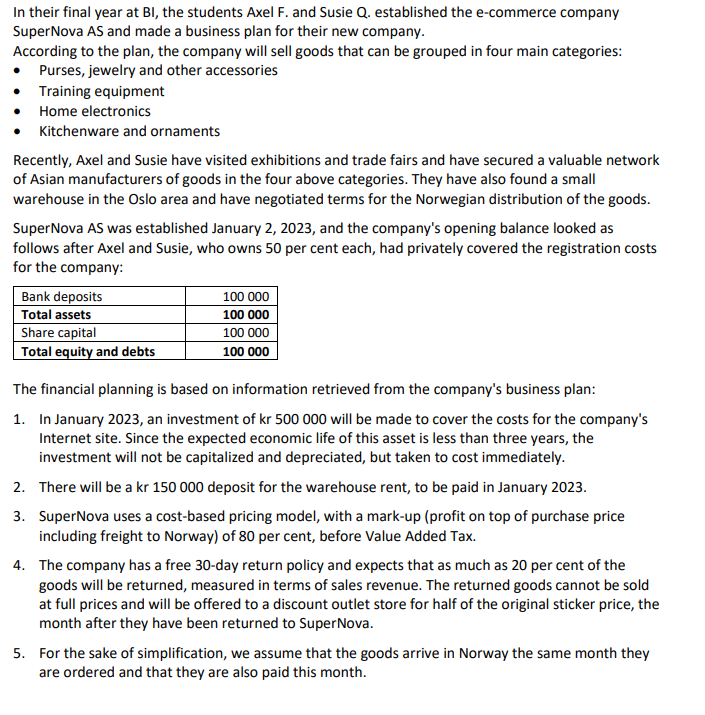

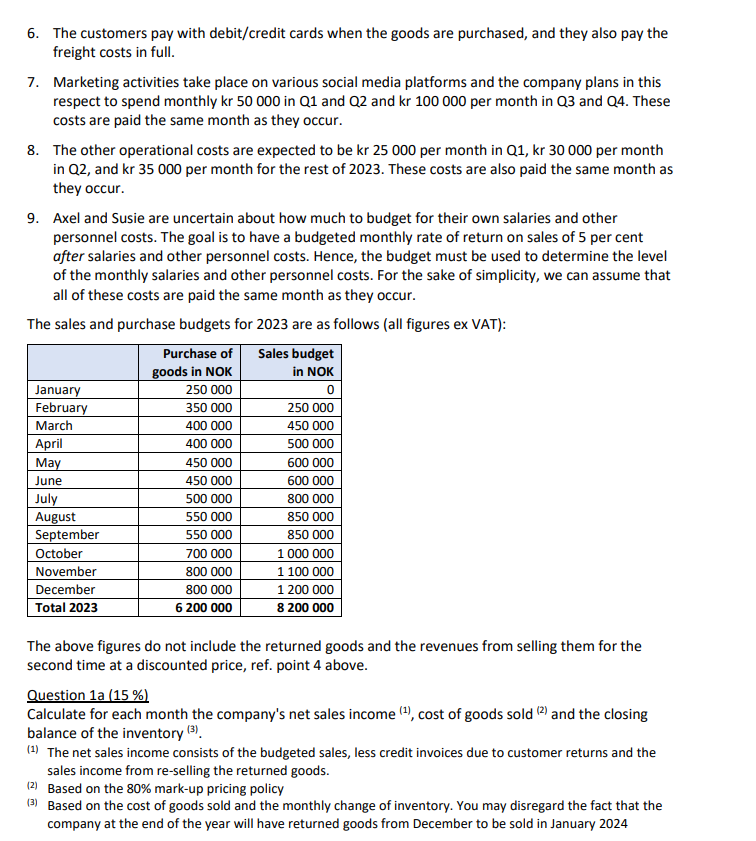

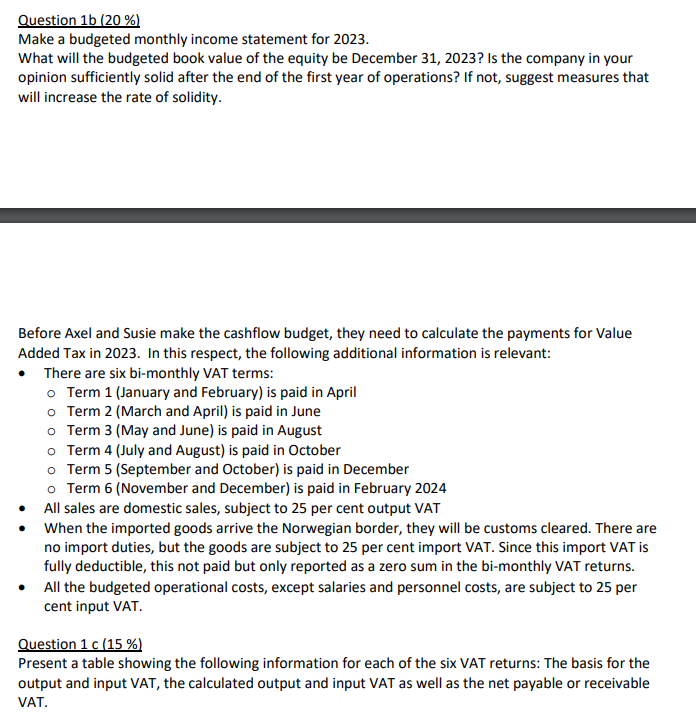

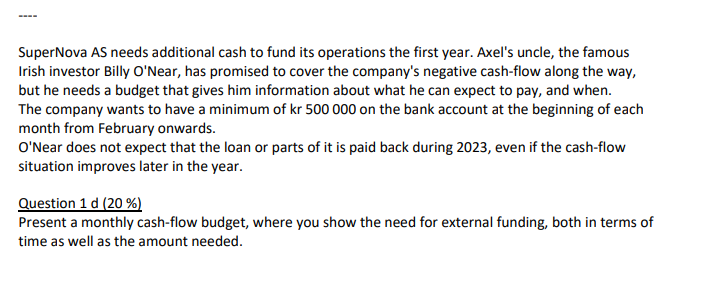

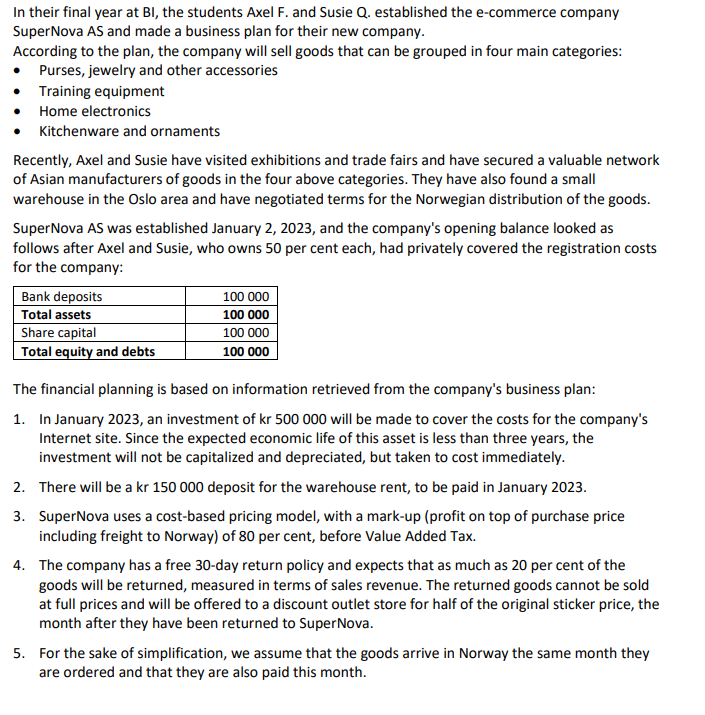

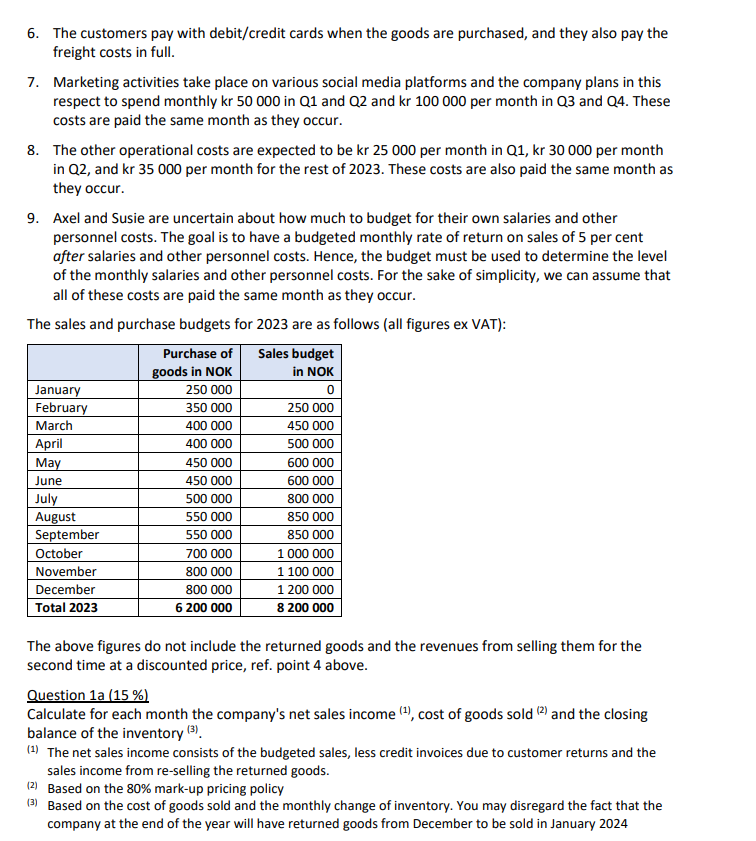

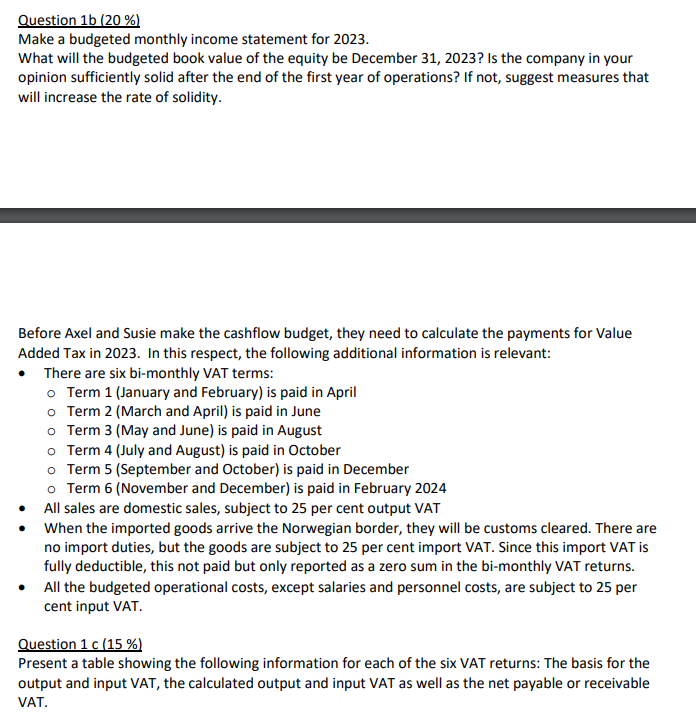

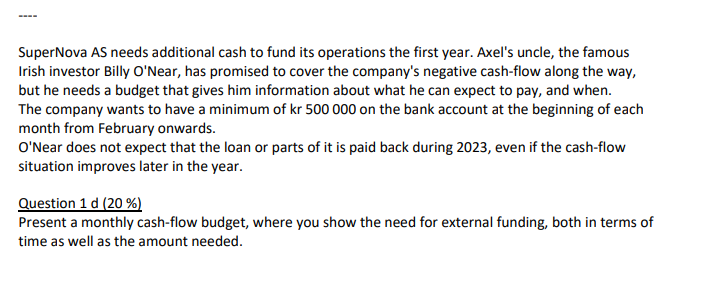

In their final year at BI, the students Axel F. and Susie Q. established the e-commerce company SuperNova AS and made a business plan for their new company. According to the plan, the company will sell goods that can be grouped in four main categories: - Purses, jewelry and other accessories - Training equipment - Home electronics - Kitchenware and ornaments Recently, Axel and Susie have visited exhibitions and trade fairs and have secured a valuable network of Asian manufacturers of goods in the four above categories. They have also found a small warehouse in the Oslo area and have negotiated terms for the Norwegian distribution of the goods. SuperNova AS was established January 2, 2023, and the company's opening balance looked as follows after Axel and Susie, who owns 50 per cent each, had privately covered the registration costs for the company: The financial planning is based on information retrieved from the company's business plan: 1. In January 2023, an investment of kr 500000 will be made to cover the costs for the company's Internet site. Since the expected economic life of this asset is less than three years, the investment will not be capitalized and depreciated, but taken to cost immediately. 2. There will be a kr150000 deposit for the warehouse rent, to be paid in January 2023. 3. SuperNova uses a cost-based pricing model, with a mark-up (profit on top of purchase price including freight to Norway) of 80 per cent, before Value Added Tax. 4. The company has a free 30-day return policy and expects that as much as 20 per cent of the goods will be returned, measured in terms of sales revenue. The returned goods cannot be sold at full prices and will be offered to a discount outlet store for half of the original sticker price, the month after they have been returned to SuperNova. 5. For the sake of simplification, we assume that the goods arrive in Norway the same month they are ordered and that they are also paid this month. 