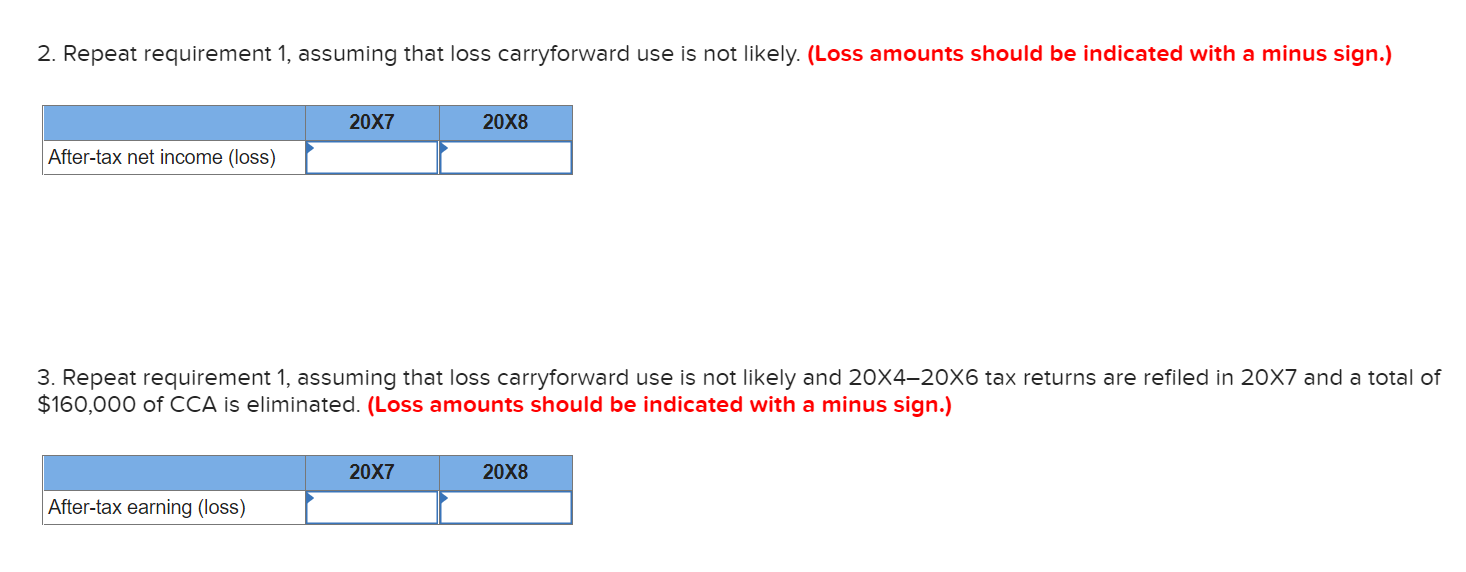

In the years 20X4 through 20X6, Leader Corp. reported a total of $450,000 of taxable income. The enacted tax rate during those years was 38%. At the end of 20X6, Leader reported a deferred income tax liability related to capital assets. The net book value of these assets was $800,000, while the UCC was $630,000 at the end of 20X6. During 20X7, Leader recorded an accounting loss of $660,000 after depreciation expense of $50,000. No CCA was claimed in 20X7. In 20X7, the enacted rate changed to 40% for both 20X7 and 20X8. In 20X8, Leader reported accounting earnings before tax of $520,000. Depreciation of $50,000 was equal to the CCA claim. Required: 1. Determine after-tax earnings for 20X7 and 20X8, assuming that the loss carryforwards are most likely to be used in the carryforward period. (Loss amounts should be indicated with a minus sign.) After-tax earning (loss) 20X7 20X8 2. Repeat requirement 1, assuming that loss carryforward use is not likely. (Loss amounts should be indicated with a minus sign.) After-tax net income (loss) 20X7 After-tax earning (loss) 3. Repeat requirement 1, assuming that loss carryforward use is not likely and 20X4-206 tax returns are refiled in 20X7 and a total of $160,000 of CCA is eliminated. (Loss amounts should be indicated with a minus sign.) 20X8 20X7 20X8

Step by Step Solution

★★★★★

3.49 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

Answer 1 Aftertax earnings for 20X7 and 20X8 assuming that the loss ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started