Question

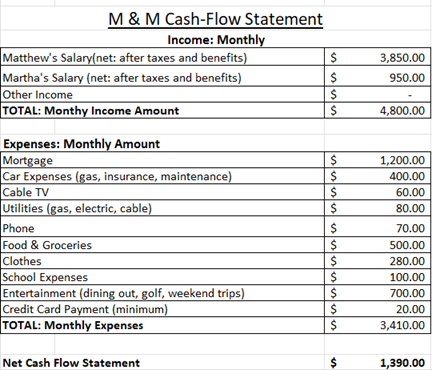

In this assignment, you continue to provide financial advising to Matthew and Martha (the M&M family). M&S financial situation changes since Matthew had a promotion,

In this assignment, you continue to provide financial advising to Matthew and Martha (the M&M family). M&S financial situation changes since Matthew had a promotion, few changes in their expense. However, M&M have resolved, as originally planned, to save a total of $800 per month:

- M&M are saving $500 each month for a down payment on a new care they will purchase within a year.

- M&S are also saving $300 each month for their childrens post-secondary education which begins 12 years from now.

M&M noticed that their local bank offers guaranteed investment certificates (GICs) with a number of different maturities. M&M need to determine which GICs will best suit their savings goal. Each GIC requires a minimum investment of $300.00

Here are the different GICs maturity options were the bank stated that the interest rate for each GIC is compounded annually:

Q1 Advise M&S on which maturity to select when investing their savings in a GIC for a down payment on a car. What are the advantages or disadvantages of the relatively short-term maturities versus the longer-term maturities?

| Maturity | Annual Interest Rate (%) |

| 1 Year | 1.25% |

| 2 Years | 1.5% |

| 5 Years | 2% |

| 10 Years | 3% |

Assume that M&M decided to save $800 per month in a GIC account. The funds will not be available to M&M for the term of the GIC they choose.

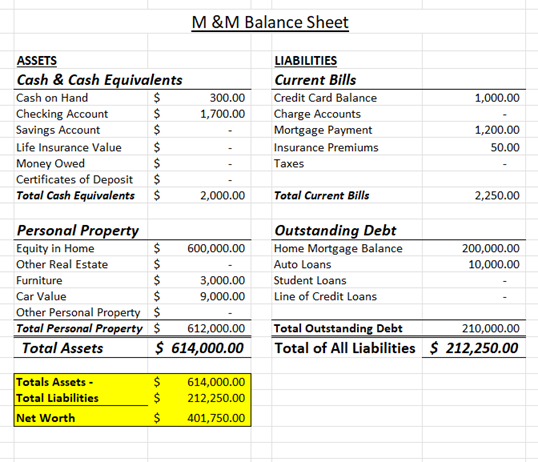

Based on the current M&M status, they have about $300 in cash and $1700 in their chequing account.

To give you the current perspective of the current personal cash flow statement and personal Balance Sheet, please use the following:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started