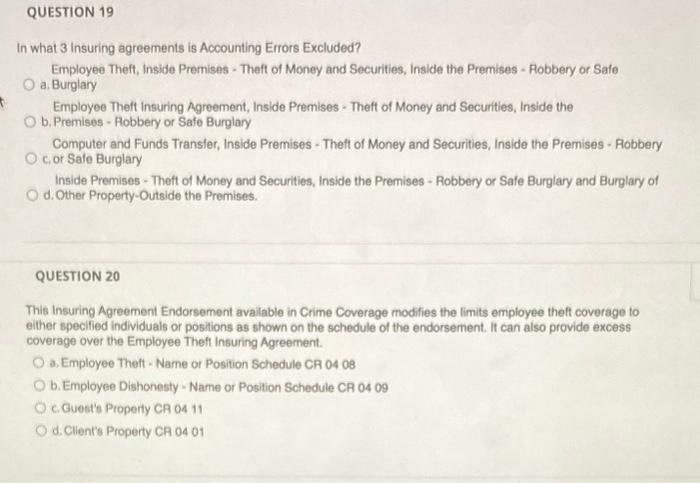

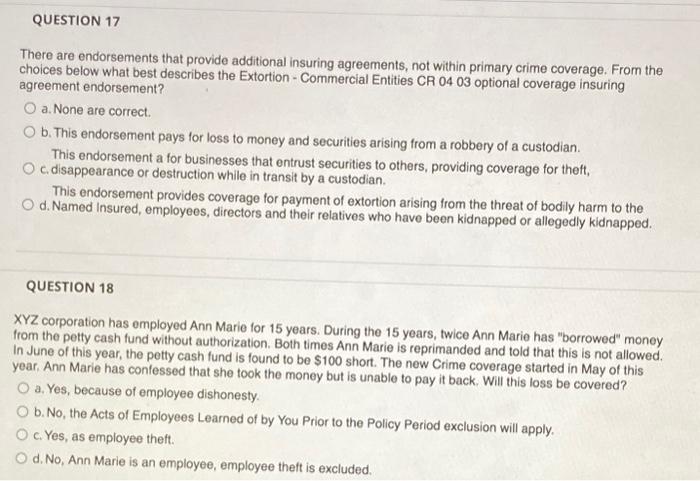

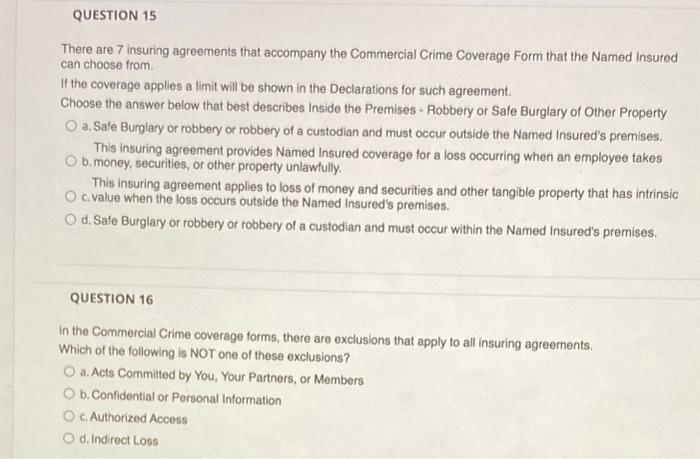

In what 3 insuring agreements is Accounting Errors Excluded? Employee Theft, Inside Premises - Theft of Money and Securities, Inside the Premises - Robbery or Sale a. Burglary Employee Theft insuring Agreement, Inside Premises - Theft of Money and Securities, Inside the b. Premises - Robbery or Safe Burglary Computer and Funds Transfer, Inside Premises - Theft of Money and Securities, Inside the Premises - Robbery c. or Sale Burglary Inside Premises - Theft of Money and Securities, Inside the Premises - Robbery or Safe Burglary and Burglary of d. Other Property-Outside the Premises. QUESTION 20 This insuring Agreement Endorsement available in Crime Coverage modifies the limits employee theft coverage to either specified indwiduals or positions as shown on the schedule of the endorsement. It can also provide excess coverage over the Employee Theft insuring Agreement. a. Employee Theft - Name or Position Schedule CR 0408 b. Employee Dishonesty - Name or Position Schedule CR 0409 c. Gueat's Property CR 0411 d. Client's Property CR 0401 There are endorsements that provide additional insuring agreements, not within primary crime coverage. From the choices below what best describes the Extortion - Commercial Entities CR 0403 optional coverage insuring agreement endorsement? a. None are correct. b. This endorsement pays for loss to money and securities arising from a robbery of a custodian. This endorsement a for businesses that entrust securities to others, providing coverage for theft, c. disappearance or destruction while in transit by a custodian. This endorsement provides coverage for payment of extortion arising from the threat of bodily harm to the d. Named Insured, employees, directors and their relatives who have been kidnapped or allegedly kidnapped. QUESTION 18 XYZ corporation has employed Ann Marie for 15 years. During the 15 years, twice Ann Marie has "borrowed" money from the petty cash fund without authorization. Both times Ann Marie is reprimanded and told that this is not allowed. In June of this year, the petty cash fund is found to be $100 short. The new Crime coverage started in May of this year. Ann Marie has confessed that she took the money but is unable to pay it back. Will this loss be covered? a. Yes, because of employee dishonesty. b. No, the Acts of Employees Learned of by You Prior to the Policy Period exclusion will apply. c. Yes, as employee theft. d. No, Ann Marie is an employee, employee theft is excluded. There are 7 insuring agreements that accompany the Commercial Crime Coverage Form that the Named Insured can choose from. If the coverage applies a limit will be shown in the Declarations for such agreement. Choose the answer below that best describes Inside the Premises - Robbery or Sale Burglary of Other Property a. Sate Burglary or robbery or robbery of a custodian and must occur outside the Named insured's premises. This insuring agreement provides Named insured coverage for a loss occurring when an employee takes b. money, securities, or other property unlawtully. This insuring agreement applies to loss of money and securities and other tangible property that has intrinsic c. value when the loss occurs outside the Named insured's premises. d. Safe Burglary or robbery or robbery of a custodian and must occur within the Named Insured's premises. QUESTION 16 In the Commercial Crime coverage forms, there are exclusions that apply to all insuring agreements. Which of the following is NOT one of these exclusions? a. Acts Committed by You, Your Partners, or Members b. Confidential or Personal information c. Authorized Access d. Indirect Loss