Consider your assigned role in the situation, and let that guide your perspective. Look deeper at the details: facts, problems, organizational goals, objectives, policies, strategies.

Consider your assigned role in the situation, and let that guide your perspective. Look deeper at the details: facts, problems, organizational goals, objectives, policies, strategies. Next, consider the concepts, theories, tools and research you need to use to address the issues presented. Then, complete any research, analysis, calculations, or graphing to support your decisions and make recommendations.

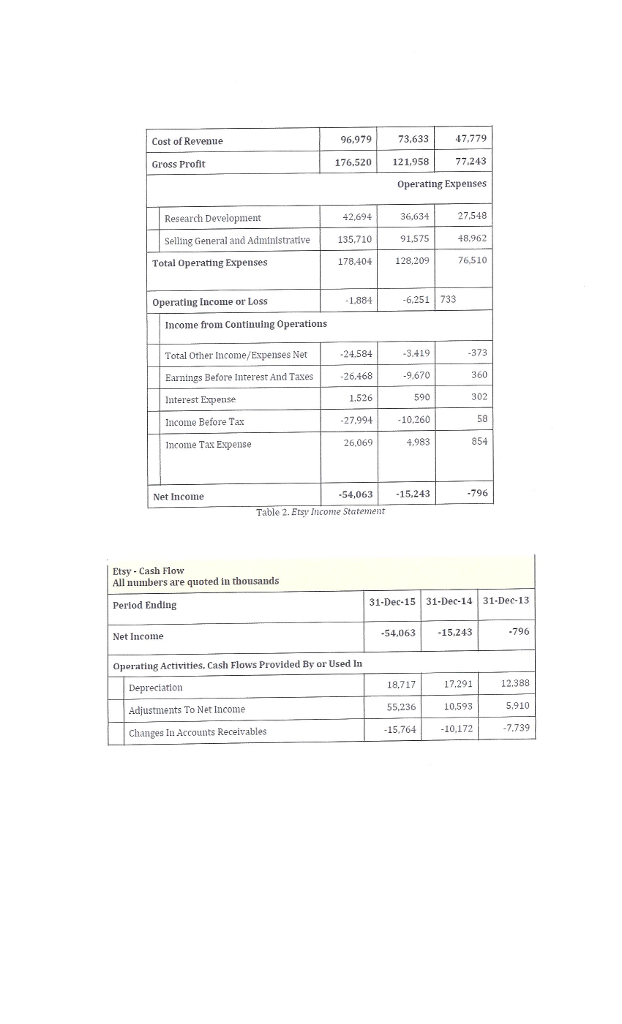

ScenarioInvestigate the areas of corporate finance as you examine basic financial statements for Etsy (ETSY), an online retailing e-commerce platform. Etsy, which was formed in 2005, held its initial public offering in 2015, and we can thus think of Etsy as a new, publicly traded firm. Etsy has experienced rapid growth (Egan, 2015; Securities and Exchange Commission, n.d.). It is also the largest certified socially-responsible company, or B Corporation, to go public in the United States (Schweiger & Marcus, 2015; Sweeney, 2013). Benefit corporations expand the obligations of boards legally, requiring them to consider environmental and social factors, as well as the financial interests of shareholders. This gives directors and officers the legal protection to pursue a mission and consider the impact their business has on society and the environment. An enacting state's benefit corporation statutes are placed within existing state incorporation codes so that existing code applies to benefit corporations in every respect, except where explicit provisions unique to the benefit corporation form have been included. Directors are required to balance stockholders' interests, interests of those materially affected by the corporation's conduct, and a specific public benefit(s) identified in the firm?s certificate of incorporation. Prior to engaging in this discussion, please review the Management Discussion and Analysis (MD&A) section of Etsy?s Annual Report to Shareholders, and other research or materials of your choosing to become familiar with Etsy. Etsy?s financial statements are provided, for your convenience. You may also visit Yahoo Finance, and type Esty?s ticker symbol (ETSY) into the search box, to investigate more recent activity, however your answers here should address financial statements that are provided for your use.

Module Outcomes:

Assess differences between accounting value or ?book? value, and market value.

