Answered step by step

Verified Expert Solution

Question

1 Approved Answer

In this question, you need to price options with different binomial trees valuation approaches. The two figures below, extracted from Refinitiv Workspace, show the

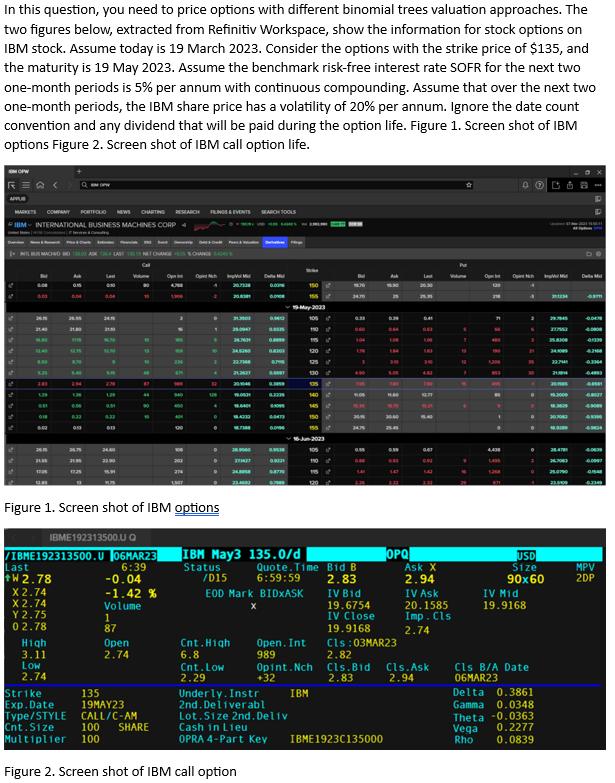

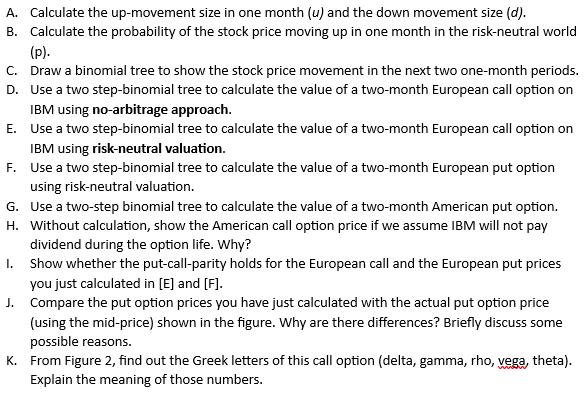

In this question, you need to price options with different binomial trees valuation approaches. The two figures below, extracted from Refinitiv Workspace, show the information for stock options on IBM stock. Assume today is 19 March 2023. Consider the options with the strike price of $135, and the maturity is 19 May 2023. Assume the benchmark risk-free interest rate SOFR for the next two one-month periods is 5% per annum with continuous compounding. Assume that over the next two one-month periods, the IBM share price has a volatility of 20% per annum. Ignore the date count convention and any dividend that will be paid during the option life. Figure 1. Screen shot of IBM options Figure 2. Screen shot of IBM call option life. MARKETS COMPANY PORTFOLIO NEWS CHARTING RESEARCH FENGS & EVENTS SEARCH TOOLS IM INTERNATIONAL BUSINESS MACHINES CORP M. KH Last GI 6.02 1115 W 2.78 AM X 2.74 X 2.74 Y 2.75 02.78 2.M 3130 High 3.11 Low 2.74 IN 8.33 059 381158000 La 6.00 21.0 Multiplier 100 K.N 129 IBME192313500.U Q VIBME192313500.U 06MAR23 6:39 Vole Op 90 Figure 1. Screen shot of IBM options 1 87 11 Open 2.74 EPEEGERE -0.04 -1.42 % Volume Strike 135 19MAY23 Exp.Date: Type/STYLE CALL/C-AM Cnt.Size 100 SHARE FIESIE148 BRAD OM 129 201 25.04 2476 34260 22:7744 212621 201046 16.03 Cnt.High 6.8 Cnt.Low 2.29 1842 T 38000 33.8883 wa Mu G.COM GO AMD san Figure 2. Screen shot of IBM call option BA BARRY 8.2226 GOV 60473 BO ANCH 0001 IBM May3 135.0/d Status 19 May 2003 /D15 EOD Mark BIDXASK X 150 Underly. Instr 2nd. Deliverabl Lot.Size 2nd. Deliv Cash in Lieu OPRA 4-Part Key 120 130 150 155 16-Jun-2023 88 110 Open. Int 989 Opint.Nch +32 1 IBM 1 * 32 **** ************ 35 8895 3430 0.31 104 Quote.Time Bid B 6:59:59 2.83 LO 34.8 3475 25 100 IBME1923C135000 20 LI HA 30.40 38 OPQ IV Bid 19.6754 IV Close 19.9168 Cls:03MAR23 An 13:31 2.82 Cls. Bid Cls.Ask 2.83 2.94 32 Ask X 2.94 IV Ask 20.1585 Imp. Cls 2.74 T ******** Vega Rho O M Op DODA IV Mid 19.9168 29794 ZUM 1 158300 N 34.2009 22:744 21 26105 3000 M . . USD Size 90x60 Cls B/A Date 06MAR23 Delta 0.3861 Gamma 0.0348 Theta -0.0363 0.2277 0.0839 M 20:3083 M 38.47 263063 233009 DeMil m ODEN 4000 4339 4208 43364 640) AR 67 4300 AM 4304 4.063 4000 GIA 43300 MPV 2DP A. Calculate the up-movement size in one month (u) and the down movement size (d). B. Calculate the probability of the stock price moving up in one month in the risk-neutral world (p). C. Draw a binomial tree to show the stock price movement in the next two one-month periods. Use a two step-binomial tree to calculate the value of a two-month European call option on IBM using no-arbitrage approach. D. E. Use a two step-binomial tree to calculate the value of a two-month European call option on IBM using risk-neutral valuation. F. Use a two step-binomial tree to calculate the value of a two-month European put option using risk-neutral valuation. G. Use a two-step binomial tree to calculate the value of a two-month American put option. H. Without calculation, show the American call option price if we assume IBM will not pay dividend during the option life. Why? 1. Show whether the put-call-parity holds for the European call and the European put prices you just calculated in [E] and [F]. J. Compare the put option prices you have just calculated with the actual put option price (using the mid-price) shown in the figure. Why are there differences? Briefly discuss some possible reasons. K. From Figure 2, find out the Greek letters of this call option (delta, gamma, rho, vega, theta). Explain the meaning of those numbers.

Step by Step Solution

★★★★★

3.39 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Here are the answers to the questions A Using 20 annual volatility and a monthly time step u et e021...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started