Answered step by step

Verified Expert Solution

Question

1 Approved Answer

In this paper, please discuss the following case study. In doing so, explain your approach to the problem, support your approach with references, and execute

In this paper, please discuss the following case study. In doing so, explain your approach to the problem, support your approach with references, and execute your approach. Provide an answer to the case studys question with a recommendation.

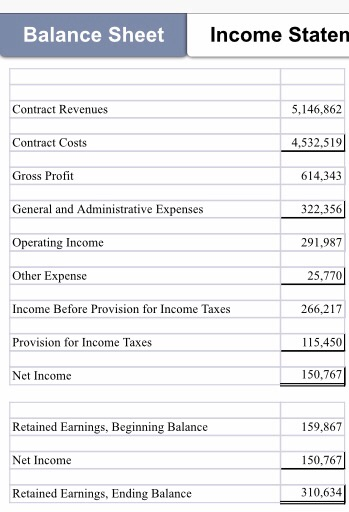

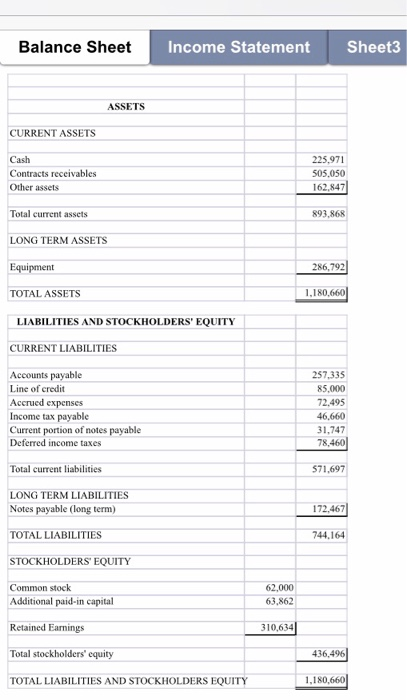

Please refer to the attached income statement and balance sheet for the Diamond Gem Cleaning and Maintenance Company. Perform a financial ratio analysis of the company using the following ratios: (1) Gross profit margin, (2) Current ratio, and (3) Debt ratio.

Select significant lines from the financial statements and provide an observation of their trends (Is the account increasing or decreasing in value? What does this mean?)

Draw some conclusions based on your observations.

Support your observations with research, data, and logic. Research should be from at least four sources outside textbook materials and should address financial ratio and trend analysis. Discuss what limitations exist with the informational material provided. What other material would be important to your trend analysis?

Superior papers will do the following:

Provide a financial ratio analysis of the company using: (1) Gross profit margin, (2) Current ratio, and (3) Debt ratio.

Provide a narrative about, and observations of, significant lines from the statements.

Provide conclusions that are supported with research, data and logic.

Provide a brief discussion of what limitations exist with the informational material provided.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started