Question: IN TWO THOUSAND WORDS, ANSWER THE FOLLOWING: Read the Material entitled as Sample Marketing Plan: Chill Beverage Company in Page 634-642 in Principles of Marketing

IN TWO THOUSAND WORDS, ANSWER THE FOLLOWING:

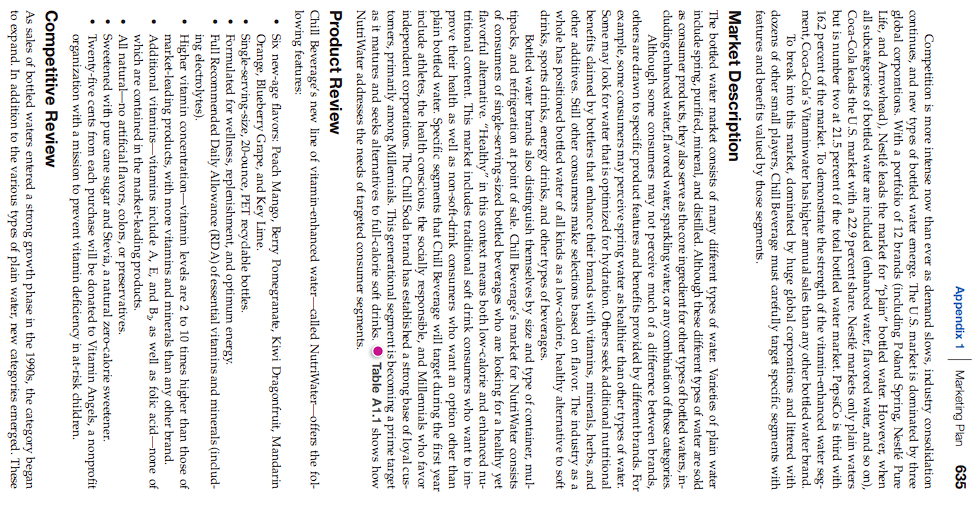

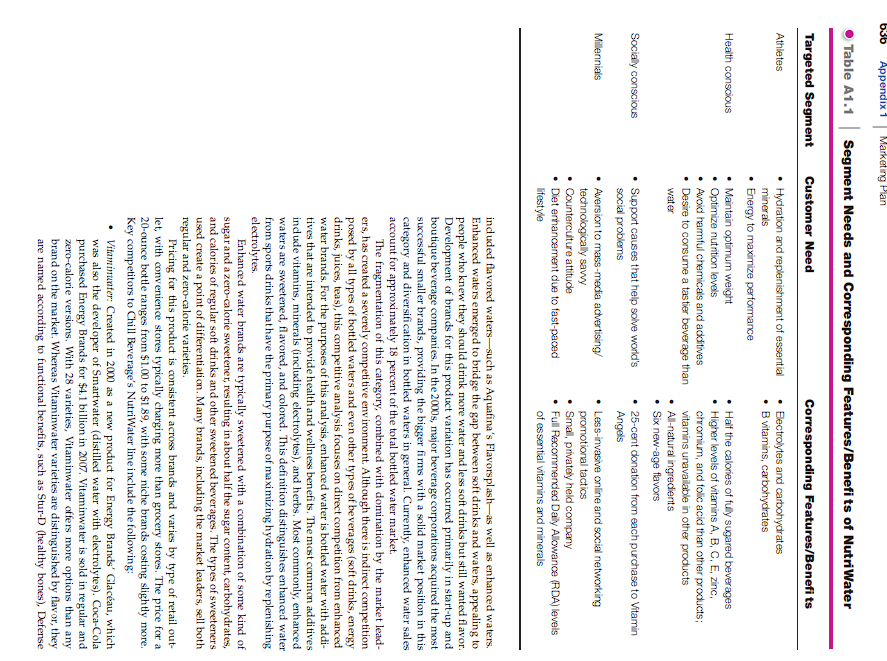

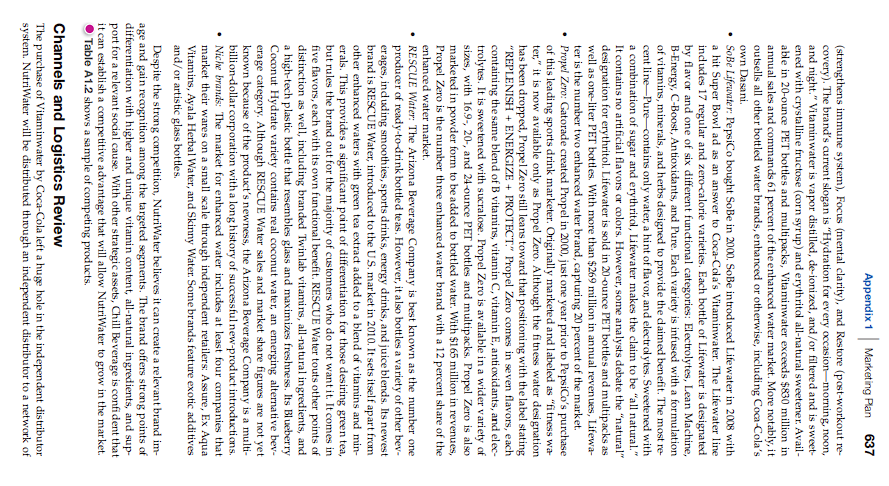

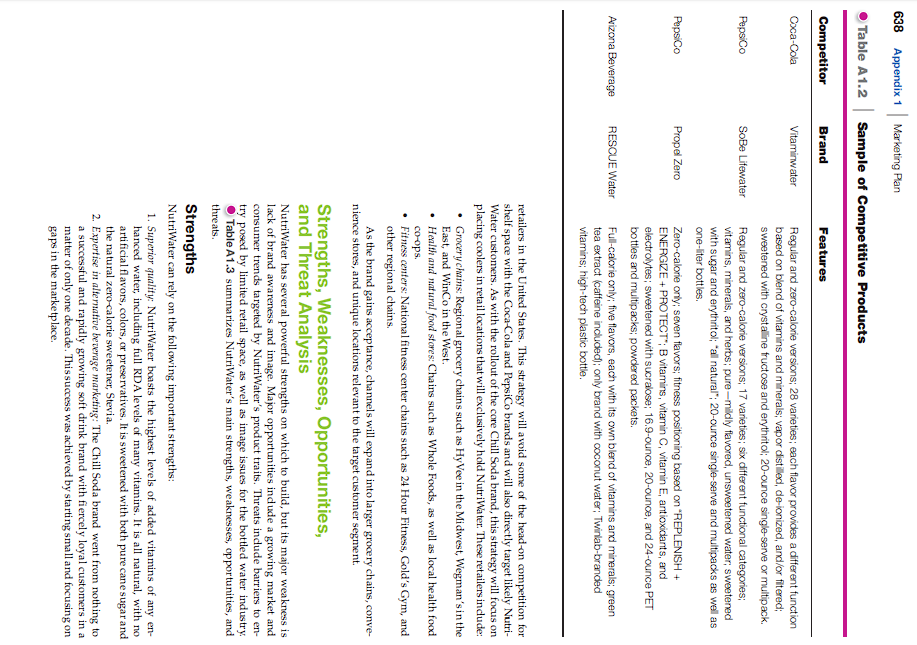

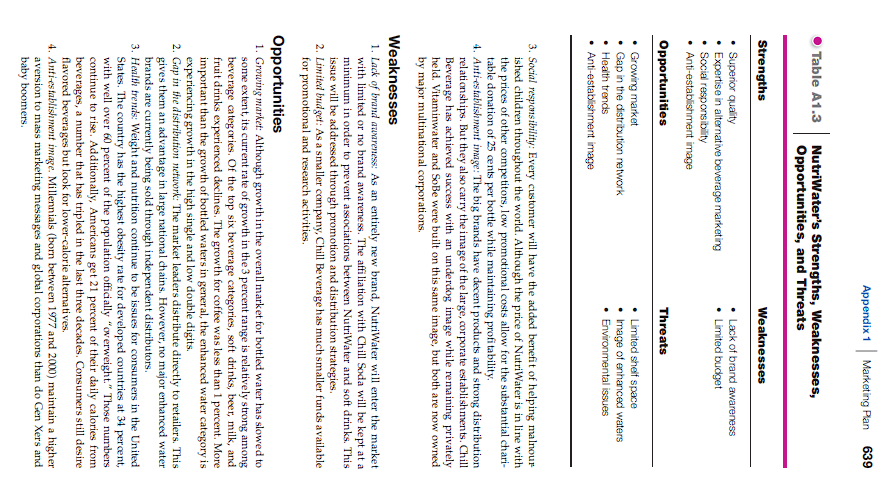

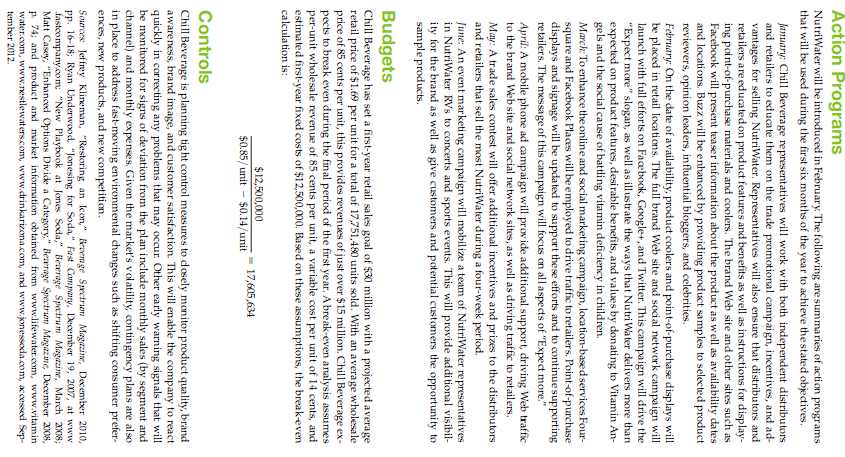

Read the Material entitled as Sample Marketing Plan: Chill Beverage Company in Page 634-642 in Principles of Marketing by Kotler and Armstrong (2014) and answer the following questions. From Marketing Plan to Marketing Action Companies generally create yearly marketing plans, although some plans cover a longer period. Marketers start planning well in advance of the implementation date to allow time for marketing research, thorough analysis, management review, and coordination between departments. Then, after each action program begins, marketers monitor ongoing results, compare them with projections, analyze any differences, and take corrective steps as needed. Some marketers also prepare contingency plans for implementation if certain conditions emerge. Because of inevitable and sometimes unpredictable environmental changes, mar- keters must be ready to update and adapt marketing plans at any time. For effective implementation and control, the marketing plan should define how prog- ress toward objectives will be measured. Managers typically use budgets, schedules, and per- formance standards for monitoring and evaluating results with budgets, they can compare planned expenditures with actual expenditures for a given week, month, orother period. Sched- ules allow management to see when tasks were supposed to be completed and when they were actually completed. Performance standards track the outcomes of marketing programs to see whether the company is moving toward its objectives. Some examples of performance standards are market share, sales volume, product profitability, and customer satisfaction. Sample Marketing Plan: Chill Beverage Company Executive Summary The Chill Beverage Company is preparing to launch a new line of vitamin-enhanced water called NutriWater. Although the bottled water market is maturing, the vitamin-enhanced water category is still growing. NutriWater will be positioned by the slogan "Expect more"indicating that the brand offers more in the way of desirable product features and benefits at a competitive price. Chill Beverage is taking advantage of its existing experi- ence and brand equity among its loyal current customer base of Millennials who consume its Chill Soda soft drink. NutriWater will target similar Millennials who are maturing and looking for an alternative to soft drinks and high-calorie sugared beverages. The primary marketing objective is to achieve first-year U.S. sales of $30 million, roughly 2 percent of the enhanced water market. Based on this market share goal, the com- pany expects to sell more than 17 million units the first year and break even in the final period of the year. Current Marketing Situation The Chill Beverage Company was founded in 2001 by an entrepreneur who had success- fully built a company that primarily distributed niche and emerging products in the bever- age industry. Its Chill Soda soft drink brand hit the market with six unique flavors in glass bottles. A few years later, the Chill Soda brand introduced an energy drink as well as a line of natural juice drinks. The company now markets dozens of Chill Soda flavors, many unique to the brand. Chill Beverage has grown its business every year since it was founded. In the most recent year, it achieved $185 million in revenue and net profits of $14.5 million As part of its future growth strategy, Chill Beverage is currently preparing to enter a new beverage category with a line of vitamin-enhanced waters. As a beverage category, bottled water experienced tremendous growth during the 1990s and 2000s. Currently, the average person in the United States consumes more than 28 gallons of bottled water every year, a number that has increased 20-fold in just 30 years. Bottled water consumption is second only to soft drink consumption, ahead of milk, beer, and coffee. Although bottled water growth has tapered off somewhat in recent years, it is still moderately strong at approximately 3 percent growth annually. Most other beverage categories have experienced declines. In the most recent year, 8.75 billion gallons of bottled water were sold in the United States with a value of more than $7.6 billion. Appendix 1 Marketing Plan 635 Competition is more intense now than ever as demand slows, industry consolidation continues, and new types of bottled water emerge. The U.S. market is dominated by three global corporations. With a portfolio of 12 brands (including Poland Spring, Nestl Pure Life, and Arrowhead), Nestl leads the market for "plain" bottled water. However, when all subcategories of bottled water are included (enhanced water, flavored water, and so on), Coca-Cola leads the U.S. market with a 22.9 percent share. Nestl markets only plain waters but is number two at 21.5 percent of the total bottled water market. PepsiCo is third with 162 percent of the market. To demonstrate the strength of the vitamin-enhanced water seg ment, Coca-Cola's Vitaminwater has higher annual sales than any other bottled water brand, To break into this market, dominated by huge global corporations and littered with dozens of other small players, Chill Beverage must carefully target specific segments with features and benefits valued by those segments. Market Description The bottled water market consists of many different types of water. Varieties of plain water include spring, purified, mineral, and distilled. Although these different types of water are sold as consumer products, they also serve as the core ingredient for other types of bottled waters, in- cludingenhanced water, flavored water, sparkling water, or any combination of those categories, Although some consumers may not perceive much of a difference between brands, others are drawn to specific product features and benefits provided by different brands. For example, some consumers may perceive spring water as healthier than other types of water. Some may look for water that is optimized for hydration. Others seek additional nutritional benefits claimed by bottlers that enhance their brands with vitamins, minerals, herbs, and other additives. Still other consumers make selections based on flavor. The industry as a whole has positioned bottled water of all kinds as a low-calorie, healthy alternative to soft drinks, sports drinks, energy drinks, and other types of beverages. Bottled water brands also distinguish themselves by size by size and type of container, mul- tipacks, and refrigeration at point of sale. Chill Beverage's market for NutriWater consists of consumers of single-serving sized bottled beverages who are looking for a healthy yet flavorful alternative "Healthy" in this context means both low-calorie and enhanced nu- tritional content. This market includes traditional soft drink consumers who want to im- prove their health as well as non-soft-drink consumers who want an option other than plain bottled water. Specific segments that Chill Beverage will target during the first year include athletes, the health conscious, the socially responsible, and Millennials who favor independent corporations. The Chill Soda brand has established a strong base of loyal cus- tomers, primarily among Millennials. This generational segment is becoming a prime target as it matures and seeks alternatives to full-calorie soft drinks Table A1.1 shows how NutriWater addresses the needs of targeted consumer segments. Product Review Chill Beverage's new line of vitamin-enhanced water-called NutriWater-offers the fol- lowing features: Six new-age flavors: Peach Mango, Berry Pomegranate, Kiwi Dragonfruit, Mandarin Orange, Blueberry Grape, and Key Lime Single-serving-size, 20-ounce, PET recyclable bottles. Formulated for wellness, replenishment, and optimum energy Full Recommended Daily Allowance (RDA) of essential vitamins and minerals (includ- ing electrolytes) Higher vitamin concentration-vitamin levels are 2 to 10 times higher than those of market-leading products, with more vitamins and minerals than any other brand. Additional vitamins-vitamins include A, E, and B, as well as folic acid-none of which are contained in the market-leading products. All natural no artificial flavors, colors, or preservatives. Sweetened with pure cane sugar and Stevia, a natural zero-calorie sweetener. Twenty-five cents from each purchase will be donated to Vitamin Angels, a nonprofit organization with a mission to prevent vitamin deficiency in at-risk children. Competitive Review As sales of bottled waters entered a strong growth phase in the 1990s, the category began to expand. In addition to the various types of plain water, new categories emerged. These b3b Appendix 1 Marketing Man Table A1.1 Segment Needs and Corresponding Features/Benefits of NutriWater Targeted Segment Customer Need Corresponding Features/Benefits Athletes Electrolytes and carbohydrates B vitamins, carbohydrates Health conscious Hydration and replenishment of essential minerals Energy to maximize performance Maintain optimum weight Optimize nutrition levels Avoid harmful chemicals and additives Desire to consume a tastier beverage than water Socially conscious Half the calories of fully sugared beverages Higher levels of vitamins A, B, C, E, zinc, chromium, and folic acid than other products; vitamins unavailable in other products All-natural ingredients Six new-age flavors 25-cent donation from each purchase to Vitamin Angels Less-invasive online and social networking promotional tactics Small privately held company Full Recommended Daily Allowance (RDA) levels of essential vitamins and minerals Support causes that help solve world's social problems Aversion to mass-media advertising/ technologically savvy Counterculture attitude Diet enhancement due to fast-paced lifestyle Millennials induded flavored waterssuch as Aquafina's Flavorsplashas well as enhanced waters, Enhanced waters emerged to bridge the gap between soft drinks and waters, appealing to people who knew they should drink more water and less soft drinks but still wanted flavor. Development of brands for this product variation has occurred primarily in start-up and boutique beverage companies. In the 2000s, major beverage corporations acquired the most successful smaller brands, providing the bigger firms with a solid market position in this category and diversification in bottled waters in general. Currently, enhanced water sales account for approximately 18 percent of the total bottled water market. The fragmentation of this category, combined with domination by the market lead- ers, has created a severely competitive environment. Although there is indirect competition posed by all types of bottled waters and even other types of beverages (soft drinks, energy drinks, juices, teas), this competitive analysis focuses on direct competition from enhanced water brands. For the purposes of this analysis, enhanced water is bottled water with addi- tives that are intended to provide health and wellness benefits. The most common additives indude vitamins, minerals (including electrolytes), and herbs. Most commonly, enhanced waters are sweetened, flavored, and colored. This definition distinguishes enhanced water from sports drinks that have the primary purpose of maximizing hydration by replenishing electrolytes. Enhanced water brands are typically sweetened with a combination of some kind of sugar and a zero-calorie sweetener, resulting in about half the sugar content, carbohydrates, and calories of regular soft drinks and other sweetened beverages. The types of sweeteners used create a point of differentiation. Many brands, including the market leaders, sell both regular and zero-calorie varieties, Pricing for this product is consistent across brands and varies by type of retail out- let, with convenience stores typically charging more than grocery stores. The price for a 20-ounce bottle ranges from $1.00 to $189, with some niche brands costing slightly more. Key competitors to Chill Beverage's NutriWater line include the following Vitaminwater: Created in 2000 as a new product for Energy Brands' Glacau, which was also the developer of Smartwater (distilled water with electrolytes). Coca-Cola purchased Energy Brands for $4.1 billion in 2007. Vitaminwater is sold in regular and zero-calorie versions. With 28 varieties, Vitaminwater offers more options than any brand on the market. Whereas Vitaminwater varieties are distinguished by flavor, they are named according to functional benefits, such as Stur-D (healthy bones), Defense Appendix 1 Marketing Plan 637 (strengthens immune system), Focus (mental clarity), and Restore (post-workout re- covery). The brand's current slogan is "Hydration for every occasion-morning, noon, and night." Vitamin water is vapor distilled, de-ionized, and/or filtered and is sweet- ened with crystalline fructose corn syrup) and erythritol all-natural sweetener. Avail- able in 20-ounce PET bottles and multipacks, Vitaminwater exceeds $830 million in annual sales and commands 61 percent of the enhanced water market. More notably, it outsells all other bottled water brands, enhanced or otherwise, including Coca-Cola's own Dasani. SoBe Lifewater: PepsiCo bought SoBe in 2000. Sobe introduced Lifewater in 2008 with a hit Super Bowl ad as an answer to Coca-Cola's Vitaminwater. The Life water line indudes 17 regular and zero-calorie varieties. Each bottle of Lifewater is designated by flavor and one of six different functional categories: Electrolytes, Lean Machine, B-Energy, C-Boost, Antioxidants, and Pure. Each variety is infused with a formulation of vitamins, minerals, and herbs designed to provide the daimed benefit. The most re- cent line-Pure-contains only water, a hint of flavor, and electrolytes, Sweetened with a combination of sugar and erythritol, Lifewater makes the claim to be "all natural." It contains no artificial flavors or colors. However, some analysts debate the "natural" designation for erythritol. Lifewater is sold in 20-ounce PET bottles and multipacks as well as one-liter PET bottles. With more than $269 million in annual revenues, Lifewa- ter is the number two enhanced water brand, capturing 20 percent of the market. Propel Zero: Gatorade created Propel in 2000, just one year prior to PepsiCo's purchase of this leading sports drink marketer. Originally marketed and labeled as "fitness wa ter," it is now available only as Propel Zero. Although the fitness water designation has been dropped, Propel Zero still leans toward that positioning with the label stating "REPLENISH + ENERGIZE + PROTECT." Propel Zero comes in seven flavors, each containing the same blend of B vitamins, vitamin C, vitamin E, antioxidants, and elec trolytes. It is sweetened with sucralose. Propel Zero is available in a wider variety of sizes, with 16.9., 20-, and 24-ounce PET bottles and multipacks. Propel Zero is also marketed in powder form to be added to bottled water. With $165 million in revenues, Propel Zero is the number three en hanced water brand with a 12 percent share of the enhanced water market RESCUE Water: The Arizona Beverage Company is best known as the number one producer of ready-to-drink bottled teas. However, it also bottles a variety of other bev- erages, ind uding smoothies, sports drinks, energy drinks, and juice blends. Its newest brand is RESCUE Water, introduced to the US market in 2010. It sets itself apart from other enhanced waters with green tea extract added to a blend of vitamins and min- erals. This provides a significant point of differentiation