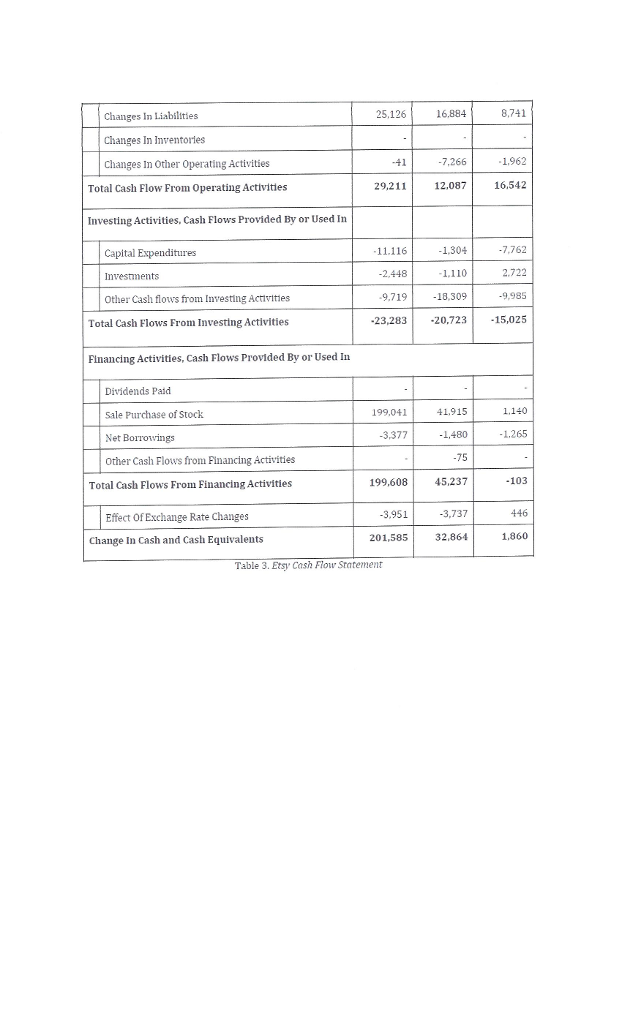

Determine a firm?'s cash flow from its financial statements.

A balance sheet needs to balance.

Balance Sheet Identity:

Assets = Liabilities + Shareholders? equity

Cash flow from assets = Cash flow to creditors + Cash flow to stockholders

The Price/Book ratio is of particular interest for value investors.

QUESTION

Using the cash flow identity (which implies that cash flow from assets must equal cash flow to creditors plus cash flow to stockholders), and?Examining the need to distinguish between book and market

?

?

Etsy Income Statement All numbers are quoted in thousands Period Ending Total Revenue 31-Dec-13 31-Dec-15 31-Dec-14 273,499 195,591 125,022 Cost of Revenue Gross Profit Research Development Selling General and Administrative. Total Operating Expenses. Operating Income or Loss Income from Continuing Operations Total Other Income/Expenses Net Earnings Before Interest And Taxes Interest Expense Income Before Tax Income Tax Expense Net Income Net Income Etsy Cash Flow All numbers are quoted in thousands Period Ending 96,979 176.520 42,694 135,710 178,404 -1.884 -24,584 -26.468 1.526 -27,994 26,069 -54,063 Table 2. Etsy Income Statement Operating Activities, Cash Flows Provided By or Used In Depreciation Adjustments To Net Income Changes In Accounts Receivables 73,633 47,779 77.243 Operating Expenses 121,958 36,634 91,575 128,209 -6,251 733 -3.419 -9,670 590 -10.260 4.983 -15,243 -54.063 27,548 18,717 55,236 -15,764 48,962 76,510 -373 360 302 854 31-Dec-15 31-Dec-14 31-Dec-13 58 -796 -15,243 17.291 10,593 -10,172 -796 12.388 5,910 -7.739 Changes In Liabilities Changes In Inventories. Changes in Other Operating Activities Total Cash Flow From Operating Activities Investing Activities, Cash Flows Provided By or Used In Capital Expenditures Investments Other Cash flows from Investing Activities Total Cash Flows From Investing Activities Financing Activities, Cash Flows Provided By or Used In Dividends Paid Sale Purchase of Stock Net Borrowings Other Cash Flows from Financing Activities Total Cash Flows From Financing Activities Effect Of Exchange Rate Changes Change In Cash and Cash Equivalents 25,126 -41 29,211 -11.116 -2,448 -9,719 -23,283 199,041 -3,377 199,608 -3.951 201,585 Table 3. Etsy Cash Flow Statement 16,884 -7,266 12,087 -1,304 -1.110 -18,309 -20,723 41,915 -1,480 -75 45,237 -3,737 32,864 8,741 -1,962 16.542 -7,762 2.722 -9,985 -15,025 1.140 -1.265 -103 446 1,860

Step by Step Solution

3.23 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Required solution Accounting value or book value of a company is the mathematical difference between the total of assets figure the total liabilities ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

635dc1d8784a7_178615.pdf

180 KBs PDF File

635dc1d8784a7_178615.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started