6. The customers pay with debit/credit cards when the goods are purchased, and they also pay the freight costs in full. 7. Marketing activities take place on various social media platforms and the company plans in this respect to spend monthly kr 50000 in Q1 and Q2 and kr 100000 per month in Q3 and Q4. These costs are paid the same month as they occur. 8. The other operational costs are expected to be kr 25000 per month in Q1,kr30000 per month in Q2, and kr 35000 per month for the rest of 2023 . These costs are also paid the same month as they occur. 9. Axel and Susie are uncertain about how much to budget for their own salaries and other personnel costs. The goal is to have a budgeted monthly rate of return on sales of 5 per cent after salaries and other personnel costs. Hence, the budget must be used to determine the level of the monthly salaries and other personnel costs. For the sake of simplicity, we can assume that all of these costs are paid the same month as they occur. The sales and purchase budgets for 2023 are as follows (all figures ex VAT): The above figures do not include the returned goods and the revenues from selling them for the second time at a discounted price, ref. point 4 above. Question 1a(15%) Calculate for each month the company's net sales income (1), cost of goods sold (2) and the closing balance of the inventory (3). (1) The net sales income consists of the budgeted sales, less credit invoices due to customer returns and the sales income from re-selling the returned goods. (2) Based on the 80% mark-up pricing policy (3) Based on the cost of goods sold and the monthly change of inventory. You may disregard the fact that the company at the end of the year will have returned goods from December to be sold in January 2024 Question 1b(20%) Make a budgeted monthly income statement for 2023. What will the budgeted book value of the equity be December 31,2023? Is the company in your opinion sufficiently solid after the end of the first year of operations? If not, suggest measures that will increase the rate of solidity. Before Axel and Susie make the cashflow budget, they need to calculate the payments for Value Added Tax in 2023. In this respect, the following additional information is relevant: - There are six bi-monthly VAT terms: Term 1 (January and February) is paid in April Term 2 (March and April) is paid in June Term 3 (May and June) is paid in August Term 4 (July and August) is paid in October Term 5 (September and October) is paid in December Term 6 (November and December) is paid in February 2024 - All sales are domestic sales, subject to 25 per cent output VAT - When the imported goods arrive the Norwegian border, they will be customs cleared. There are no import duties, but the goods are subject to 25 per cent import VAT. Since this import VAT is fully deductible, this not paid but only reported as a zero sum in the bi-monthly VAT returns. - All the budgeted operational costs, except salaries and personnel costs, are subject to 25 per cent input VAT. Question 1c(15%) Present a table showing the following information for each of the six VAT returns: The basis for the output and input VAT, the calculated output and input VAT as well as the net payable or receivable VAT. SuperNova AS needs additional cash to fund its operations the first year. Axel's uncle, the famous Irish investor Billy O'Near, has promised to cover the company's negative cash-flow along the way, but he needs a budget that gives him information about what he can expect to pay, and when. The company wants to have a minimum of kr 500000 on the bank account at the beginning of each month from February onwards. O'Near does not expect that the loan or parts of it is paid back during 2023, even if the cash-flow situation improves later in the year. Question 1d(20%) Present a monthly cash-flow budget, where you show the need for external funding, both in terms of time as well as the amount needed. In their final year at BI, the students Axel F. and Susie Q. established the e-commerce company SuperNova AS and made a business plan for their new company. According to the plan, the company will sell goods that can be grouped in four main categories: - Purses, jewelry and other accessories - Training equipment - Home electronics - Kitchenware and ornaments Recently, Axel and Susie have visited exhibitions and trade fairs and have secured a valuable network of Asian manufacturers of goods in the four above categories. They have also found a small warehouse in the Oslo area and have negotiated terms for the Norwegian distribution of the goods. SuperNova AS was established January 2, 2023, and the company's opening balance looked as follows after Axel and Susie, who owns 50 per cent each, had privately covered the registration costs for the company: The financial planning is based on information retrieved from the company's business plan: 1. In January 2023, an investment of kr 500000 will be made to cover the costs for the company's Internet site. Since the expected economic life of this asset is less than three years, the investment will not be capitalized and depreciated, but taken to cost immediately. 