for those desiring green tea, but rules the brand out for the majority of customers who do not want it. It comes in five flavors, each with its own functional benefit. RESCUE Water touts other points of distinction as well, including branded Twinlab vitamins, all-natural ingredients, and a high-tech plastic bottle that resembles glass and maximizes freshness. Its Blueberry Coconut Hydrate variety contains real coconut water, an emerging alternative bev- erage category. Although RESCUE Water sales and market share figures are not yet known because of the product's newness, the Arizona Beverage Company is a multi- billion dollar corporation with a long history of successful new-product introductions, Niche brands: The market for enhanced water includes at least four companies that market their wares on a small scale through independent retailers: Assure, Ex Aqua Vitamins, Ayala Herbal Water, and Skinny Water. Some brands feature exotic additives and/or artistic glass bottles. Despite the strong competition, NutriWater believes it can create a relevant brand im- age and gain recognition among the targeted segments. The brand offers strong points of differentiation with higher and unique vitamin content, all-natural ingredients, and sup port for a relevant social cause. With other strategic assets, Chill Beverage is confident that it can establish a competitive advantage that will allow NutriWater to grow in the market. Table A1.2 shows a sample of competing products, Channels and Logistics Review The purchase of Vitaminwater by Coca-Cola left a huge hole in the independent distributor system. NutriWater will be distributed through an independent distributor to a network of 638 Appendix 1 Marketing Plan Table A1.2 Sample of Competitive Products Competitor Brand Features Coca-Cola Vitaminwater PepsiCo SoBe Lifewater Regular and zero-calorie versions: 28 varieties; each flavor provides a different function based on blend of vitamins and minerals: vapor distilled, de-ionized, and/or fitered: sweetened with crystalline fructose and erythritol: 20-ounce single-serve or multipack. Regular and zero-calorie versions; 17 varieties; six different functional categories; vitamins, minerals, and herbs, pure -mildly flavored, unsweetened water sweetened with sugar and erythritol: all natural"; 20-ounce single-serve and multipacks as well as one-liter bottles Zero-calorie only; seven flavors; fitness positioning based on REPLENISH + ENERGZE + PROTECT"; B vitamins, vitamin C, vitamin E, antioxidants, and electrolytes, sweetened with sucralose: 16.9-ounce, 20-ounce, and 24-ounce PET bottles and multipacks; powdered packets. Full-calorie only; five flavors, each with its own blend of vitamins and minerals, green tea extract (caffeine included; only brand with coconut water; Twinlab-branded vitamins; high-tech plastic bottle. PepsiCo Propel Zero Arizona Beverage RESCUE Water retailers in the United States. This strategy will avoid some of the head on competition for shelf space with the Coca-Cola and PepsiCo brands and will also directly target likely Nutri- Water customers. As with the rollout of the core Chill Soda brand, this strategy will focus on placing coolers in retail locations that will exclusively hold NutriWater. These retailers include: Grocery chains: Regional grocery chains such as HyVee in the Midwest, Wegman's in the East, and WinCo in the West. Health and natural food stores: Chains such as Whole Foods, as well as local health food co-ops. Fitness centers: National fitness center chains such as 24 Hour Fitness, Gold's Gym, and other regional chains As the brand gains acceptance, channels will expand into larger grocery chains, conve- nience stores, and unique locations relevant to the target customer segment. Strengths, Weaknesses, Opportunities, and Threat Analysis NutriWater has several powerful strengths on which to build, but its major weakness is lack of brand awareness and image. Major opportunities indude a growing market and consumer trends targeted by NutriWater's product traits. Threats include barriers to en- try posed by limited retail space, as well as image issues for the bottled water industry Table A1.3 summarizes NutriWater's main strengths, weaknesses, opportunities, and threats. Strengths NutriWater can rely on the following important strengths: 1. Superior quality: NutriWater boasts the highest levels of added vitamins of any en- hanced water, including full RDA levels of many vitamins. It is all natural, with no artificial flavors, colors, or preservatives. It is sweetened with both pure cane sugar and the natural zero-calorie sweetener, Stevia. 2. Expertise in alternative beverage marketing: The Chill Soda brand went from nothing to a successful and rapidly growing soft drink brand with fiercely loyal customers in a matter of only one decade. This success was achieved by starting small and focusing on gaps in the marketplace Appendix 1 Marketing Pan 639 Table A1.3 NutriWater's Strengths, Weaknesses, Opportunities, and Threats Weaknesses Strengths Superior quality Expertise in alternative beverage marketing Social responsibility Anti-establishment image Opportunities Lack of brand awareness Limited budget Threats Growing market . Gap in the distribution network Heath trends Anti-establishment image Limited shelf space Image of enhanced waters Environmental issues 3. Social responsibility: Every customer will have the added benefit of helping malnour ished children throughout the world. Although the price of NutriWater is in line with the prices of other competitors, low promotional costs allow for the substantial chari- table donation of 25 cents per bottle while maintaining profitability, 4. Anti-establishment image: The big brands have decent products and strong distribution relationships. But they also carry the image of the large, corporate establishments. Chill Beverage has achieved success with an underdog image while remaining privately held. Vitaminwater and SoBe were built on this same image, but both are now owned by major multinational corporations, Weaknesses 1. Lack of brand aurreness: As an entirely new brand, NutriWater will enter the market with limited or no brand awareness. The affiliation with Chill Soda will be kept at a minimum in order to prevent associations between NutriWater and soft drinks. This issue will be addressed through promotion and distribution strategies. 2. Limited budget: As a smaller company, Chill Beverage has much smaller funds available for promotional and research activities, Opportunities 1. Growing market: Although growth in the overall market for bottled water has slowed to some extent, its current rate of growth in the 3 percent range is relatively strong among beverage categories. Of the top six beverage categories, soft drinks, beer, milk, and fruit drinks experienced declines. The growth for coffee was less than 1 percent. More important than the growth of bottled waters in general, the enhanced water category is experiencing growth in the high single and low double digits. 2. Gap in the distribution network: The market leaders distribute directly to retailers. This gives them an advantage in large national chains. However, no major enhanced water brands are currently being sold through independent distributors, 3. Health trends: Weight and nutrition continue to be issues for consumers in the United States. The country has the highest obesity rate for developed countries at 34 percent, with well over 60 percent of the population officially "owerweight." Those numbers continue to rise. Additionally, Americans get 21 percent of their daily calories from beverages, a number that has tripled in the last three decades. Consumers still desire flavored beverages but look for lower-calorie alternatives, 4. Anti-establishment image. Millennials (born between 1977 and 2000) maintain a higher aversion to mass marketing messages and global corporations than do Gen Xers and baby boomers. Threats 1. Limited shelf space: Whereas competition is generally a threat for any type of product, competition in retail beverages is particularly high because of limited retail space. Car- rying a new beverage product requires retailers to reduce shelf or cooler space already occupied by other brands. 