----------------------------------------------

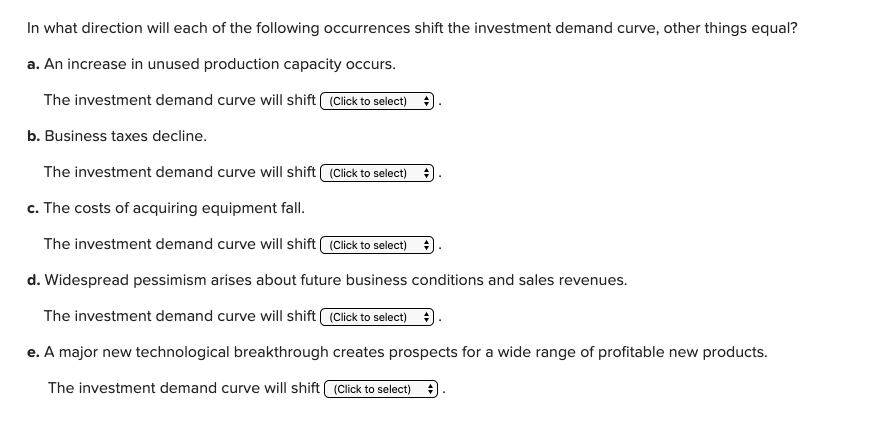

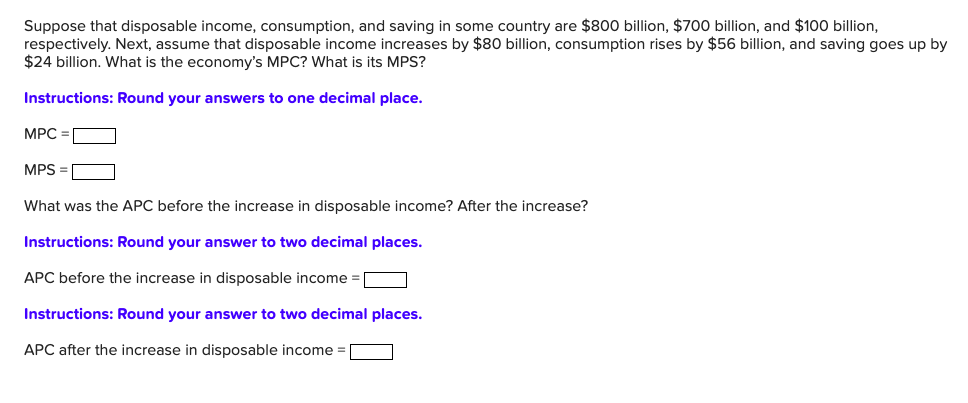

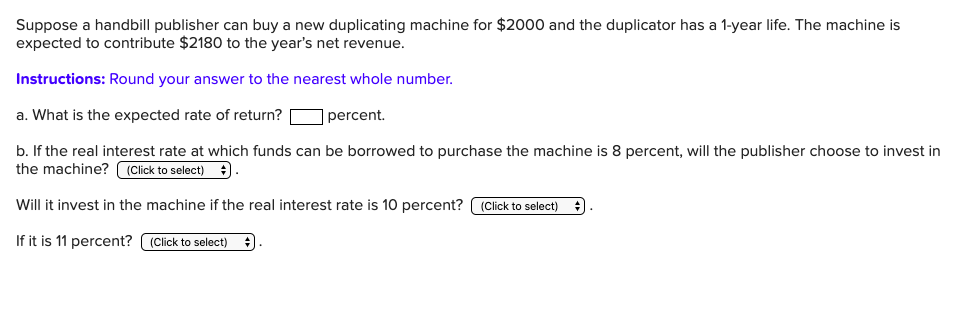

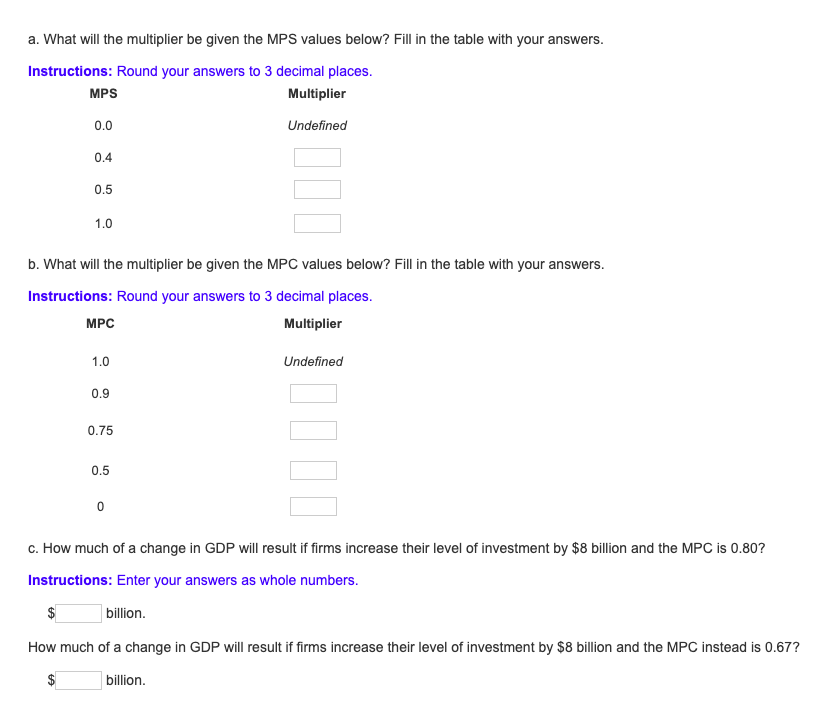

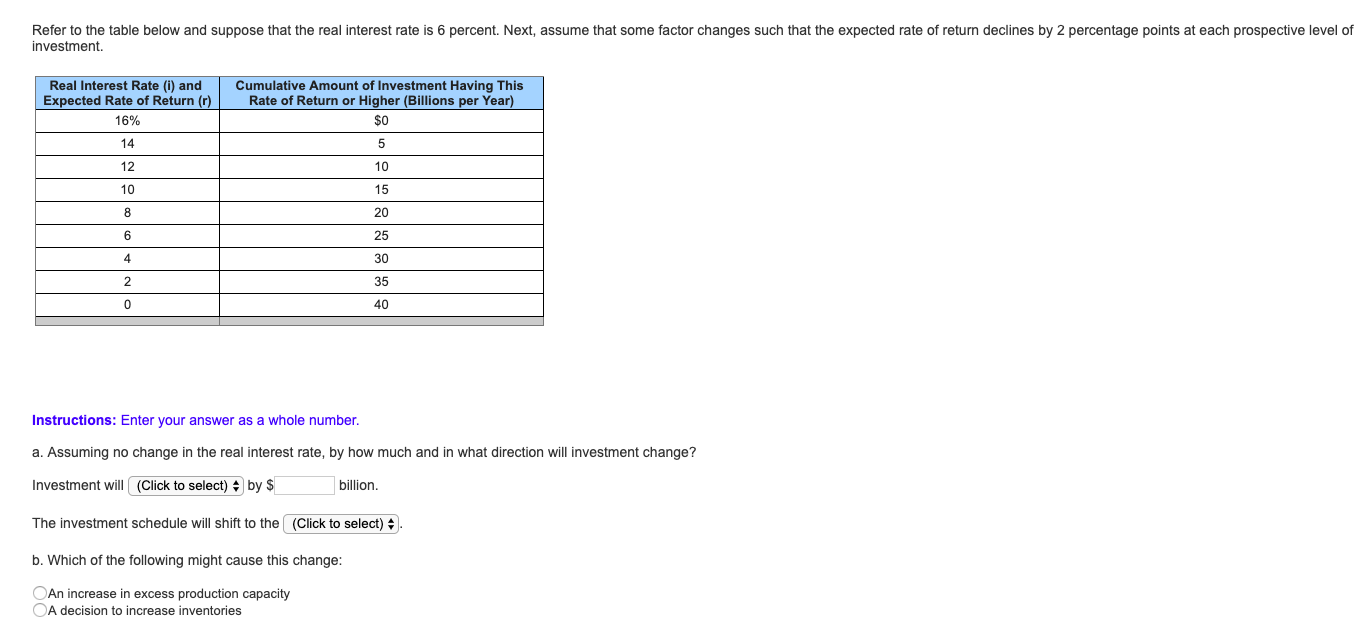

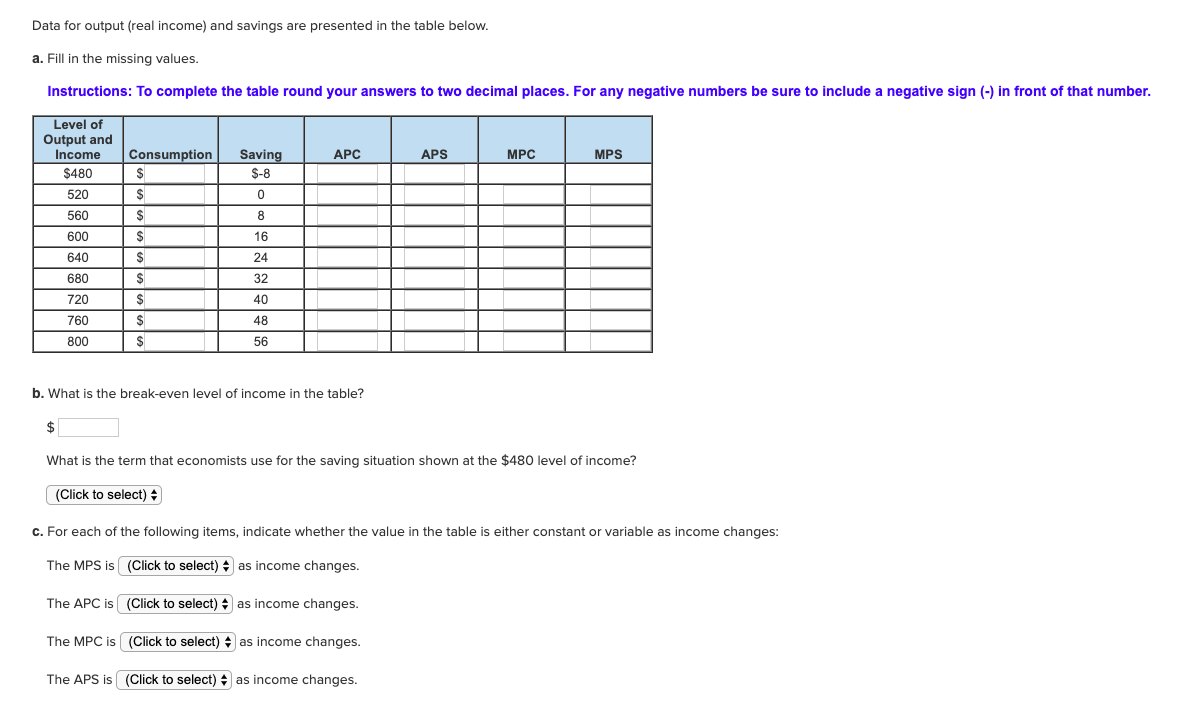

In what direction will each of the following occurrences shift the investment demand curve. other things equal? a. An increase in unused production capacityI occurs. The investment demand curve will shift . b. Business taxes decline. The investment demand curve will shift . c. The costs of acquiring equipment fall. The investment demand curve will shift . d. Widespread pessimism arises about future business conditions and sales revenues. The investment demand curve will shift . e. A major new technological breakthrough creates prospects for a wide range of protable new products. The investment demand curve will shift . Suppose that disposable income, consumption, and saving in some country are $800 billion, $700 billion. and $100 billion, respectively. Next, assume that disposable income increases by $80 billion, consumption rises by $56 billion, and saving goes up by $24 billion. What is the economy's MPC? What is its MP5? Instructions: Round your answers to one decimal place. MPC = MP5=:| 1What was the AFC before the increase in disposable income? Alter the increase? Instructions: Round your answer to two decimal places. APC before the