Answered step by step

Verified Expert Solution

Question

1 Approved Answer

In this problem the domestic currency is the dollar and the foreign currency is the dinar. Today (time 0) the price of 1 dinar

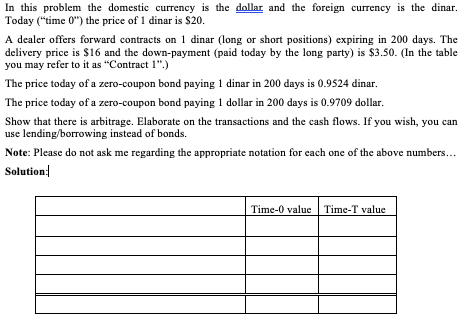

In this problem the domestic currency is the dollar and the foreign currency is the dinar. Today ("time 0") the price of 1 dinar is $20. A dealer offers forward contracts on 1 dinar (long or short positions) expiring in 200 days. The delivery price is $16 and the down-payment (paid today by the long party) is $3.50. (In the table you may refer to it as "Contract 1".) The price today of a zero-coupon bond paying 1 dinar in 200 days is 0.9524 dinar. The price today of a zero-coupon bond paying 1 dollar in 200 days is 0.9709 dollar. Show that there is arbitrage. Elaborate on the transactions and the cash flows. If you wish, you can use lending/borrowing instead of bonds. Note: Please do not ask me regarding the appropriate notation for each one of the above numbers... Solution: Time-0 value Time-T value

Step by Step Solution

★★★★★

3.44 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

elomestic Currency is dollars funagihy is dinar to tocky diner 20 duslims 2 d...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started