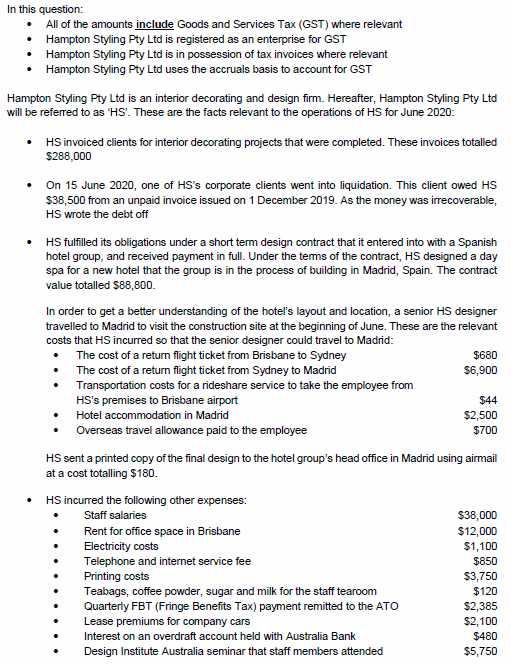

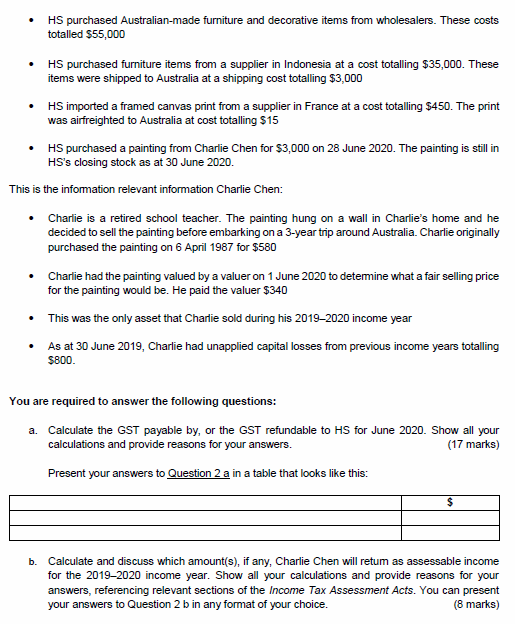

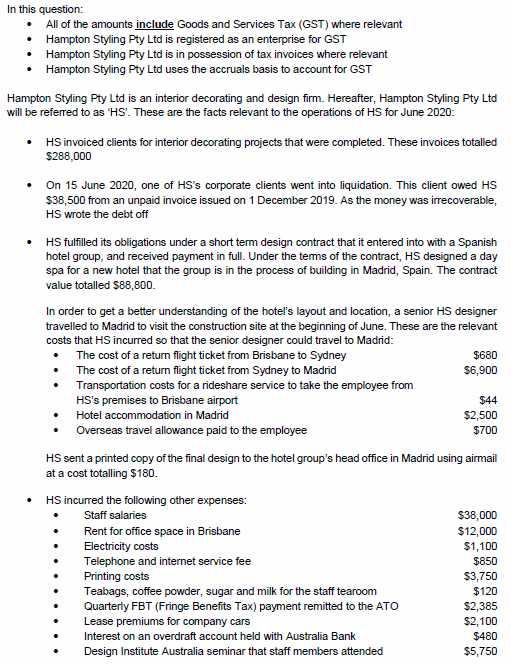

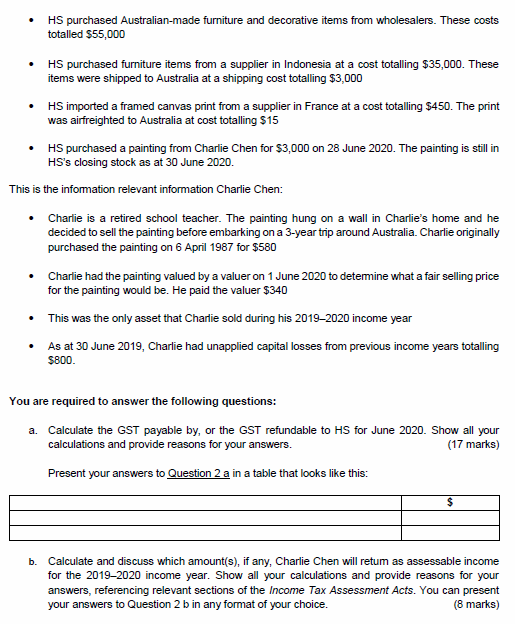

In this question: All of the amounts include Goods and Services Tax (GST) where relevant Hampton Styling Pty Ltd is registered as an enterprise for GST Hampton Styling Pty Ltd is in possession of tax invoices where relevant Hampton Styling Pty Ltd uses the accruals basis to account for GST Hampton Styling Pty Ltd is an interior decorating and design firm. Hereafter, Hampton Styling Pty Ltd will be referred to as HS. These are the facts relevant to the operations of HS for June 2020: HS invoiced clients for interior decorating projects that were completed. These invoices totalled $288,000 On 15 June 2020, one of HS's corporate clients went into liquidation. This client owed HS $38,500 from an unpaid invoice issued on 1 December 2019. As the money was irrecoverable, HS wrote the debt off HS fulfilled its obligations under a short term design contract that it entered into with a Spanish hotel group, and received payment in full. Under the terms of the contract, HS designed a day spa for a new hotel that the group is in the process of building in Madrid, Spain. The contract value totalled $88,800 In order to get a better understanding of the hotel's layout and location, a senior HS designer travelled to Madrid to visit the construction site at the beginning of June. These are the relevant costs that HS incurred so that the senior designer could travel to Madrid: The cost of a return flight ticket from Brisbane to Sydney $680 The cost of a return flight ticket from Sydney to Madrid $6,900 Transportation costs for a rideshare service to take the employee from HS's premises to Brisbane airport $44 Hotel accommodation in Madrid $2,500 Overseas travel allowance paid to the employee $700 HS sent a printed copy of the final design to the hotel group's head office in Madrid using airmail at a cost totalling $180. HS incurred the following other expenses: Staff salaries $38,000 Rent for office space in Brisbane $12,000 Electricity costs $1,100 Telephone and internet service fee $850 Printing costs $3,750 Teabags, coffee powder, sugar and milk for the staff tearoom $120 Quarterly FBT (Fringe Benefits Tax) payment remitted to the ATO $2,385 Lease premiums for company cars $2,100 Interest on an overdraft account held with Australia Bank $480 Design Institute Australia seminar that staff members attended $5,750 HS purchased Australian-made furniture and decorative items from wholesalers. These costs totalled $55,000 HS purchased furniture items from a supplier in Indonesia at a cost totalling $35,000. These items were shipped to Australia at a shipping cost totalling $3,000 HS imported a framed canvas print