2. Image of enhanced unters: The image of enhanced waters is currently in question, as Coca-Cola recently fought a class-action lawsuit accusing it of violating Food and Drug Administration (FDA) regulations by promoting the health benefits of Vitaminwater. The lawsuit exposed the number one bottled water brand as basically sugar water with minimal nutritional value 3. Environmental issues: Environmental groups continue to educate the public on the en- vironmental costs of bottled water, induding landfill waste, carbon emissions from production and transportation, and harmful effects of chemicals in plastics. Objectives and Issues Chill Beverage has set aggressive but achievable objectives for NutriWater for the first and second years of market entry. First-Year Objectives During the initial year on the market, Chill Beverage aims for NutriWater to achieve a 2 percent share of the enhanced water market, or approximately $30 million in sales, with break-even status achieved in the final period of the year. With an average retail price of $1.69, that equates with a sales goal of 17,751,480 bottles, Second-Year Objectives During the second year, Chill Beverage will unveil additional NutriWater flavors, includ- ing zero-calorie varieties. The second-year objective is to double sales from the first year, to $60 million Issues In launching this new brand, the main issue is the ability to establish brand awareness and a meaningful brand image based on positioning that is relevant to target customer segments. Chill Beverage will invest in non traditional means of promotion to accomplish these goals and to spark word-of-mouth interactions. Establishing distributor and retailer relationships will also be critical in order to make the product available and provide point-of-purchase communications. Brand awareness and knowledge will be measured in order to adjust mar- keting efforts as necessary Marketing Strategy NutriWater's marketing strategy will involve developing a "more for the same" positioning based on extra benefits for the price. The brand will also establish channel differentiation, as it will be available in locations where major competing brands are not. The primary target segment is Millennials. This segment is comprised of tweens (ages 10 to 12), teens (13 to 18), and young adults (19 to 33). NutriWater will focus specifically on the young adult market. Subsets of this generational segment include athletes, the health conscious, and the socially responsible Positioning NutriWater will be positioned on an "Expect more" value proposition. This will allow for differentiating the brand based on product features (expect more vitamin content and all- natural ingredients), desirable benefits (expect greater nutritional benefits), and values (do more for a social cause). Marketing will focus on conveying that NutriWater is more than just a beverage: It gives customers much more for their money in a variety of ways. Product Strategy NutriWater will be sold with all the features described in the Product Review section. As awareness takes hold and retail availability increases, more varieties will be made available. Appendix 1 Marketing Plan 641 Azero-calorie version will be added to the product line, providing a solid fit with the health benefits sought by consumers. Chill Beverage's considerable experience in brand-building will be applied as an integral part of the product strategy for NutriWater. All aspects of the marketing mix will be consistent with the brand. Pricing There is little price variation in the enhanced water category, particularly among leading brands. For this reason, NutriWater will follow a competition-based pricing strategy. Given that NutriWater claims superior quality, it must be careful not to position itself as a lower- cost alternative. Manufacturers do not quote list prices on this type of beverage, and prices vary considerably based on type of retail outlet and whether or not the product is refriger- ated. Regular prices for single 20-ounce bottles of competing products are as low as $1.00 in discount-retailer stores and as high as $1 89 in convenience stores. Because NutriWater will not be targeting discount retailers and convenience stores initially, this will allow Chill Beverage to set prices at the average to higher end of the range for similar products in the same outlets. For grocery chains, this should be approximately $1.49 per bottle, with that price rising to $1 89 at health food stores and fitness centers, where prices tend to be higher Distribution Strategy Based on the information presented in the Channels and Logistics Review section, NutriWater will employ a selective distribution strategy with well-known regional grocers, health and natural food stores, and fitness centers. This distribution strategy will be ex- ecuted through a network of independent beverage distributors, as there are no other major brands of enhanced water following this strategy. Chill Beverage gained success for its core Chill Soda soft drink line using this method. It also placed coolers with the brand logo in truly unique venues such as skate, surf, and snowboarding shops; tattoo and piercing par lors; fashion stores; and music stores-places that would expose the brand to target custom ers. Then, the soft drink brand expanded by getting contracts with retailers such as Panera, Barnes & Noble, Target, and Starbucks. This same approach will be taken with NutriWater by starting small, then expanding into larger chains, Nutri Water will not target all the same stores used originally by Chill Soda, as many of those outlets were unique to the positioning and target customer for the Chill Soda soft drink brand, Marketing Communication Strategy As with the core Chill Soda brand, the marketing communication strategy for NutriWater will not be based on traditional mass-communication advertising. Initially, there will be no broadcast or print advertising, Promotional resources for NutriWater will focus on three areas: Online and mobile marketing: The typical target customer for NutriWater spends more time online than with traditional media channels. A core component for this strategy will be building Web and mobile brand sites and driving traffic to those sites by cre- ating a presence on social networks, including Facebook, Google+, and Twitter. The NutriWater brand will also incorporate location-based services by Foursquare and Facebook to help drive traffic to retail locations. A mobile phone ad campaign will provide additional support to the online efforts. Trade promotions: Like the core Chill Soda brand, NutriWater's success will rely on re- lationships with retailers to create product availability. Primary incentives to retailers will include point-of-purchase displays, branded coolers, and volume incentives and contests. This push marketing strategy will combine with the other pull strategies. Evert marketing: NutriWater will deploy teams in brand-labeled RVs to distribute product samples at events such as skiing and snowboarding competitions, golf tourna- ments, and concerts. Marketing Research To remain consistent with the online promotional approach, as well as using research meth- ods that will effectively reach target customers, Chill Beverage will monitor online dis- cussions via services such as Radiant. In this manner, the company will gauge customer perceptions of the brand, the products, and general satisfaction. For future development of the product and new distribution outlets, crowdsourcing methods will be utilized. Action Programs NutriWater will be introduced in February. The following are summaries of action programs that