Answered step by step

Verified Expert Solution

Question

1 Approved Answer

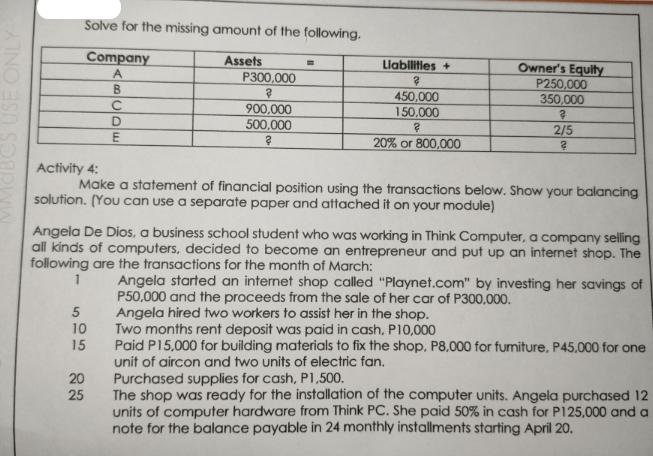

BCS USE ONLY Solve for the missing amount of the following. Company Assets A B D E P300,000 2 5 10 15 900,000 500,000

BCS USE ONLY Solve for the missing amount of the following. Company Assets A B D E P300,000 2 5 10 15 900,000 500,000 20 25 Liabilities + 2 450,000 150,000 ? 20% or 800,000 Activity 4: Make a statement of financial position using the transactions below. Show your balancing solution. [You can use a separate paper and attached it on your module) Owner's Equity P250,000 350,000 ? 2/5 2 Angela De Dios, a business school student who was working in Think Computer, a company selling all kinds of computers, decided to become an entrepreneur and put up an internet shop. The following are the transactions for the month of March: 1 Angela started an internet shop called "Playnet.com" by investing her savings of P50,000 and the proceeds from the sale of her car of P300,000. Angela hired two workers to assist her in the shop. Two months rent deposit was paid in cash, P10,000 Paid P15,000 for building materials to fix the shop, P8,000 for furniture, P45,000 for one unit of aircon and two units of electric fan. Purchased supplies for cash, P1,500. The shop was ready for the installation of the computer units. Angela purchased 12 units of computer hardware from Think PC. She paid 50% in cash for P125,000 and a note for the balance payable in 24 monthly installments starting April 20.

Step by Step Solution

★★★★★

3.39 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

The image youve provided contains a table with entries for Assets Liabilities and Owners Equity for ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started