Answered step by step

Verified Expert Solution

Question

1 Approved Answer

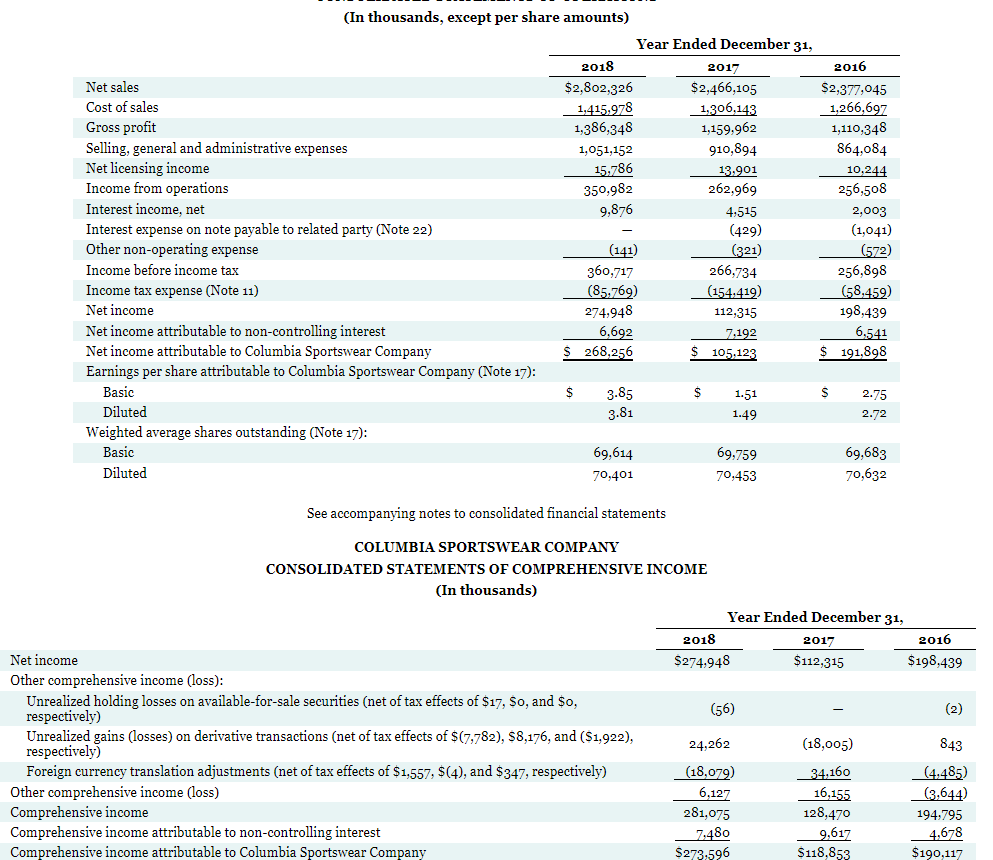

( In thousands, except per share amounts ) Year Ended December 3 1 , table [ [ , Year Ended December 3 1 ,

In thousands, except per share amounts

Year Ended December

tableYear Ended December Net sales,$$$Cost of sales,Gross profit,Selling general and administrative expenses,Net licensing income,Income from operations,Interest income, net,Interest expense on note payable to related party Note Other nonoperating expense,Income before income tax,Income tax expense Note Net income,Net income attributable to noncontrolling interest,Net income attributable to Columbia Sportswear Company,$ $$ Earnings per share attributable to Columbia Sportswear Company Note :Basic$ $ $ DilutedWeighted average shares outstanding Note :BasicDiluted

See accompanying notes to consolidated financial statements

COLUMBIA SPORTSWEAR COMPANY CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME In thousands

Year Ended December

tabletableNet income,$$$

Other comprehensive income loss:

tabletableUnrealized holding losses on availableforsale securities net of tax effects of $ $o and $orespectivelytableUnrealized gains losses on derivative transactions net of tax effects of $$ and $respectivelyForeign currency translation adjustments net of tax effects of $$ and $ respectivelyOther comprehensive income lossComprehensive income,Comprehensive income attributable to noncontrolling interest,Comprehensive income attributable to Columbia Sportswear Company,S$$ Based on the information in these financial statements, compute the return on common stockholders' equity, debt to assets

ratio, and return on assets for each company. Enter negative amounts using either a negative sign preceding the number eg or

parentheses eg Round answers to decimal places, eg

Columbia

Under Armour, Inc.

Return on common stockholders' equity

Debt to assets

Return on assets

c

Compute the payout ratio for each company. Do not leave any answer field blank. Enter for amounts. Round answers to decimal

places, eg

Which pays out a higher percentage of its earnings?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started