2. There will be a kr150000 deposit for the warehouse rent, to be paid in January 2023. 3. SuperNova uses a cost-based pricing model, with a mark-up (profit on top of purchase price including freight to Norway) of 80 per cent, before Value Added Tax. 4. The company has a free 30-day return policy and expects that as much as 20 per cent of the goods will be returned, measured in terms of sales revenue. The returned goods cannot be sold at full prices and will be offered to a discount outlet store for half of the original sticker price, the month after they have been returned to SuperNova. 5. For the sake of simplification, we assume that the goods arrive in Norway the same month they are ordered and that they are also paid this month. 6. The customers pay with debit/credit cards when the goods are purchased, and they also pay the freight costs in full. 7. Marketing activities take place on various social media platforms and the company plans in this respect to spend monthly kr 50000 in Q1 and Q2 and kr 100000 per month in Q3 and Q4. These costs are paid the same month as they occur. 8. The other operational costs are expected to be kr 25000 per month in Q1,kr30000 per month in Q2, and kr 35000 per month for the rest of 2023 . These costs are also paid the same month as they occur. 9. Axel and Susie are uncertain about how much to budget for their own salaries and other personnel costs. The goal is to have a budgeted monthly rate of return on sales of 5 per cent after salaries and other personnel costs. Hence, the budget must be used to determine the level of the monthly salaries and other personnel costs. For the sake of simplicity, we can assume that all of these costs are paid the same month as they occur. The sales and purchase budgets for 2023 are as follows (all figures ex VAT): The above figures do not include the returned goods and the revenues from selling them for the second time at a discounted price, ref. point 4 above. Question 1a(15%) Calculate for each month the company's net sales income (1), cost of goods sold (2) and the closing balance of the inventory (3). (1) The net sales income consists of the budgeted sales, less credit invoices due to customer returns and the sales income from re-selling the returned