increase in disposable income = Instructions: Round your answer to two decimal places. APC after the increase in disposable income = Suppose a handbill publisher can buy a new duplicating machine for $2000 and the duplicator has a 1-year life. The machine is expected to contribute $2180 to the year's net revenue. Instructions: Round your answer to the nearest whole number. a. What is the expected rate of return? percent. b. If the real interest rate at which funds can be borrowed to purchase the machine is 8 percent, will the publisher choose to invest in the machine? Will it invest in the machine if the real interest rate is 10 percent? . If it is '11 percent? a. What will the multiplier be given the MPS values below? Fill in the table with your answers. lnstmctlons: Round your answers to 3 decimal places. ups Multiplier 0.0 Undened 0.4 |:| 0.5 |:| 1.0 |:| b. What will the multiplier be given the MPG values below? Fill in the table with your answers. lnstmctlons: Round your answers to 3 decimal places. mac Multiplier 1.0 Undened 0.9 |:| 0.75 |:| 0.5 |:| |:| c. How much of a change in GDP will result if rms increase their level of investment by $3 billion and the MPG is 0.30? Instructions: Enter your answers as whole numbers. $|:| billion. How much of a change in GDP will result if rms increase their level of investment by $3 billion and the MPG instead is (16?? $|:| billion. Refer to the table below and suppose that the real interest rate is 6 percent. Next, assume that some factor changes such that the expected rate of return declines by 2 percentage points at each prospective level of Investment. Real Interest Rate (i) and Cumulative Amount of Investment Having This Expected Rate of Return (r) Rate of Return or Higher (Billions per Year) 16% $0 14 5 12 10 10 15 8 20 6 25 4 30 2 35 O 40 Instructions: Enter your answer as a whole number. a. Assuming no change in the real interest rate, by how much and in what direction will investment change? Investment will | (Click to select) + ) by $ billion. The investment schedule will shift to the ( (Click to select) ;) b. Which of the following might cause this change: OAn increase in excess production capacity A decision to increase inventoriesData for output {real income) and savings are presented in the table below. a. Fill in the missing values. Instructions: To complete the table round your answers to two decimal places. For any negative numbers be sure to Include a negative sign H in from of that number. b. What is the break-even level of income in the table? $ What is the term that economists use for the saving situation shown at the $480 level of income? (Click to select} : c. For each of the following items indicate whether the value in the table is either constant or variable as income changes: The MP5 is as income changes. The APC is as income changes. The MPC is as income changes. The APS is as income changes