from a supplier in France at a cost totalling $450. The print was airfreighted to Australia at cost totalling $15 HS purchased a painting from Charlie Chen for $3,000 on 28 June 2020. The painting is still in HS's closing stock as at 30 June 2020. This is the information relevant information Charlie Chen: Charlie is a retired school teacher. The painting hung on a wall in Charlie's home and he decided to sell the painting before embarking on a 3-year trip around Australia. Charlie originally purchased the painting on 6 April 1987 for $580 Charlie had the painting valued by a valuer on 1 June 2020 to determine what a fair selling price for the painting would be. He paid the valuer $340 This was the only asset that Charlie sold during his 2019-2020 income year As at 30 June 2019, Charlie had unapplied capital losses from previous income years totalling $800. You are required to answer the following questions: a. Calculate the GST payable by, or the GST refundable to HS for June 2020. Show all your calculations and provide reasons for your answers. (17 marks) Present your answers to Question 2 a in a table that looks like this: $ b. Calculate and discuss which amount(s), if any, Charlie Chen will retum as assessable income for the 2019-2020 income year. Show all your calculations and provide reasons for your answers, referencing relevant sections of the Income Tax Assessment Acts. You can present your answers to Question 2 b in any format of your choice. (8 marks) In this question: All of the amounts include Goods and Services Tax (GST) where relevant Hampton Styling Pty Ltd is registered as an enterprise for GST Hampton Styling Pty Ltd is in possession of tax invoices where relevant Hampton Styling Pty Ltd uses the accruals basis to account for GST Hampton Styling Pty Ltd is an interior decorating and design firm. Hereafter, Hampton Styling Pty Ltd will be referred to as HS. These are the facts relevant to the operations of HS for June 2020: HS invoiced clients for interior decorating projects that were completed. These invoices totalled $288,000 On 15 June 2020, one of HS's corporate clients went into liquidation. This client owed HS $38,500 from an unpaid invoice issued on 1 December 2019. As the money was irrecoverable, HS wrote the debt off HS fulfilled its obligations under a short term design contract that it entered into with a Spanish hotel group, and received payment in full. Under the terms of the contract, HS designed a day spa for a new hotel that the group is in the process of building in Madrid, Spain. The contract value totalled $88,800 In order to get a better understanding of the hotel's layout and location, a senior HS designer travelled to Madrid to visit the construction site at the beginning of June. These are the relevant costs that