Question

In this project, you will be required to apply the concepts that you have learned in the course to arrive at real-world solutions. The project

In this project, you will be required to apply the concepts that you have learned in the course to arrive at real-world solutions. The project has been divided into multiple smaller questions in order to test your ability to think all the steps and attention to detail.

In this project, you would represent a business magnate who has decided to expand his growing portfolio of companies. Already a key player in the automotive industry, now you're planning to step into EVs or all-electric vehicles. For this next stage of your plan, you are looking for battery manufacturers who might help you in establishing the production facility.

One of your friends told you about the Green Energy Company. It is a small business that has been in the battery manufacturing business for the past 20 years. In this project, you would be evaluating the company for its worth and taking a decision on whether or not you should buy it. In another case, you will also be evaluating a few projects to decide on the next investment for the company. Finally, you will take an investor's perspective to decide if the current performance of the company makes it a lucrative investment opportunity or not.

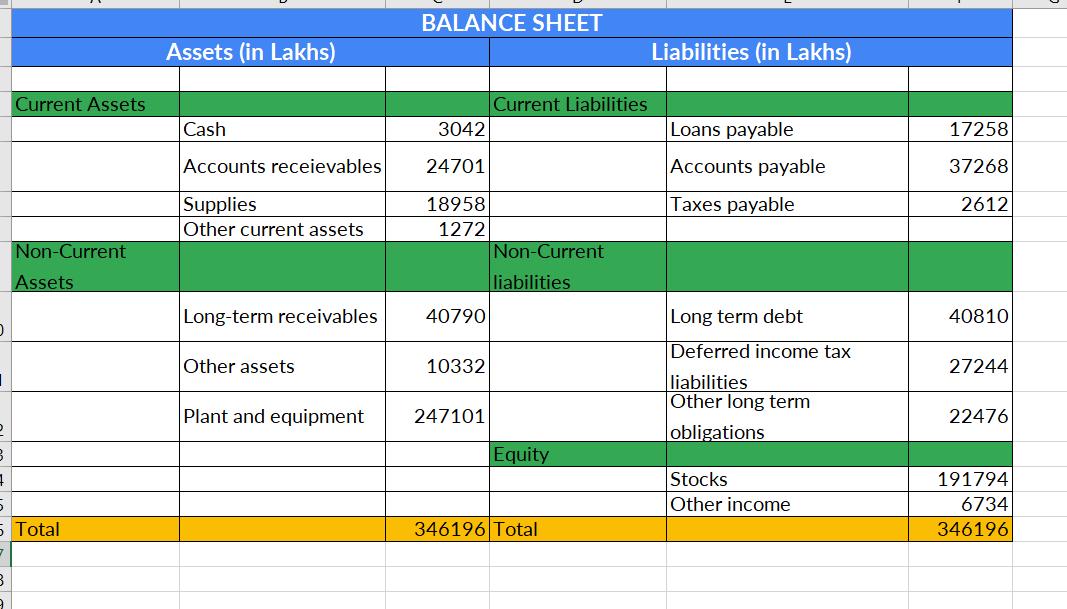

Below is the balance sheet of Green Energy Company.

e

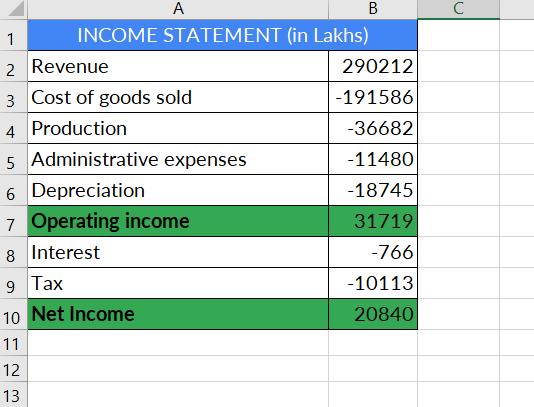

Below is the income statement of Green Energy Company

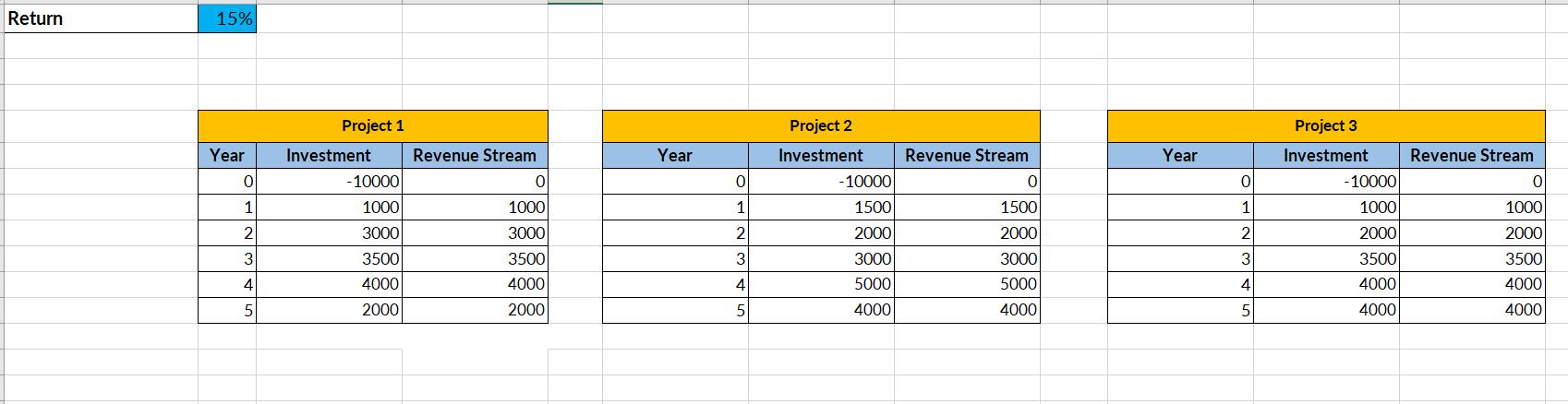

Now, once you have acquired the company and are doing well, you decide to open up one more plant for expanding the production facility. But there are three options from which you have to choose which location you want to invest. These options are provided in the data set shared below.

Choose one location that is most suitable for investing

Choose one location that is most suitable for investing

Determine the NPV and IRR for each project.

0 D B Current Assets 1 5 5 Total 9 Non-Current Assets Assets (in Lakhs) Cash Accounts receievables Supplies Other current assets Long-term receivables Other assets Plant and equipment BALANCE SHEET 3042 24701 18958 1272 40790 10332 247101 Current Liabilities Non-Current liabilities Equity 346196 Total Liabilities (in Lakhs) Loans payable Accounts payable Taxes payable Long term debt Deferred income tax liabilities Other long term obligations Stocks Other income 17258 37268 2612 40810 27244 22476 191794 6734 346196

Step by Step Solution

3.47 Rating (167 Votes )

There are 3 Steps involved in it

Step: 1

The provided images show the balance sheet and income statement of Green Energy Company as well as the cash flow details for three potential investment projects To evaluate these projects we need to c...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started