Question

In this assignment, you will incorporate what you learned in your accounting and finance classes to estimate your required start-up funding and financial projections. Download

In this assignment, you will incorporate what you learned in your accounting and finance classes to estimate your required start-up funding and financial projections. Download the Excel budget template and create a sample budget for one year that you will take to a commercial lender when applying for a start-up loan for your business. You may request a start-up loan in the amount of $0 to $500,000, but the loan can be for no more than $500,000.

Excel (budget) portion of assignment:

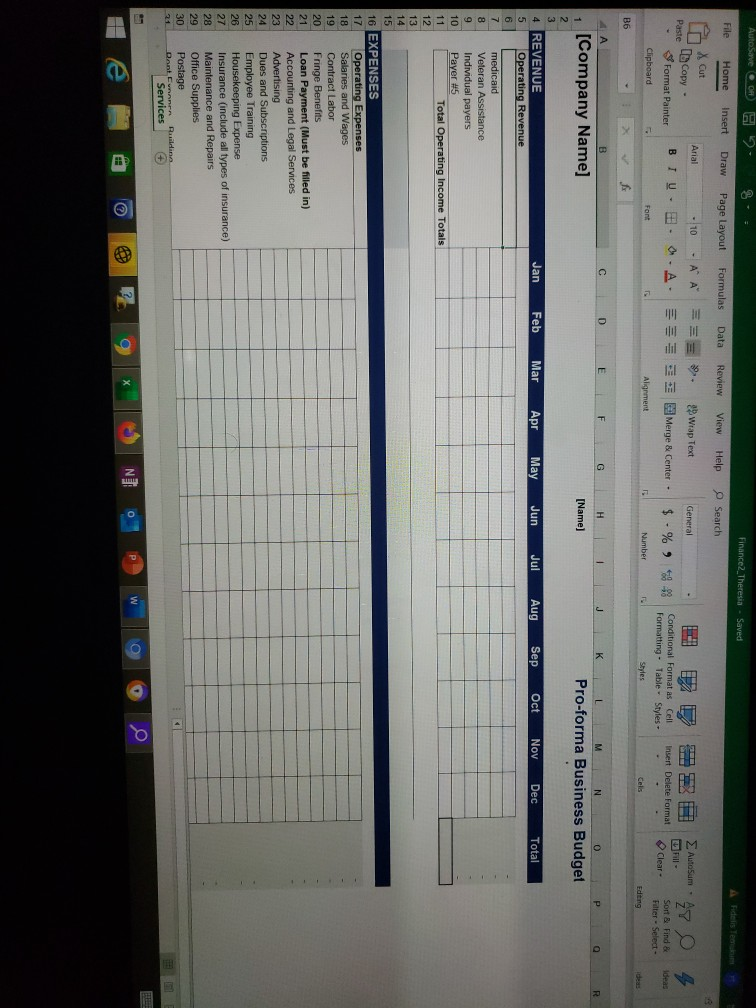

Download the Budget Template that has been provided to you. You will notice that the 12 months of the calendar year have been inserted for you, as have the categories of Revenue and Operating Expenses. Prepare a 12-month annual budget by doing the following:

- Under the Revenue section, list the payers from whom you will receive revenue. For ease of developing this budget, list no more than five payers. For example, this may include sources such as Medicare, Medicaid, and otherfrom which other payer groups will you receive reimbursement?

- Under the Operating Expenses section, review the list of expenses that has been provided to you. Delete any expenses that will not affect your business and add any additional expenses line items that you believe are needed in your type of business.

- Be sure to NOT delete the Loan Payment line item, as this is the amount of money that you will pay back towards your loan each month. Assume that the loan is received on January 1st and the first loan payment is also due in January.

- Insert numbers for each month for all line items and to totals for each month in each section. How much revenue do you expect will come in from each payer source each month and what will be the total revenue for the month? How much money do you believe will flow out of the business in the form of expenses each month and what will be the total of all expenses? Be sure to use Excel to total all rows and columns. Be realistic here! Conduct external research, as needed, to determine what figures should be inserted for each line item. For example, if you start a two physician medical practice that also employs one nurse, one medical assistant and an office manager, what would be the total salaries for all of these individuals? The annual salary figure for each individual must then be divided by 12 (for 12 months in a year) to determine your monthly total salary expense.

