Answered step by step

Verified Expert Solution

Question

1 Approved Answer

In this problem's solution, why has the salvage cost, net working capital and shutdown costs listed under 6th year, when the project lasts for 5

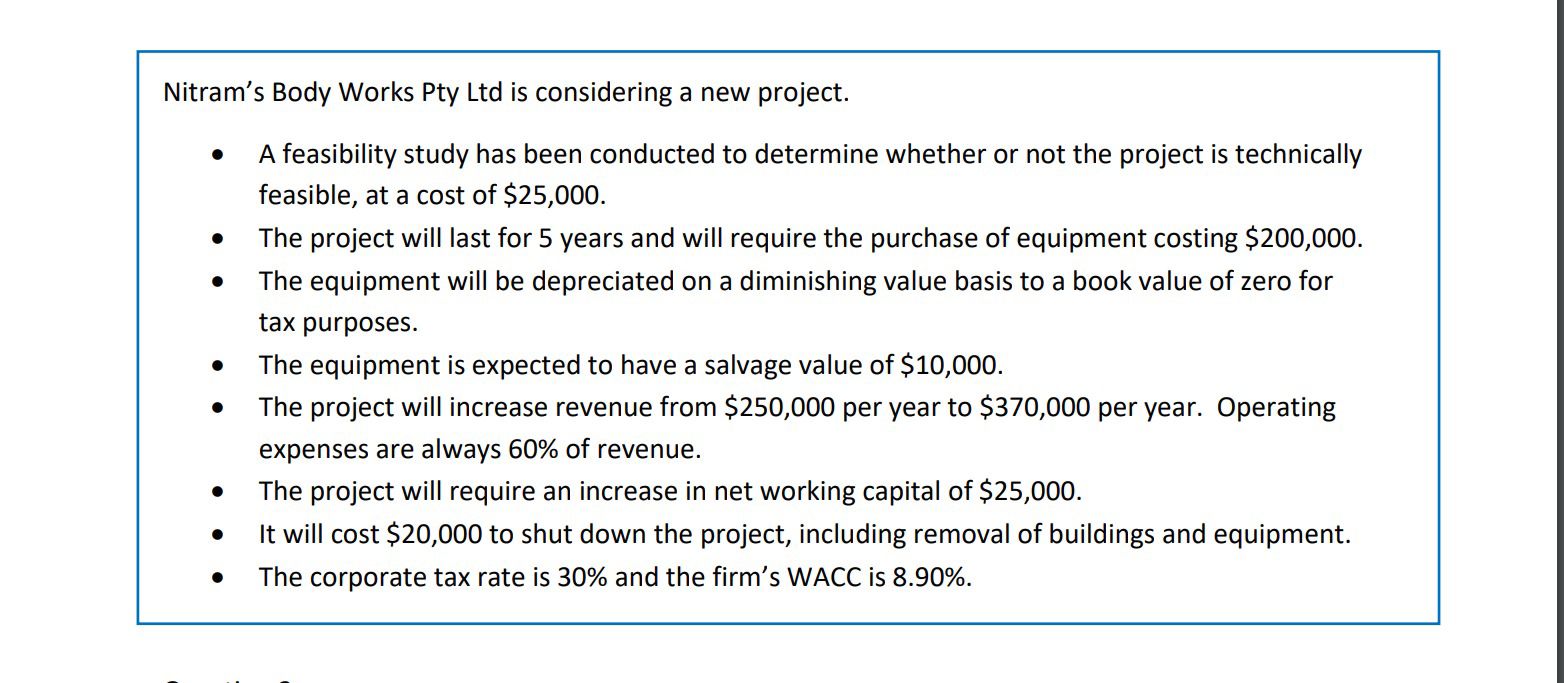

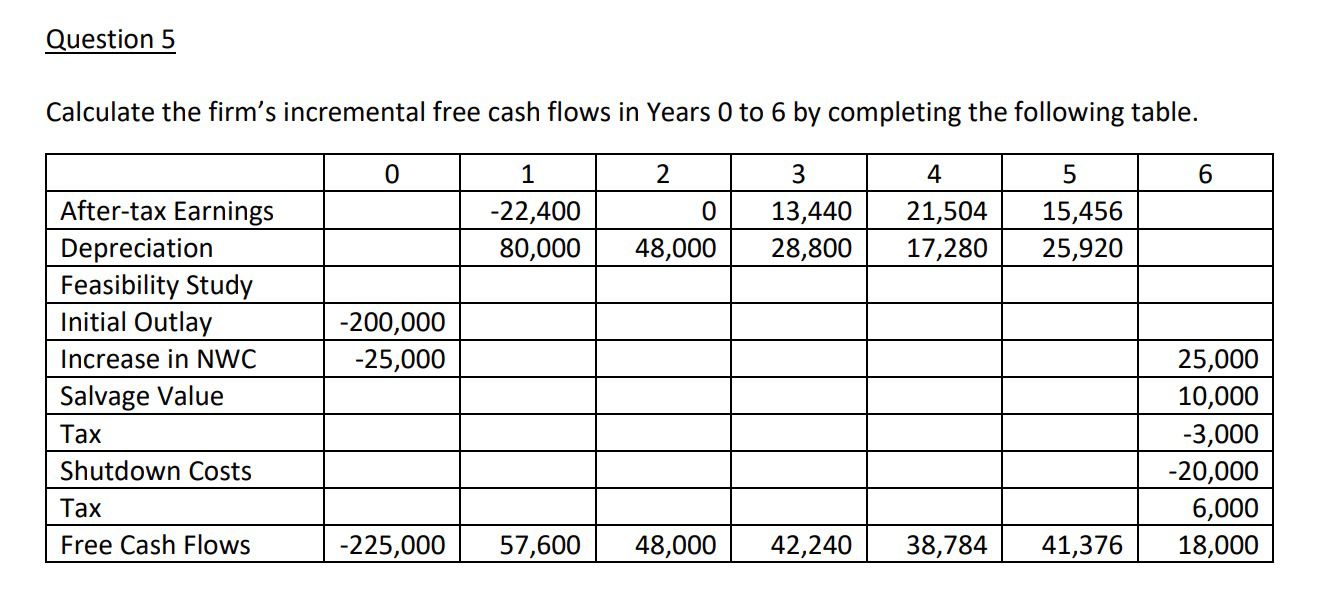

In this problem's solution, why has the salvage cost, net working capital and shutdown costs listed under 6th year, when the project lasts for 5 years?

Nitram's Body Works Pty Ltd is considering a new project. - A feasibility study has been conducted to determine whether or not the project is technically feasible, at a cost of $25,000. - The project will last for 5 years and will require the purchase of equipment costing $200,000. - The equipment will be depreciated on a diminishing value basis to a book value of zero for tax purposes. - The equipment is expected to have a salvage value of $10,000. - The project will increase revenue from $250,000 per year to $370,000 per year. Operating expenses are always 60% of revenue. - The project will require an increase in net working capital of $25,000. - It will cost $20,000 to shut down the project, including removal of buildings and equipment. - The corporate tax rate is 30% and the firm's WACC is 8.90%. Calculate the firm's incremental free cash flows in Years 0 to 6 by completing the following table

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started