will be used during the first six months of the year to achieve the stated objectives, January: Chill Beverage representatives will work with both independent distributors and retailers to educate them on the trade promotional campaign, incentives, and ad- vantages for selling NutriWater. Representatives will also ensure that distributors and retailers are educated on product features and benefits as well as instructions for display- ing point-of-purchase materials and coolers. The brand Web site and other sites such as Facebook will present teaser information about the product as well as availability dates and locations. Buzz will be enhanced by providing product samples to selected product reviewers, opinion leaders, influential bloggers, and celebrities. February: On the date of availability, product coolers and point-of-purchase displays will be placed in retail locations. The full brand Web site and social network campaign will launch with full efforts on Facebook, Google+, and Twitter. This campaign will drive the "Expect more" slogan, as well as illustrate the ways that NutriWater delivers more than expected on product features, desirable benefits, and values by donating to Vitamin An- gels and the social cause of battling vitamin deficiency in children. March: To enhance the online and social marketing campaign, location-based services Four- square and Facebook Places will be employed to drive traffic to retailers. Point-of-purchase displays and signage will be updated to support these efforts and to continue supporting retailers. The message of this campaign will focus on all aspects of "Expect more." April: A mobile phone ad campaign will provide additional support, driving Web traffic to the brand Web site and social network sites, as well as driving traffic to retailers. May: A trade sales contest will offer additional incentives and prizes to the distributors and retailers that sell the most NutriWater during a four-week period. June: An event marketing campaign will mobilize a team of NutriWater representatives in NutriWater RVs to concerts and sports events. This will provide additional visibil- ity for the brand as well as give customers and potential customers the opportunity to sample products. Budgets Chill Beverage has set a first-year retail sales goal of $30 million with a projected average retail price of $1.69 per unit for a total of 17,751,480 units sold. With an average wholesale price of 85 cents per unit, this provides revenues of just over $15 million Chill Beverage ex- pects to break even during the final period of the first year. A break-even analysis assumes per-unit wholesale revenue of 85 cents per unit, a variable cost per unit of 14 cents, and estimated first-year fixed costs of $12,500,000. Based on these assumptions, the break-even calculation is: $12,500,000 $0.85/ unit - $0.14/unit = 17,605,634 Controls Chill Beverage is planning tight control measures to dosely monitor product quality, brand awareness, brand image, and customer satisfaction. This will enable the company to react quickly in correcting any problems that may occur Other early warning signals that will be monitored for signs of deviation from the plan include monthly sales (by segment and channel) and monthly expenses. Given the market's volatility, contingency plans are also in place to address fast-moving environmental changes such as shifting consumer prefer ences, new products, and new competition Sources: Jeffrey Kline man, "Restoring an Icon," Berenge Spectron Magazine, December 2010, pp. 16-18; Ryan Underwood, "Jonesing for Soda," Fast Comprory, December 19, 2007, at www fastcompany.com; "New Playbook at Jones Soda," Berenage Spectrum Magazine, March 2008; Matt Casey, "Enhanced Options Divide a Category," Bererage Spectron Magazine, December 2008, p. 74; and product and market information obtained from www.lifewater.com, www.vitamin water.com, www.nestlewaters.com, www.drinkarizona.com, and www.jonessoda.com, accessed Sep- tember 2012 5. Discuss the four marketing management functions. Read the Material entitled as Sample Marketing Plan: Chill Beverage Company in Page 634-642 in Principles of Marketing by Kotler and Armstrong (2014) and answer the following questions. From Marketing Plan to Marketing Action Companies generally create yearly marketing plans, although some plans cover a longer period. Marketers start planning well in advance of the implementation date to allow time for marketing research, thorough analysis, management review, and coordination between departments. Then, after each action program begins, marketers monitor ongoing results, compare them with projections, analyze any differences, and take corrective steps as needed. Some marketers also prepare contingency plans for implementation if certain conditions emerge. Because of inevitable and sometimes unpredictable environmental changes, mar- keters must be ready to update and adapt marketing plans at any time. For effective implementation and control, the marketing plan should define how prog- ress toward objectives will be measured. Managers typically use budgets, schedules, and per- formance standards for monitoring and evaluating results with budgets, they can compare planned expenditures with actual expenditures for a given week, month, orother period. Sched- ules allow management to see when tasks were supposed to be completed and when they were actually completed. Performance standards track the outcomes of marketing programs to see whether the company is moving toward its objectives. Some examples of performance standards are market share, sales volume, product profitability, and customer satisfaction. Sample Marketing Plan: Chill Beverage Company Executive Summary The Chill Beverage Company is preparing to launch a new line of vitamin-enhanced water called NutriWater. Although the bottled water market is maturing, the vitamin-enhanced water category is still growing. NutriWater will be positioned by the slogan "Expect more"indicating that the brand offers more in the way of desirable product features and benefits at a competitive price. Chill Beverage is taking advantage of its existing experi- ence and brand equity among its loyal current customer base of Millennials who consume its Chill Soda soft drink. NutriWater will target similar Millennials who are maturing and looking for an alternative to soft drinks and high-calorie sugared beverages. The primary marketing objective is to achieve first-year U.S. sales of $30 million, roughly 2 percent of the enhanced water market. Based on this market share goal, the com- pany expects to sell more than 17 million units the first year and break even in the final period of the year. Current Marketing Situation The Chill Beverage Company was founded in 2001 by an entrepreneur who had success- fully built a company that primarily distributed niche and emerging products in the bever- age industry. Its Chill Soda soft drink brand hit the market with six unique flavors in glass bottles. A few years later, the Chill Soda brand introduced an energy drink as well as a line of natural juice drinks. The company now markets dozens of Chill Soda flavors, many unique to the brand. Chill Beverage has grown its business every year since it was founded. In the most recent year, it achieved $185 million in revenue and net profits of $14.5 million As part of its future growth strategy, Chill Beverage is currently preparing to enter a new beverage category with a line of vitamin-enhanced waters. As a beverage category, bottled water experienced tremendous growth during the 1990s and 2000s. Currently, the average person in the United States consumes more than 28 gallons of bottled water every year, a number that has increased 20-fold in just 30 years. Bottled water consumption is second only to soft drink consumption, ahead of milk, beer, and coffee. Although bottled water growth has tapered off somewhat in recent years, it is still