- Using the Excel features, build a formula for the Net Income/Net Loss row to see if you will be earning a profit or a loss for each month of the first year. Insert your tax (month by month) totals. Then calculate your Net Income Total (month by month).

Narrative portion of assignment:

- Prepare a two-page paper (on a separate Word document) summarizing your financial needs and discussing any assumptions or limitations of your budget. Be sure to also address any unexpected things that might occur (downturn in the economy, policy or legislative changes to insurance, etc.). This written narrative will be given to the commercial lender in support of your application for the loan, along with your pro forma Excel budget.

Finance2 Theresia - Saved A Fidelis Team Review ViewHelp Search AutoSaver 2. 8- File Home Insert Draw Page Layout Formulas Data X Cut Anal - 10 -A A === - Format Painter B TU. . .A. Clipboard General Copy - Paste > S wrap Text Merge & Center - E $ - % 9298 Conditional Format as Cell Formatting - Table Styles - Insert Delete Format Autosum. 47 Clear Sort & Find & Filter - Select - Ideas Font Alignment Number Styles Cells B6 C D E F 4 A 1 [Company Name] G H [Name] I J K L M N O Pro-forma Business Budget P Q R vo AWN 4 REVENUE Operating Revenue Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Total medicaid Veteran Assistance Individual payers Payer #5 Total Operating Income Totals 18 19 21 16 EXPENSES Operating Expenses Salaries and Wages Contract Labor 20 Fringe Benefits Loan Payment (Must be filled in) Accounting and Legal Services Advertising Dues and Subscriptions Employee Training Housekeeping Expense Insurance (include all types of insurance) Maintenance and Repairs Office Supplies Postage Dont Can Bundan Services 28 O 23 24 26 WUST De med in) Accounting and Legal Services Advertising Dues and Subscriptions Employee Training Housekeeping Expense Insurance (include all types of insurance) Maintenance and Repairs Office Supplies Postage Rent Expense - Building Taxes and Licenses Telephone/Internet Provider Travel Utilities 34 Total Operating Expenses Totals 40 Net Income Before Taxes Totals 41 Income Tax Expense Totals 42 NET INCOME TOTALS Services N b ke I wil RTI rulo H I J K L F G S D Finance2 Theresia - Saved A Fidelis Team Review ViewHelp Search AutoSaver 2. 8- File Home Insert Draw Page Layout Formulas Data X Cut Anal - 10 -A A === - Format Painter B TU. . .A. Clipboard General Copy - Paste > S wrap Text Merge & Center - E $ - % 9298 Conditional Format as Cell Formatting - Table Styles - Insert Delete Format Autosum. 47 Clear Sort & Find & Filter - Select - Ideas Font Alignment Number Styles Cells B6 C D E F 4 A 1 [Company Name] G H [Name] I J K L M N O Pro-forma Business Budget P Q R vo AWN 4 REVENUE Operating Revenue Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Total medicaid Veteran Assistance Individual payers Payer #5 Total Operating Income Totals 18 19 21 16 EXPENSES Operating Expenses Salaries and Wages Contract Labor 20 Fringe Benefits Loan Payment (Must be filled in) Accounting and Legal Services Advertising Dues and Subscriptions Employee Training Housekeeping Expense Insurance (include all types of insurance) Maintenance and Repairs Office Supplies Postage Dont Can Bundan Services 28 O 23 24 26 WUST De med in) Accounting and Legal Services Advertising Dues and Subscriptions Employee Training Housekeeping Expense Insurance (include all types of insurance) Maintenance and Repairs Office Supplies Postage Rent Expense - Building Taxes and Licenses Telephone/Internet Provider Travel Utilities 34 Total Operating Expenses Totals 40 Net Income Before Taxes Totals 41 Income Tax Expense Totals 42 NET INCOME TOTALS Services N b ke I wil RTI rulo H I J K L F G S D

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started