Answered step by step

Verified Expert Solution

Question

1 Approved Answer

In Week Eight we work with the bonds that make up the securities portfolio of a bank. We should understand the calculation of the Yield

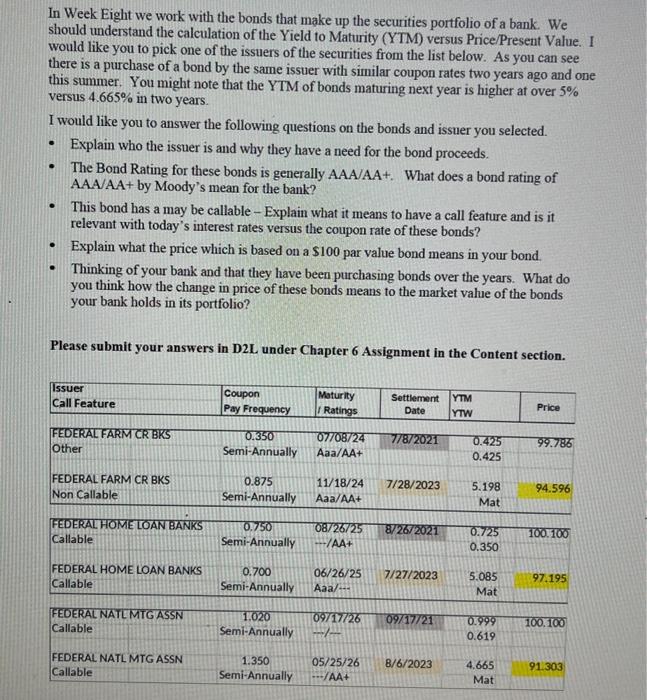

In Week Eight we work with the bonds that make up the securities portfolio of a bank. We should understand the calculation of the Yield to Maturity (YTM) versus Price/Present Value. I would like you to pick one of the issuers of the securities from the list below. As you can see there is a purchase of a bond by the same issuer with similar coupon rates two years ago and one this summer. You might note that the YTM of bonds maturing next year is higher at over 5% versus 4.665% in two years. I would like you to answer the following questions on the bonds and issuer you selected. Explain who the issuer is and why they have a need for the bond proceeds. The Bond Rating for these bonds is generally AAA/AA+. What does a bond rating of AAA/AA+ by Moody's mean for the bank? This bond has a may be callable - Explain what it means to have a call feature and is it relevant with today's interest rates versus the coupon rate of these bonds? Explain what the price which is based on a $100 par value bond means in your bond. Thinking of your bank and that they have been purchasing bonds over the years. What do you think how the change in price of these bonds means to the market value of the bonds your bank holds in its portfolio? Please submit your answers in D2L under Chapter 6 Assignment in the Content section. Issuer Call Feature FEDERAL FARM CR BKS Other FEDERAL FARM CR BKS Non Callable FEDERAL HOME LOAN BANKS Callable FEDERAL HOME LOAN BANKS Callable FEDERAL NATL MTG ASSN Callable FEDERAL NATL MTG ASSN Callable Coupon Pay Frequency 0.350 Semi-Annually 0.875 Semi-Annually 0.750 Semi-Annually 0.700 Semi-Annually 1.020 Semi-Annually Maturity Ratings 07/08/24 Aaa/AA+ 11/18/24 Aaa/AA+ 06/26/25 Aaa/--- 09/17/26 08/26/25 8/26/2021 ---/AA+ SUP Settlement YTM Date YTW 1.350 05/25/26 Semi-Annually ---/AA+ 7/8/2021 7/28/2023 7/27/2023 09/17/21 8/6/2023 0.425 0.425 5.198 Mat 0.725 0.350 5.085 Mat 0.999 0.619 4.665 Mat Price 99.786 94.596 100.100 97.195 100,100 91.303

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started