moderately strong at approximately 3 percent growth annually. Most other beverage categories have experienced declines. In the most recent year, 8.75 billion gallons of bottled water were sold in the United States with a value of more than $7.6 billion. Appendix 1 Marketing Plan 635 Competition is more intense now than ever as demand slows, industry consolidation continues, and new types of bottled water emerge. The U.S. market is dominated by three global corporations. With a portfolio of 12 brands (including Poland Spring, Nestl Pure Life, and Arrowhead), Nestl leads the market for "plain" bottled water. However, when all subcategories of bottled water are included (enhanced water, flavored water, and so on), Coca-Cola leads the U.S. market with a 22.9 percent share. Nestl markets only plain waters but is number two at 21.5 percent of the total bottled water market. PepsiCo is third with 162 percent of the market. To demonstrate the strength of the vitamin-enhanced water seg ment, Coca-Cola's Vitaminwater has higher annual sales than any other bottled water brand, To break into this market, dominated by huge global corporations and littered with dozens of other small players, Chill Beverage must carefully target specific segments with features and benefits valued by those segments. Market Description The bottled water market consists of many different types of water. Varieties of plain water include spring, purified, mineral, and distilled. Although these different types of water are sold as consumer products, they also serve as the core ingredient for other types of bottled waters, in- cludingenhanced water, flavored water, sparkling water, or any combination of those categories, Although some consumers may not perceive much of a difference between brands, others are drawn to specific product features and benefits provided by different brands. For example, some consumers may perceive spring water as healthier than other types of water. Some may look for water that is optimized for hydration. Others seek additional nutritional benefits claimed by bottlers that enhance their brands with vitamins, minerals, herbs, and other additives. Still other consumers make selections based on flavor. The industry as a whole has positioned bottled water of all kinds as a low-calorie, healthy alternative to soft drinks, sports drinks, energy drinks, and other types of beverages. Bottled water brands also distinguish themselves by size by size and type of container, mul- tipacks, and refrigeration at point of sale. Chill Beverage's market for NutriWater consists of consumers of single-serving sized bottled beverages who are looking for a healthy yet flavorful alternative "Healthy" in this context means both low-calorie and enhanced nu- tritional content. This market includes traditional soft drink consumers who want to im- prove their health as well as non-soft-drink consumers who want an option other than plain bottled water. Specific segments that Chill Beverage will target during the first year include athletes, the health conscious, the socially responsible, and Millennials who favor independent corporations. The Chill Soda brand has established a strong base of loyal cus- tomers, primarily among Millennials. This generational segment is becoming a prime target as it matures and seeks alternatives to full-calorie soft drinks Table A1.1 shows how NutriWater addresses the needs of targeted consumer segments. Product Review Chill Beverage's new line of vitamin-enhanced water-called NutriWater-offers the fol- lowing features: Six new-age flavors: Peach Mango, Berry Pomegranate, Kiwi Dragonfruit, Mandarin Orange, Blueberry Grape, and Key Lime Single-serving-size, 20-ounce, PET recyclable bottles. Formulated for wellness, replenishment, and optimum energy Full Recommended Daily Allowance (RDA) of essential vitamins and minerals (includ- ing electrolytes) Higher vitamin concentration-vitamin levels are 2 to 10 times higher than those of market-leading products, with more vitamins and minerals than any other brand. Additional vitamins-vitamins include A, E, and B, as well as folic acid-none of which are contained in the market-leading products. All natural no artificial flavors, colors, or preservatives. Sweetened with pure cane sugar and Stevia, a natural zero-calorie sweetener. Twenty-five cents from each purchase will be donated to Vitamin Angels, a nonprofit organization with a mission to prevent vitamin deficiency in at-risk children. Competitive Review As sales of bottled waters entered a strong growth phase in the 1990s, the category began to expand. In addition to the various types of plain water, new categories emerged. These b3b Appendix 1 Marketing Man Table A1.1 Segment Needs and Corresponding Features/Benefits of NutriWater Targeted Segment Customer Need Corresponding Features/Benefits Athletes Electrolytes and carbohydrates B vitamins, carbohydrates Health conscious Hydration and replenishment of essential minerals Energy to maximize performance Maintain optimum weight Optimize nutrition levels Avoid harmful chemicals and additives Desire to consume a tastier beverage than water Socially conscious Half the calories of fully sugared beverages Higher levels of vitamins A, B, C, E, zinc, chromium, and folic acid than other products; vitamins unavailable in other products All-natural ingredients Six new-age flavors 25-cent donation from each purchase to Vitamin Angels Less-invasive online and social networking promotional tactics Small privately held company Full Recommended Daily Allowance (RDA) levels of essential vitamins and minerals Support causes that help solve world's social problems Aversion to mass-media advertising/ technologically savvy Counterculture attitude Diet enhancement due to fast-paced lifestyle Millennials induded flavored waterssuch as Aquafina's Flavorsplashas well as enhanced waters, Enhanced waters emerged to bridge the gap between soft drinks and waters, appealing to people who knew they should drink more water and less soft drinks but still wanted flavor. Development of brands for this product variation has occurred primarily in start-up and boutique beverage companies. In the 2000s, major beverage corporations acquired the most successful smaller brands, providing the bigger firms with a solid market position in this category and diversification in bottled waters in general. Currently, enhanced water sales account for approximately 18 percent of the total bottled water market. The fragmentation of this category, combined with domination by the market lead- ers, has created a severely competitive environment. Although there is indirect competition posed by all types of bottled waters and even other types of beverages (soft drinks, energy drinks, juices, teas), this competitive analysis focuses on direct competition from enhanced water brands. For the purposes of this analysis, enhanced water is bottled water with addi- tives that are intended to provide health and wellness benefits. The most common additives indude vitamins, minerals (including electrolytes), and herbs. Most commonly, enhanced waters are sweetened, flavored, and colored. This definition distinguishes enhanced water from sports drinks that have the primary purpose of maximizing hydration by replenishing electrolytes. Enhanced water brands are typically sweetened with a combination of some kind of sugar and a zero-calorie sweetener, resulting in about half the sugar content, carbohydrates, and calories of regular soft drinks and other sweetened beverages. The types of sweeteners used create a point of differentiation. Many brands, including the market leaders, sell both regular and zero-calorie varieties, Pricing for this product is consistent across brands and varies by type of retail out- let, with convenience stores typically charging more than grocery stores. The price for a 20-ounce bottle ranges from $1.00 to $189, with some niche brands costing slightly more. Key