Answered step by step

Verified Expert Solution

Question

1 Approved Answer

In these T accounts record the accounting entries for the transactions listed below 3. H. Hogan, an accountant, owns a business with the following assets

In these T accounts record the accounting entries for the transactions listed below

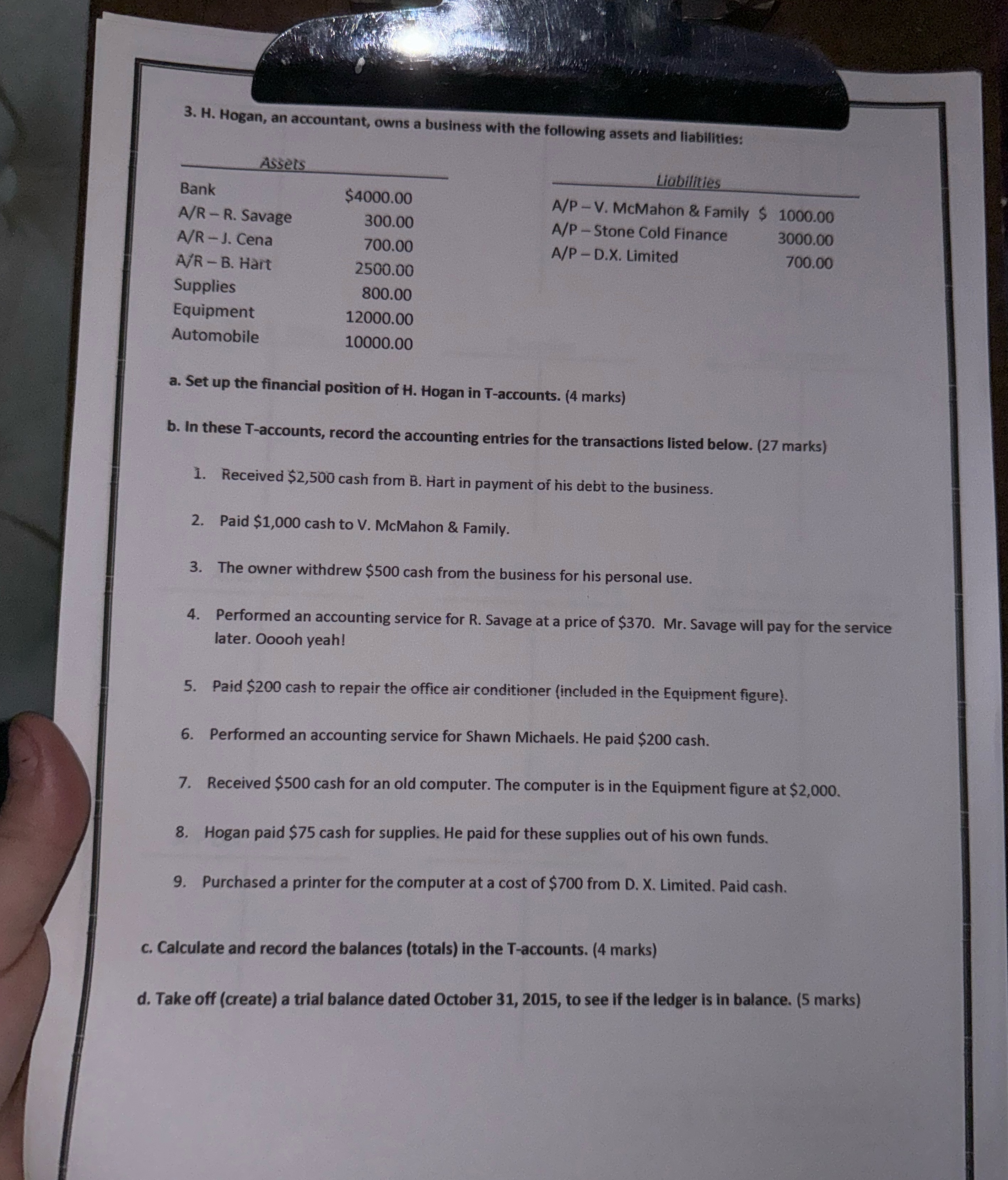

3. H. Hogan, an accountant, owns a business with the following assets and liabilities: Assets Bank A/R-R. Savage A/R - J. Cena A/R - B. Hart Supplies Equipment Automobile $4000.00 300.00 700.00 2500.00 800.00 12000.00 10000.00 Liabilities A/P-V. McMahon & Family $ 1000.00 A/P-Stone Cold Finance 3000.00 700.00 A/P-D.X. Limited a. Set up the financial position of H. Hogan in T-accounts. (4 marks) b. In these T-accounts, record the accounting entries for the transactions listed below. (27 marks) 1. Received $2,500 cash from B. Hart in payment of his debt to the business. 2. Paid $1,000 cash to V. McMahon & Family. 3. The owner withdrew $500 cash from the business for his personal use. 4. Performed an accounting service for R. Savage at a price of $370. Mr. Savage will pay for the service later. Ooooh yeah! 5. Paid $200 cash to repair the office air conditioner (included in the Equipment figure). 6. Performed an accounting service for Shawn Michaels. He paid $200 cash. 7. Received $500 cash for an old computer. The computer is in the Equipment figure at $2,000. 8. Hogan paid $75 cash for supplies. He paid for these supplies out of his own funds. 9. Purchased a printer for the computer at a cost of $700 from D. X. Limited. Paid cash. c. Calculate and record the balances (totals) in the T-accounts. (4 marks) d. Take off (create) a trial balance dated October 31, 2015, to see if the ledger is in balance. (5 marks)

Step by Step Solution

★★★★★

3.38 Rating (142 Votes )

There are 3 Steps involved in it

Step: 1

To solve this problem well set up Taccounts for the assets liabilities and owners equity record the transactions calculate the balances and finally cr...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started