HS incurred so that the senior designer could travel to Madrid: The cost of a return flight ticket from Brisbane to Sydney $680 The cost of a return flight ticket from Sydney to Madrid $6,900 Transportation costs for a rideshare service to take the employee from HS's premises to Brisbane airport $44 Hotel accommodation in Madrid $2,500 Overseas travel allowance paid to the employee $700 HS sent a printed copy of the final design to the hotel group's head office in Madrid using airmail at a cost totalling $180. HS incurred the following other expenses: Staff salaries $38,000 Rent for office space in Brisbane $12,000 Electricity costs $1,100 Telephone and internet service fee $850 Printing costs $3,750 Teabags, coffee powder, sugar and milk for the staff tearoom $120 Quarterly FBT (Fringe Benefits Tax) payment remitted to the ATO $2,385 Lease premiums for company cars $2,100 Interest on an overdraft account held with Australia Bank $480 Design Institute Australia seminar that staff members attended $5,750 HS purchased Australian-made furniture and decorative items from wholesalers. These costs totalled $55,000 HS purchased furniture items from a supplier in Indonesia at a cost totalling $35,000. These items were shipped to Australia at a shipping cost totalling $3,000 HS imported a framed canvas print from a supplier in France at a cost totalling $450. The print was airfreighted to Australia at cost totalling $15 HS purchased a painting from Charlie Chen for $3,000 on 28 June 2020. The painting is still in HS's closing stock as at 30 June 2020. This is the information relevant information Charlie Chen: Charlie is a retired school teacher. The painting hung on a wall in Charlie's home and he decided to sell the painting before embarking on a 3-year trip around Australia. Charlie originally purchased the painting on 6 April 1987 for $580 Charlie had the painting valued by a valuer on 1 June 2020 to determine what a fair selling price for the painting would be. He paid the valuer $340 This was the only asset that Charlie sold during his 2019-2020 income year As at 30 June 2019, Charlie had unapplied capital losses from previous income years totalling $800. You are required to answer the following questions: a. Calculate the GST payable by, or the GST refundable to HS for June 2020. Show all your calculations and provide reasons for your answers. (17 marks) Present your answers to Question 2 a in a table that looks like this: $ b. Calculate and discuss which amount(s), if any, Charlie Chen will retum as assessable income for the 2019-2020 income year. Show all your calculations and provide reasons for your answers, referencing relevant sections of the Income Tax Assessment Acts. You can present your answers to Question 2 b in any format of your choice. (8 marks)