Answered step by step

Verified Expert Solution

Question

1 Approved Answer

In Uganda, consumers are likely to buy cell phones from either MTN Rwanda Ltd or Tigo Rwanda Ltd because the two firms have a

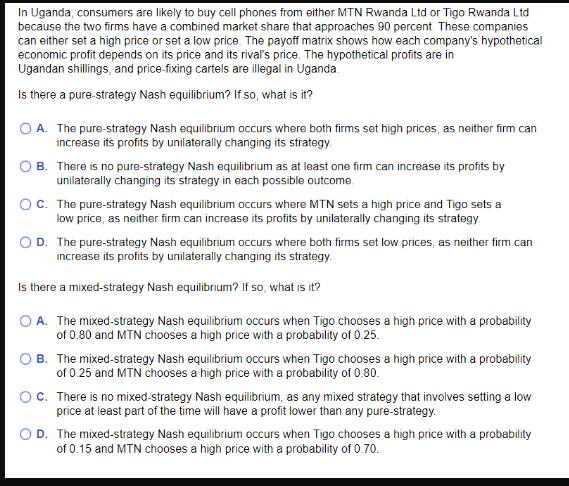

In Uganda, consumers are likely to buy cell phones from either MTN Rwanda Ltd or Tigo Rwanda Ltd because the two firms have a combined market share that approaches 90 percent. These companies can either set a high price or set a low price. The payoff matrix shows how each company's hypothetical economic profit depends on its price and its rival's price. The hypothetical profits are in Ugandan shillings, and price-fixing cartels are illegal in Uganda Is there a pure-strategy Nash equilibrium? If so, what is it? A. The pure-strategy Nash equilibrium occurs where both firms set high prices, as neither firm can increase its profits by unilaterally changing its strategy. B. There is no pure-strategy Nash equilibrium as at least one firm can increase its profits by unilaterally changing its strategy in each possible outcome OC. The pure-strategy Nash equilibrium occurs where MTN sets a high price and Tigo sets a low price, as neither firm can increase its profits by unilaterally changing its strategy. D. The pure-strategy Nash equilibrium occurs where both firms set low prices, as neither firm can increase its profits by unilaterally changing its strategy. Is there a mixed-strategy Nash equilibrium? If so, what is it? O A. The mixed-strategy Nash equilibrium occurs when Tigo chooses a high price with a probability of 0.80 and MTN chooses a high price with a probability of 0.25. B. The mixed-strategy Nash equilibrium occurs when Tigo chooses a high price with a probability of 0.25 and MTN chooses a high price with a probability of 0.80. OC. There is no mixed-strategy Nash equilibrium, as any mixed strategy that involves setting a low price at least part of the time will have a profit lower than any pure-strategy. OD. The mixed-strategy Nash equilibrium occurs when Tigo chooses a high price with a probability of 0.15 and MTN chooses a high price with a probability of 0.70. Tigo Rwanda Set High Price Set Low Price Set High Price Tigo: USH 20 billion Tigo: USH 25 billion MTN Rwanda MTN: USH 50 billion MTN: USH 30 billion. Set Low Price Tigo: USH 30 billion Tigo: USH 10 billion MTN: USH 20 billion MTN: USH 40 billion

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below Based on the payoff matrix you provided ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started