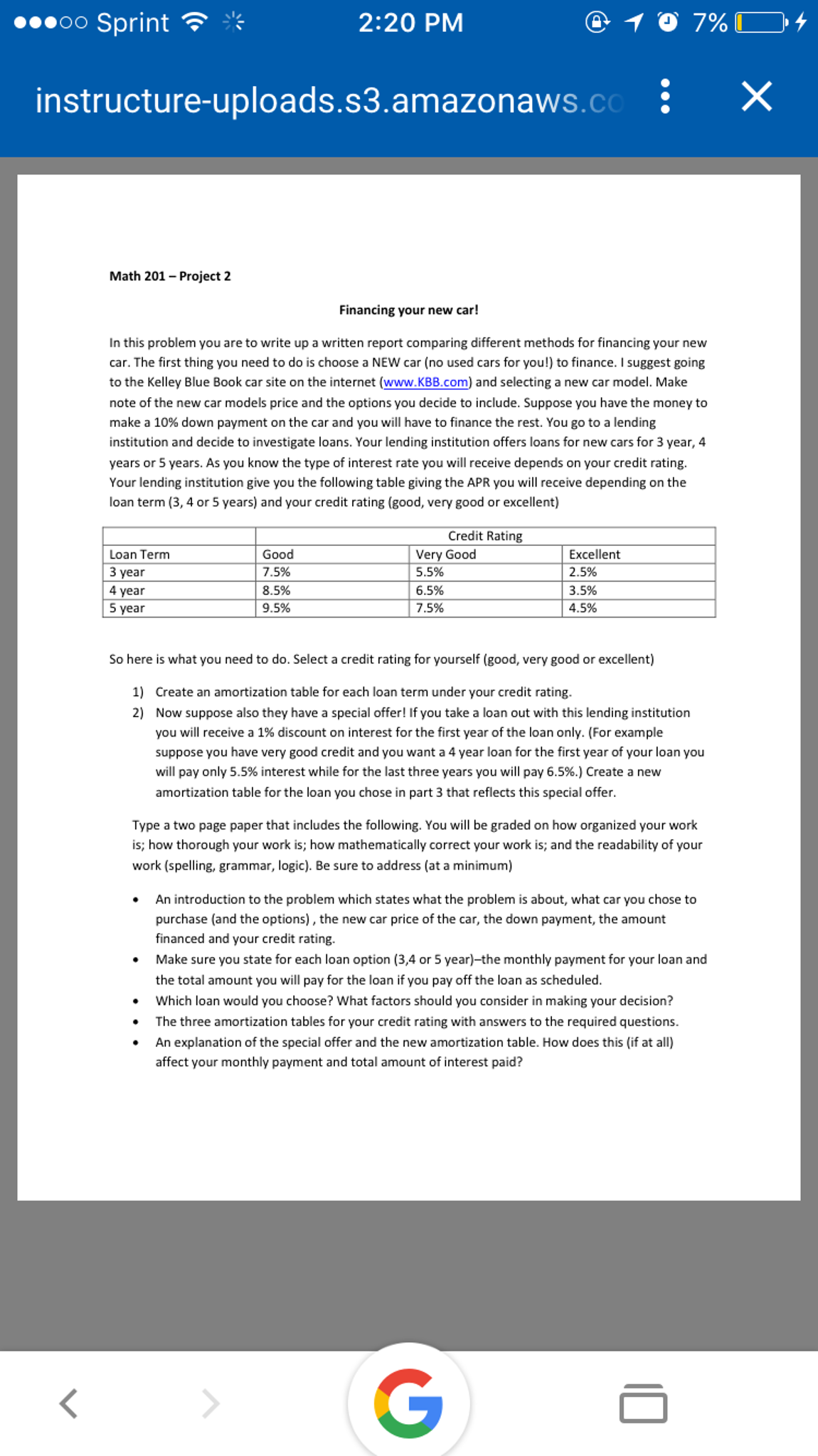

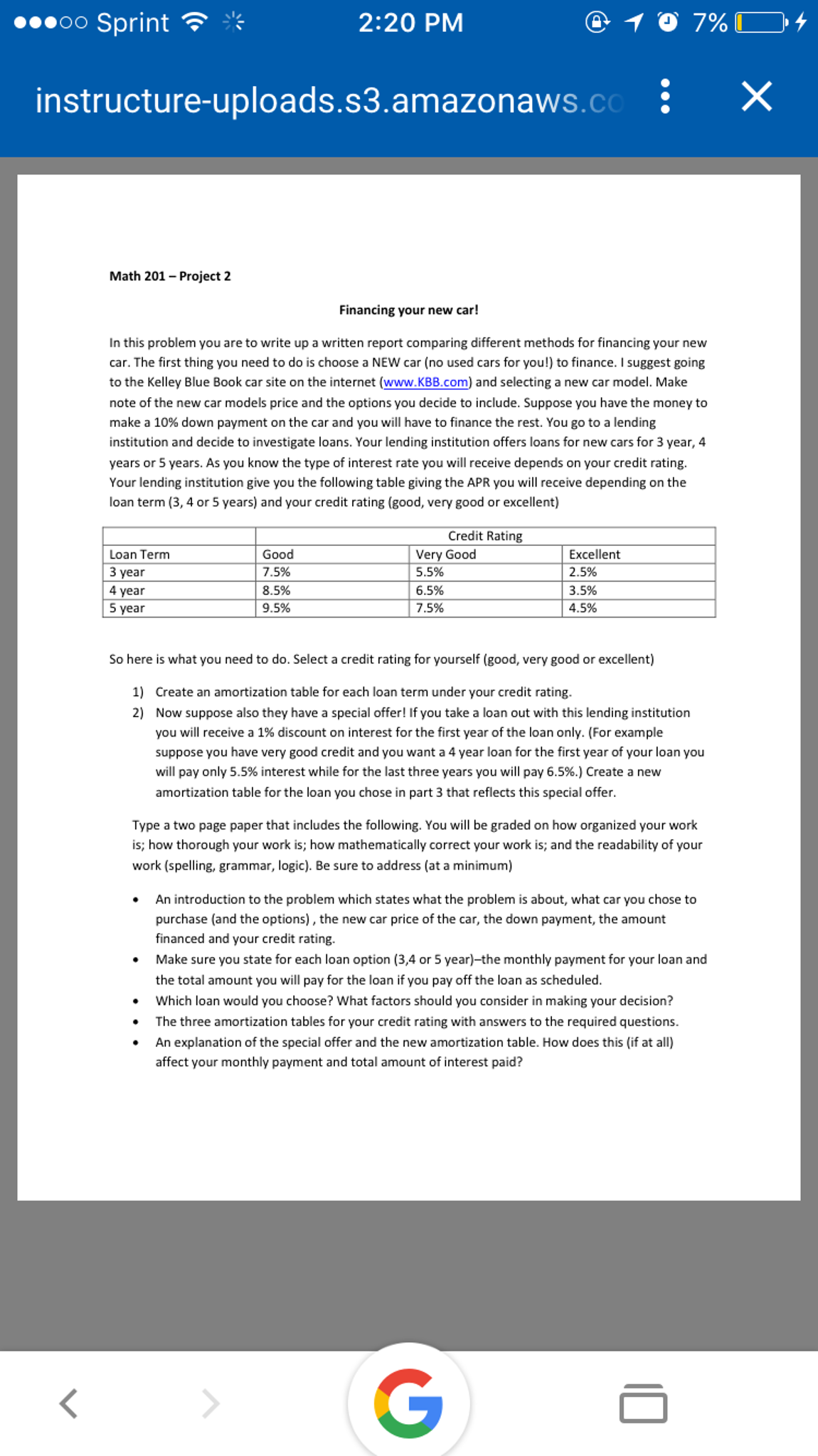

In this problem you are to write up a written report comparing different methods for financing your new car. The first thing you need to do is choose a NEW car (no used cars for you!) to finance. I suggest going to the Kelley Blue Book car site on the internet (www.KBB.com) and selecting a new car model. Make note of the new car models price and the options you decide to include. Suppose you have the money to make a 10% down payment on the car and you will have to finance the rest. You go to a lending institution and decide to investigate loans. Your lending institution offers loans for new cars for 3 year, 4 years or 5 years. As you know the type of interest rate you will receive depends on your credit rating. Your lending institution give you the following table giving the APR you will receive depending on the loan term (3, 4 or 5 years) and your credit rating (good, very good or excellent) So here is what you need to do. Select a credit rating for yourself (good, very good or excellent) Create an amortization table for each loan term under your credit rating. Now suppose also they have a special offer! If you take a loan out with this lending institution you will receive a 1% discount on interest for the first year of the loan only. (For example suppose you have very good credit and you want a 4 year loan for the first year of your loan you will pay only 5.5% interest while for the last three years you will pay 6.5%.) Create a new amortization table for the loan you chose in part 3 that reflects this special offer. Type a two page paper that includes the following. You will be graded on how organized your work is; how thorough your work is; how mathematically correct your work is; and the readability of your work (spelling, grammar, logic). Be sure to address (at a minimum) An introduction to the problem which states what the problem is about, what can you chose to purchase (and the options), the new car price of the car, the down payment, the amount financed and your credit rating. Make sure you state for each loan option (3, 4 or 5 year)-the monthly payment for your loan and the total amount you will pay for the loan if you pay off the loan as scheduled. Which loan would you choose? What factors should you consider in making your decision? The three amortization tables for your credit rating with answers to the required questions. An explanation of the special offer and the new amortization table. How does this (if at all) affect your monthly payment and total amount of interest paid