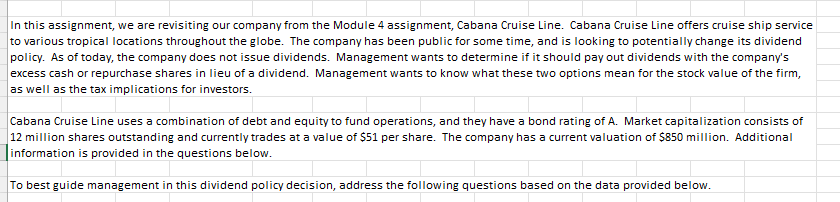

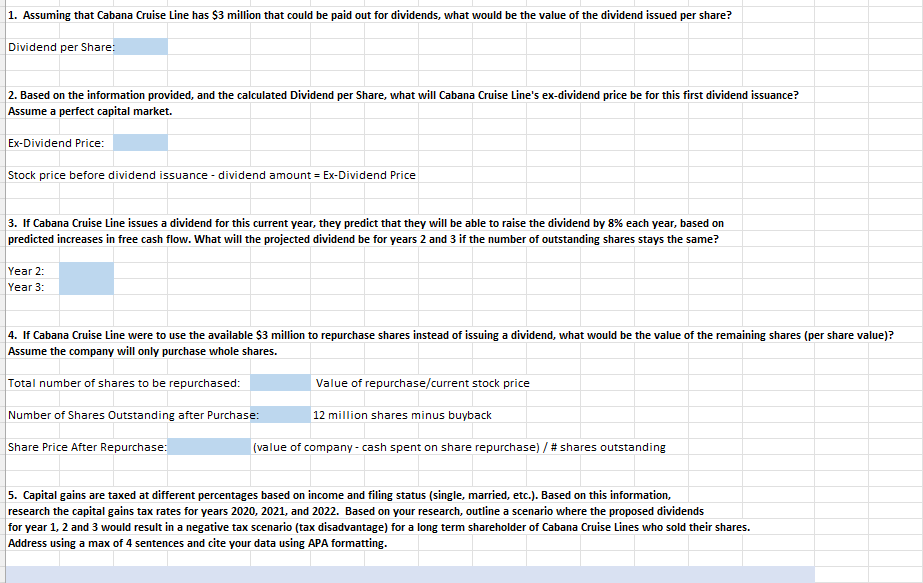

In this assignment, we are revisiting our company from the Module 4 assignment, Cabana Cruise Line. Cabana Cruise Line offers cruise ship service to various tropical locations throughout the globe. The company has been public for some time, and is looking to potentially change its dividend policy. As of today, the company does not issue dividends. Management wants to determine if it should pay out dividends with the company's excess cash or repurchase shares in lieu of a dividend. Management wants to know what these two options mean for the stock value of the firm, as well as the tax implications for investors. Cabana Cruise Line uses a combination of debt and equity to fund operations, and they have a bond rating of A. Market capitalization consists of 12 million shares outstanding and currently trades at a value of $51 per share. The company has a current valuation of $850 million. Additional information is provided in the questions below. 1. Assuming that Cabana Cruise Line has $3 million that could be paid out for dividends, what would be the value of the dividend issued per share? Dividend per Share: 2. Based on the information provided, and the calculated Dividend per Share, what will Cabana Cruise Line's ex-dividend price be for this first dividend issuance? Assume a perfect capital market. Ex-Dividend Price: Stock price before dividend issuance - dividend amount = Ex-Dividend Price 3. If Cabana Cruise Line issues a dividend for this current year, they predict that they will be able to raise the dividend by 8% each year, based on predicted increases in free cash flow. What will the projected dividend be for years 2 and 3 if the number of outstanding shares stays the same? Year 2: Year 3: 4. If Cabana Cruise Line were to use the available $3 million to repurchase shares instead of issuing a dividend, what would be the value of the remaining shares (per share value)? Assume the company will only purchase whole shares. Total number of shares to be repurchased: Value of repurchase/current stock price Number of Shares Outstanding after Purchase: 12 million shares minus buyback Share Price After Repurchase: (value of company - cash spent on share repurchase) / # shares outstanding 5. Capital gains are taxed at different percentages based on income and filing status (single, married, etc.). Based on this information, research the capital gains tax rates for years 2020, 2021, and 2022. Based on your research, outline a scenario where the proposed dividends for year 1, 2 and 3 would result in a negative tax scenario (tax disadvantage) for a long term shareholder of Cabana Cruise Lines who sold their shares. Address using a max of 4 sentences and cite your data using APA formatting. In this assignment, we are revisiting our company from the Module 4 assignment, Cabana Cruise Line. Cabana Cruise Line offers cruise ship service to various tropical locations throughout the globe. The company has been public for some time, and is looking to potentially change its dividend policy. As of today, the company does not issue dividends. Management wants to determine if it should pay out dividends with the company's excess cash or repurchase shares in lieu of a dividend. Management wants to know what these two options mean for the stock value of the firm, as well as the tax implications for investors. Cabana Cruise Line uses a combination of debt and equity to fund operations, and they have a bond rating of A. Market capitalization consists of 12 million shares outstanding and currently trades at a value of $51 per share. The company has a current valuation of $850 million. Additional information is provided in the questions below. 1. Assuming that Cabana Cruise Line has $3 million that could be paid out for dividends, what would be the value of the dividend issued per share? Dividend per Share: 2. Based on the information provided, and the calculated Dividend per Share, what will Cabana Cruise Line's ex-dividend price be for this first dividend issuance? Assume a perfect capital market. Ex-Dividend Price: Stock price before dividend issuance - dividend amount = Ex-Dividend Price 3. If Cabana Cruise Line issues a dividend for this current year, they predict that they will be able to raise the dividend by 8% each year, based on predicted increases in free cash flow. What will the projected dividend be for years 2 and 3 if the number of outstanding shares stays the same? Year 2: Year 3: 4. If Cabana Cruise Line were to use the available $3 million to repurchase shares instead of issuing a dividend, what would be the value of the remaining shares (per share value)? Assume the company will only purchase whole shares. Total number of shares to be repurchased: Value of repurchase/current stock price Number of Shares Outstanding after Purchase: 12 million shares minus buyback Share Price After Repurchase: (value of company - cash spent on share repurchase) / # shares outstanding 5. Capital gains are taxed at different percentages based on income and filing status (single, married, etc.). Based on this information, research the capital gains tax rates for years 2020, 2021, and 2022. Based on your research, outline a scenario where the proposed dividends for year 1, 2 and 3 would result in a negative tax scenario (tax disadvantage) for a long term shareholder of Cabana Cruise Lines who sold their shares. Address using a max of 4 sentences and cite your data using APA formatting