In this interest rate calculation example, where does the equation on the top of page 227 come from?

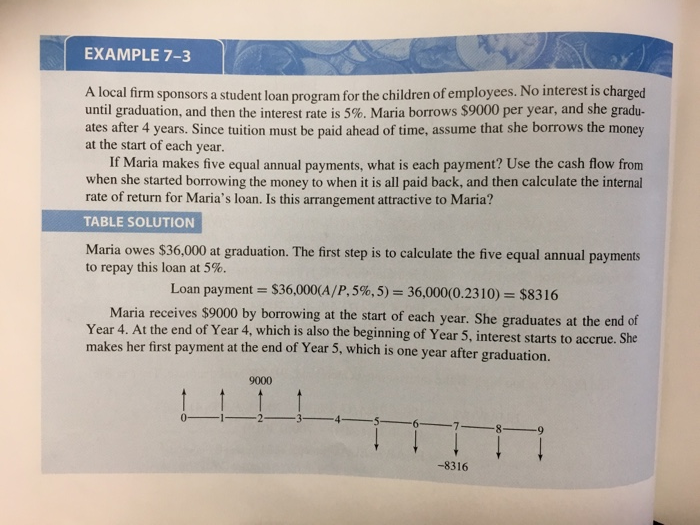

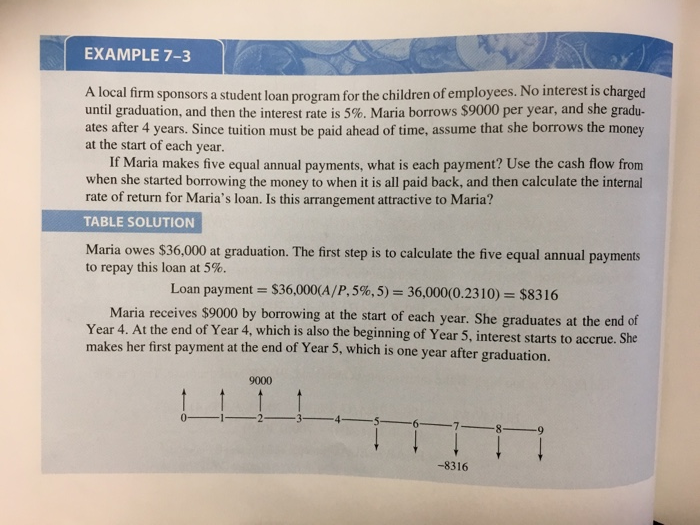

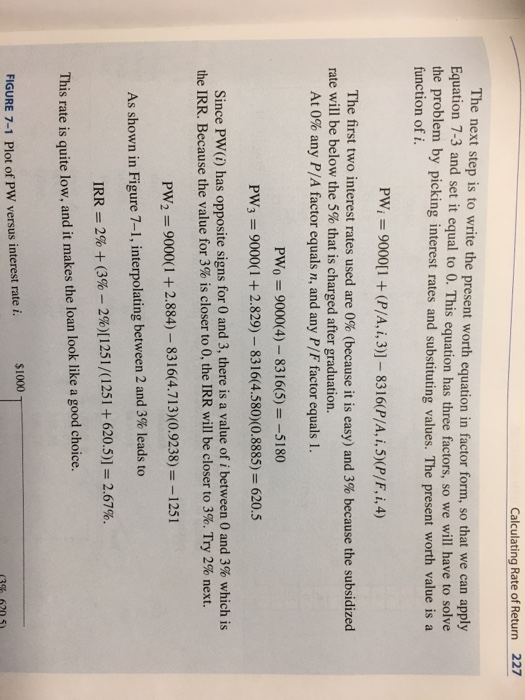

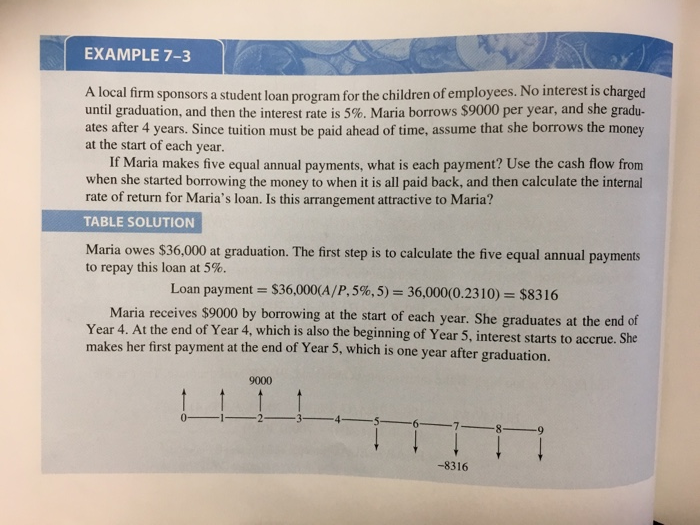

EXAMPLE 7-3 A local firm sponsors a student loan program for the children of employees. No interest is charged until graduation, and then the interest rate is 5%. Maria borrows $9000 per year, and she gradu- ates after 4 years. Since tuition must be paid ahead of time, assume that she borrows the money at the start of each year. If Maria makes five equal annual payments, what is each payment? Use the cash flow from when she started borrowing the money to when it is all paid back, and then calculate the internal rate of return for Maria's loan. Is this arrangement attractive to Maria? TABLE SOLUTION Maria owes $36,000 at graduation. The first step is to calculate the five equal annual payments to repay this loan at 5% Loan payment--$36,000(A/P, 5%, 5) 36,000(0.23 10)-$831 6 Maria receives $9000 by borrowing at the start of each year. She graduates at the end o Year 4. At the end of Year 4, which is also the beginning of Year 5, interest starts to accrue. She makes her first payment at the end of Year 5, which is one year after gr 9000 6789 -8316 Calculating Rate of Return 227 The next step is to write the present worth equation in factor form, so that we can a Equation 7-3 the problem by picking interest rates and su function of i. pply and set it equal to 0. This equation has three factors, so we will have to solve bstituting values. The present worth value is a PW 9000[I (P/A.i,3)] 8316(P/A, i,5)(P/F,i,4) The first two interest rates used are 0% (because it is easy) and 3% because the subsidized rate will be below the 5% that is charged after graduation. At 0% any P/A factor equals n, and any P/F factor equals l . PWo 9000(4)-8316(5)-5180 PW3-# 9000( I + 2.829)-831 6(4.580)(0.8885) 620.5 Since PW) has opposite signs for 0 and 3, there is a value of 1 between 0 and 3% which is the IRR. Because the value for 3% is closer to 0, the IRR will be closer to 3%. Try 2% next. PW2 9000(+2.884) 8316(4.713)(0.9238)--1251 As shown in Figure 7-1, interpolating between 2 and 3% leads to IRR 2% + (3%-2%)[ 125 1 /( 1 25 1 + 620.5)] = 2.67%. This rate is quite low, and it makes the loan look like a good choice. $1000 FIGURE 7-1 Plot of PW versus interest rate