goods. (2) Based on the 80% mark-up pricing policy (3) Based on the cost of goods sold and the monthly change of inventory. You may disregard the fact that the company at the end of the year will have returned goods from December to be sold in January 2024 Question 1b(20%) Make a budgeted monthly income statement for 2023. What will the budgeted book value of the equity be December 31,2023? Is the company in your opinion sufficiently solid after the end of the first year of operations? If not, suggest measures that will increase the rate of solidity. Before Axel and Susie make the cashflow budget, they need to calculate the payments for Value Added Tax in 2023. In this respect, the following additional information is relevant: - There are six bi-monthly VAT terms: Term 1 (January and February) is paid in April Term 2 (March and April) is paid in June Term 3 (May and June) is paid in August Term 4 (July and August) is paid in October Term 5 (September and October) is paid in December Term 6 (November and December) is paid in February 2024 - All sales are domestic sales, subject to 25 per cent output VAT - When the imported goods arrive the Norwegian border, they will be customs cleared. There are no import duties, but the goods are subject to 25 per cent import VAT. Since this import VAT is fully deductible, this not paid but only reported as a zero sum in the bi-monthly VAT returns. - All the budgeted operational costs, except salaries and personnel costs, are subject to 25 per cent input VAT. Question 1c(15%) Present a table showing the following information for each of the six VAT returns: The basis for the output and input VAT, the calculated output and input VAT as well as the net payable or receivable VAT. SuperNova AS needs additional cash to fund its operations the first year. Axel's uncle, the famous Irish investor Billy O'Near, has promised to cover the company's negative cash-flow along the way, but he needs a budget that gives him information about what he can expect to pay, and when. The company wants to have a minimum of kr 500000 on the bank account at the beginning of each month from February onwards. O'Near does not expect that the loan or parts of it is paid back during 2023, even if the cash-flow situation improves later in the year. Question 1d(20%) Present a monthly cash-flow budget, where you show the need for external funding, both in terms of time as well as the amount needed