Answered step by step

Verified Expert Solution

Question

1 Approved Answer

In this question you have to make a spreadsheet on my excel. 1. Canada Duck sells a variety of winter coats to individual and retail

In this question you have to make a spreadsheet on my excel.

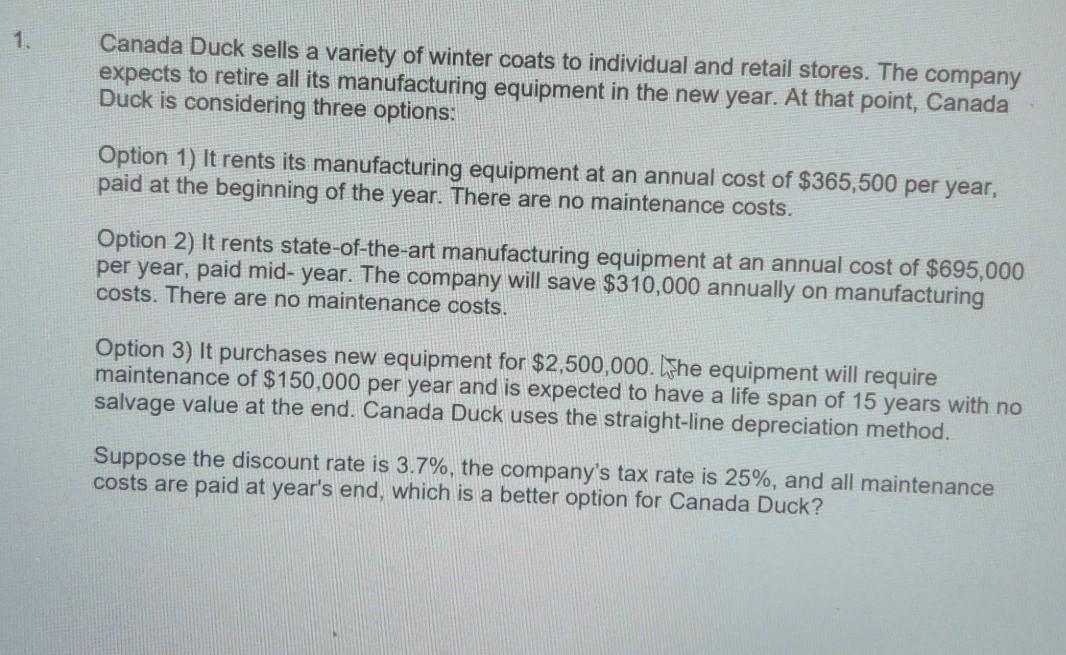

1. Canada Duck sells a variety of winter coats to individual and retail stores. The company expects to retire all its manufacturing equipment in the new year. At that point, Canada Duck is considering three options: Option 1) It rents its manufacturing equipment at an annual cost of $365,500 per year, paid at the beginning of the year. There are no maintenance costs. Option 2) It rents state-of-the-art manufacturing equipment at an annual cost of $695,000 per year, paid mid- year. The company will save $310,000 annually on manufacturing costs. There are no maintenance costs. Option 3) It purchases new equipment for $2,500,000. Ishe equipment will require maintenance of $150,000 per year and is expected to have a life span of 15 years with no salvage value at the end. Canada Duck uses the straight-line depreciation method. Suppose the discount rate is 3.7%, the company's tax rate is 25%, and all maintenance costs are paid at year's end, which is a better option for Canada DuckStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started