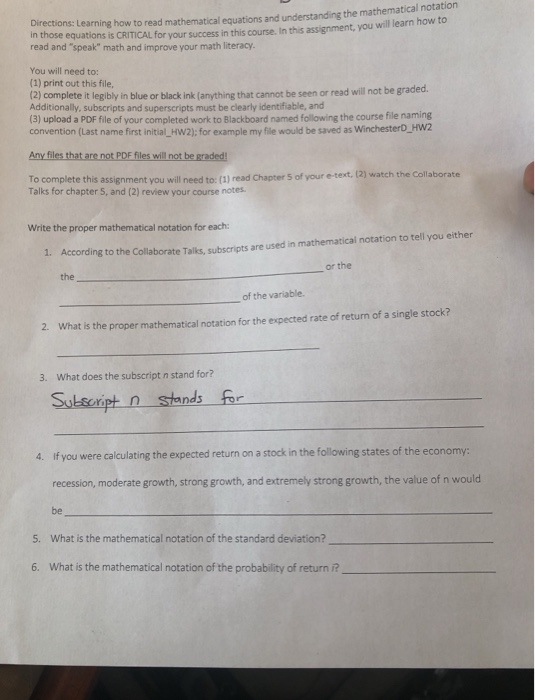

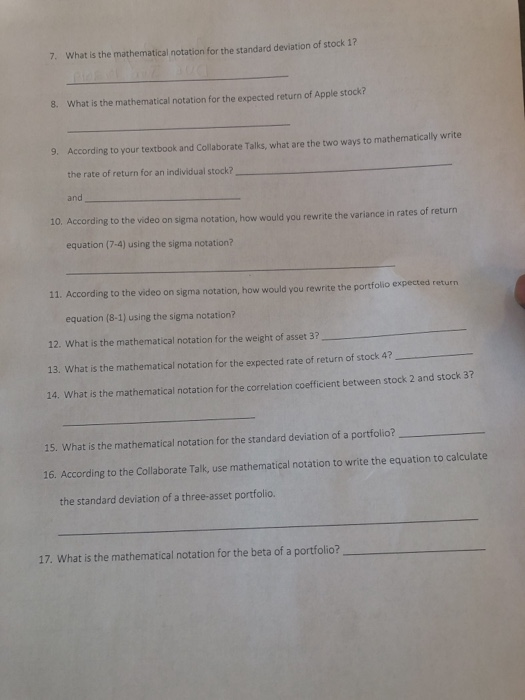

in those equations is CRITICAL for your success in this course. In this assignment, you will learn how to read and "speak" math and improve your math literacy. Directions: Learning how to read mathematical equations and understanding the mathematical notation You will need to: (1) print out this file, (2) complete it legibly in blue or black ink (anything that cannot be seen or read will not be graded. Additionally, subscripts and superscripts must be clearly identifiable, and (3) upload a PDF file of your completed work to Blackboard named following the course file naming convention (Last name first initial HW2): for example my file would be saved as WinchesterD HW2 Any files that are not PDF files will not be graded! To complete this assignment vou will need to: (1) read Chapter 5 of your e-text, (2) watch the Collaborate Talks for chapter 5, and (2) review your course notes Write the proper mathematical notation for each: 1. According to the Collaborate Talks, subscripts are used in mathematical notation to tell you either or the the of the variable 2. What is the proper mathematical notation for the expected rate of return of a single stock? What does the subscript n stand for? 3. Stands for Subseript n If you were calculating the expected return on a stock in the following states of the economy: 4. recession, moderate growth, strong growth, and extremely strong growth, the value of n would be What is the mathematical notation of the standard deviation? 5. What is the mathematical notation of the probability of return i? 6. 7. What is the mathematical notation for the standard deviation of stock 1? What is the mathematical notation for the expected return of Apple stock? 8. According to your textbook and Collaborate Talks, what are the two ways to mathematically write 9. the rate of return for an individual stock? and 10. According to the video on sigma notation, how would you rewrite the variance in rates of return equation (7-4) using the sigma notation? 11. According to the video on sigma notation, how would you rewrite the portfolio expected return equation (8-1) using the sigma notation? 12. What is the mathematical notation for the weight of asset 3? 13. What is the mathematical notation for the expected rate of return of stock 4? 14. What is the mathematical notation for the correlation coefficient between stock 2 and stock 3? 15. What is the mathematical notation for the standard deviation of a portfolio? 16. According to the Collaborate Talk, use mathematical notation to write the equation to calculate the standard deviation of a three-asset portfolio. 17. What is the mathematical notation for the beta of a portfolio? in those equations is CRITICAL for your success in this course. In this assignment, you will learn how to read and "speak" math and improve your math literacy. Directions: Learning how to read mathematical equations and understanding the mathematical notation You will need to: (1) print out this file, (2) complete it legibly in blue or black ink (anything that cannot be seen or read will not be graded. Additionally, subscripts and superscripts must be clearly identifiable, and (3) upload a PDF file of your completed work to Blackboard named following the course file naming convention (Last name first initial HW2): for example my file would be saved as WinchesterD HW2 Any files that are not PDF files will not be graded! To complete this assignment vou will need to: (1) read Chapter 5 of your e-text, (2) watch the Collaborate Talks for chapter 5, and (2) review your course notes Write the proper mathematical notation for each: 1. According to the Collaborate Talks, subscripts are used in mathematical notation to tell you either or the the of the variable 2. What is the proper mathematical notation for the expected rate of return of a single stock? What does the subscript n stand for? 3. Stands for Subseript n If you were calculating the expected return on a stock in the following states of the economy: 4. recession, moderate growth, strong growth, and extremely strong growth, the value of n would be What is the mathematical notation of the standard deviation? 5. What is the mathematical notation of the probability of return i? 6. 7. What is the mathematical notation for the standard deviation of stock 1? What is the mathematical notation for the expected return of Apple stock? 8. According to your textbook and Collaborate Talks, what are the two ways to mathematically write 9. the rate of return for an individual stock? and 10. According to the video on sigma notation, how would you rewrite the variance in rates of return equation (7-4) using the sigma notation? 11. According to the video on sigma notation, how would you rewrite the portfolio expected return equation (8-1) using the sigma notation? 12. What is the mathematical notation for the weight of asset 3? 13. What is the mathematical notation for the expected rate of return of stock 4? 14. What is the mathematical notation for the correlation coefficient between stock 2 and stock 3? 15. What is the mathematical notation for the standard deviation of a portfolio? 16. According to the Collaborate Talk, use mathematical notation to write the equation to calculate the standard deviation of a three-asset portfolio. 17. What is the mathematical notation for the beta of a portfolio