competitors to Chill Beverage's NutriWater line include the following Vitaminwater: Created in 2000 as a new product for Energy Brands' Glacau, which was also the developer of Smartwater (distilled water with electrolytes). Coca-Cola purchased Energy Brands for $4.1 billion in 2007. Vitaminwater is sold in regular and zero-calorie versions. With 28 varieties, Vitaminwater offers more options than any brand on the market. Whereas Vitaminwater varieties are distinguished by flavor, they are named according to functional benefits, such as Stur-D (healthy bones), Defense Appendix 1 Marketing Plan 637 (strengthens immune system), Focus (mental clarity), and Restore (post-workout re- covery). The brand's current slogan is "Hydration for every occasion-morning, noon, and night." Vitamin water is vapor distilled, de-ionized, and/or filtered and is sweet- ened with crystalline fructose corn syrup) and erythritol all-natural sweetener. Avail- able in 20-ounce PET bottles and multipacks, Vitaminwater exceeds $830 million in annual sales and commands 61 percent of the enhanced water market. More notably, it outsells all other bottled water brands, enhanced or otherwise, including Coca-Cola's own Dasani. SoBe Lifewater: PepsiCo bought SoBe in 2000. Sobe introduced Lifewater in 2008 with a hit Super Bowl ad as an answer to Coca-Cola's Vitaminwater. The Life water line indudes 17 regular and zero-calorie varieties. Each bottle of Lifewater is designated by flavor and one of six different functional categories: Electrolytes, Lean Machine, B-Energy, C-Boost, Antioxidants, and Pure. Each variety is infused with a formulation of vitamins, minerals, and herbs designed to provide the daimed benefit. The most re- cent line-Pure-contains only water, a hint of flavor, and electrolytes, Sweetened with a combination of sugar and erythritol, Lifewater makes the claim to be "all natural." It contains no artificial flavors or colors. However, some analysts debate the "natural" designation for erythritol. Lifewater is sold in 20-ounce PET bottles and multipacks as well as one-liter PET bottles. With more than $269 million in annual revenues, Lifewa- ter is the number two enhanced water brand, capturing 20 percent of the market. Propel Zero: Gatorade created Propel in 2000, just one year prior to PepsiCo's purchase of this leading sports drink marketer. Originally marketed and labeled as "fitness wa ter," it is now available only as Propel Zero. Although the fitness water designation has been dropped, Propel Zero still leans toward that positioning with the label stating "REPLENISH + ENERGIZE + PROTECT." Propel Zero comes in seven flavors, each containing the same blend of B vitamins, vitamin C, vitamin E, antioxidants, and elec trolytes. It is sweetened with sucralose. Propel Zero is available in a wider variety of sizes, with 16.9., 20-, and 24-ounce PET bottles and multipacks. Propel Zero is also marketed in powder form to be added to bottled water. With $165 million in revenues, Propel Zero is the number three en hanced water brand with a 12 percent share of the enhanced water market RESCUE Water: The Arizona Beverage Company is best known as the number one producer of ready-to-drink bottled teas. However, it also bottles a variety of other bev- erages, ind uding smoothies, sports drinks, energy drinks, and juice blends. Its newest brand is RESCUE Water, introduced to the US market in 2010. It sets itself apart from other enhanced waters with green tea extract added to a blend of vitamins and min- erals. This provides a significant point of differentiation for those desiring green tea, but rules the brand out for the majority of customers who do not want it. It comes in five flavors, each with its own functional benefit. RESCUE Water touts other points of distinction as well, including branded Twinlab vitamins, all-natural ingredients, and a high-tech plastic bottle that resembles glass and maximizes freshness. Its Blueberry Coconut Hydrate variety contains real coconut water, an emerging alternative bev- erage category. Although RESCUE Water sales and market share figures are not yet known because of the product's newness, the Arizona Beverage Company is a multi- billion dollar corporation with a long history of successful new-product introductions, Niche brands: The market for enhanced water includes at least four companies that market their wares on a small scale through independent retailers: Assure, Ex Aqua Vitamins, Ayala Herbal Water, and Skinny Water. Some brands feature exotic additives and/or artistic glass bottles. Despite the strong competition, NutriWater believes it can create a relevant brand im- age and gain recognition among the targeted segments. The brand offers strong points of differentiation with higher and unique vitamin content, all-natural ingredients, and sup port for a relevant social cause. With other strategic assets, Chill Beverage is confident that it can establish a competitive advantage that will allow NutriWater to grow in the market. Table A1.2 shows a sample of competing products, Channels and Logistics Review The purchase of Vitaminwater by Coca-Cola left a huge hole in the independent distributor system. NutriWater will be distributed through an independent distributor to a network of 638 Appendix 1 Marketing Plan Table A1.2 Sample of Competitive Products Competitor Brand Features Coca-Cola Vitaminwater PepsiCo SoBe Lifewater Regular and zero-calorie versions: 28 varieties; each flavor provides a different function based on blend of vitamins and minerals: vapor distilled, de-ionized, and/or fitered: sweetened with crystalline fructose and erythritol: 20-ounce single-serve or multipack. Regular and zero-calorie versions; 17 varieties; six different functional categories; vitamins, minerals, and herbs, pure -mildly flavored, unsweetened water sweetened with sugar and erythritol: all natural"; 20-ounce single-serve and multipacks as well as one-liter bottles Zero-calorie only; seven flavors; fitness positioning based on REPLENISH + ENERGZE + PROTECT"; B vitamins, vitamin C, vitamin E, antioxidants, and electrolytes, sweetened with sucralose: 16.9-ounce, 20-ounce, and 24-ounce PET bottles and multipacks; powdered packets. Full-calorie only; five flavors, each with its own blend of vitamins and minerals, green tea extract (caffeine included; only brand with coconut water; Twinlab-branded vitamins; high-tech plastic bottle. PepsiCo Propel Zero Arizona Beverage RESCUE Water retailers in the United States. This strategy will avoid some of the head on competition for shelf space with the Coca-Cola and PepsiCo brands and will also directly target likely Nutri- Water customers. As with the rollout of the core Chill Soda brand, this strategy will focus on placing coolers in retail locations that will exclusively hold NutriWater. These retailers include: Grocery chains: Regional grocery chains such as HyVee in the Midwest, Wegman's in the East, and WinCo in the West. Health and natural food stores: Chains such as Whole Foods, as well as local health food co-ops. Fitness centers: National fitness center chains such as 24 Hour Fitness, Gold's Gym, and other regional chains As the brand gains acceptance, channels will expand into larger grocery chains, conve- nience stores, and unique locations relevant to the target customer segment. Strengths, Weaknesses, Opportunities, and Threat Analysis NutriWater has several powerful strengths on which to build, but its major weakness is lack of brand awareness and image. Major opportunities indude a growing market and consumer trends targeted by NutriWater's product traits. Threats include barriers to en- try posed by limited retail space, as well as image issues for the bottled water industry Table A1.3 summarizes NutriWater's main strengths, weaknesses, opportunities, and threats. Strengths NutriWater can rely on the following important strengths: 1. Superior quality: NutriWater boasts the highest levels of added vitamins of any en- hanced water, including full RDA levels of many vitamins. It is all natural, with no artificial flavors, colors, or preservatives. It is sweetened with both pure cane sugar and the natural zero-calorie sweetener, Stevia. 2. Expertise in alternative beverage marketing: The Chill Soda brand went from nothing to a successful and rapidly growing soft drink brand with fiercely loyal customers in a matter of only one decade. This success was achieved by starting small and focusing on gaps in the marketplace Appendix 1 Marketing Pan 639 Table A1.3 NutriWater's Strengths, Weaknesses, Opportunities, and Threats Weaknesses Strengths Superior quality Expertise in alternative beverage marketing Social responsibility Anti-establishment image Opportunities Lack of brand awareness Limited budget Threats Growing market . Gap in the distribution network Heath trends Anti-establishment image Limited shelf space Image of enhanced waters Environmental issues 3. Social responsibility: Every customer will have the added benefit of helping malnour ished children throughout the world. Although the price of NutriWater is in line with the prices of other competitors, low promotional costs allow for the substantial chari- table donation of 25 cents per bottle while maintaining profitability, 4. Anti-establishment image: The big brands have decent products and strong distribution relationships. But they also carry the image of the large, corporate establishments. Chill Beverage has achieved success with an underdog image while remaining privately held. Vitaminwater and SoBe were built on this same image, but both are now owned by major multinational corporations, Weaknesses 1. Lack of brand aurreness: As an entirely new brand, NutriWater will enter the market with limited or no brand awareness. The affiliation with Chill Soda will be kept at a minimum in order to prevent associations between NutriWater and soft drinks. This issue will be addressed through promotion and distribution strategies. 2. Limited budget: As a smaller company, Chill Beverage has much smaller funds available for promotional and research activities, Opportunities 1. Growing market: Although growth in the overall market for bottled water has slowed to some extent, its current rate of growth in the 3 percent range is relatively strong among beverage categories. Of the top six beverage categories, soft drinks, beer, milk, and fruit drinks experienced declines. The growth for coffee was less than 1 percent. More important than the growth of bottled waters in general, the enhanced water category is experiencing growth in the high single and low double digits. 2. Gap in the distribution network: The market leaders distribute directly to retailers. This gives them an advantage in large national chains. However, no major enhanced water brands are currently being sold through independent distributors, 3. Health trends: Weight and nutrition continue to be issues for consumers in the United States. The country has the highest obesity rate for developed countries at 34 percent, with well over 60 percent of the population officially "owerweight." Those numbers continue to rise. Additionally, Americans get 21 percent of their daily calories from beverages, a number that has tripled in the last three decades. Consumers still desire flavored beverages but look for lower-calorie alternatives, 4. Anti-establishment image. Millennials (born between 1977 and 2000) maintain a higher aversion to mass marketing messages and global corporations than do Gen Xers and baby boomers. Threats 1. Limited shelf space: Whereas competition is generally a threat for any type of product, competition in retail beverages is particularly high because of limited retail space. Car- rying a new beverage product requires retailers to reduce shelf or cooler space already occupied by other brands. 2. Image of enhanced unters: The image of enhanced waters is currently in question, as Coca-Cola recently fought a class-action lawsuit accusing it of violating Food and Drug Administration (FDA) regulations by promoting the health benefits of Vitaminwater. The lawsuit exposed the number one bottled water brand as basically sugar water with minimal nutritional value 3. Environmental issues: Environmental groups continue to educate the public on the en- vironmental costs of bottled water, induding landfill waste, carbon emissions from production and transportation, and harmful effects of chemicals in plastics. Objectives and Issues Chill Beverage has set aggressive but achievable objectives for NutriWater for the first and second years of market entry. First-Year Objectives During the initial year on the market, Chill Beverage aims for NutriWater to achieve a 2 percent share of the enhanced water market, or approximately $30 million in sales, with break-even status achieved in the final period of the year. With an average retail price of $1.69, that equates with a sales goal of 17,751,480 bottles, Second-Year Objectives During the second year, Chill Beverage will unveil additional NutriWater flavors, includ- ing zero-calorie varieties. The second-year objective is to double sales from the first year, to $60 million Issues In launching this new brand, the main issue is the ability to establish brand awareness and a meaningful brand image based on positioning that is relevant to target customer segments. Chill Beverage will invest in non traditional means of promotion to accomplish these goals and to spark word-of-mouth interactions. Establishing distributor and retailer relationships will also be critical in order to make the product available and provide point-of-purchase communications. Brand awareness and knowledge will be measured in order to adjust mar- keting efforts as necessary Marketing Strategy NutriWater's marketing strategy will involve developing a "more for the same" positioning based on extra benefits for the price. The brand will also establish channel differentiation, as it will be available in locations where major competing brands are not. The primary target segment is Millennials. This segment is comprised of tweens (ages 10 to 12), teens (13 to 18), and young adults (19 to 33). NutriWater will focus specifically on the young adult market. Subsets of this generational segment include athletes, the health conscious, and the socially responsible Positioning NutriWater will be positioned on an "Expect more" value proposition. This will allow for differentiating the brand based on product features (expect more vitamin content and all- natural ingredients), desirable benefits (expect greater nutritional benefits), and values (do more for a social cause). Marketing will focus on conveying that NutriWater is more than just a beverage: It gives customers much more for their money in a variety of ways. Product Strategy NutriWater will be sold with all the features described in the Product Review section. As awareness takes hold and retail availability increases, more varieties will be made available. Appendix 1 Marketing Plan 641 Azero-calorie version will be added to the product line, providing a solid fit with the health benefits sought by consumers. Chill Beverage's considerable experience in brand-building will be applied as an integral part of the product strategy for NutriWater. All aspects of the marketing mix will be consistent with the brand. Pricing There is little price variation in the enhanced water category, particularly among leading brands. For this reason, NutriWater will follow a competition-based pricing strategy. Given that NutriWater claims superior quality, it must be careful not to position itself as a lower- cost alternative. Manufacturers do not quote list prices on this type of beverage, and prices vary considerably based on type of retail outlet and whether or not the product is refriger- ated. Regular prices for single 20-ounce bottl

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock