Answered step by step

Verified Expert Solution

Question

1 Approved Answer

In which of the following situations is the person considered a non-resident of Canada, in 2019, for income tax purposes? a. Bath, a member

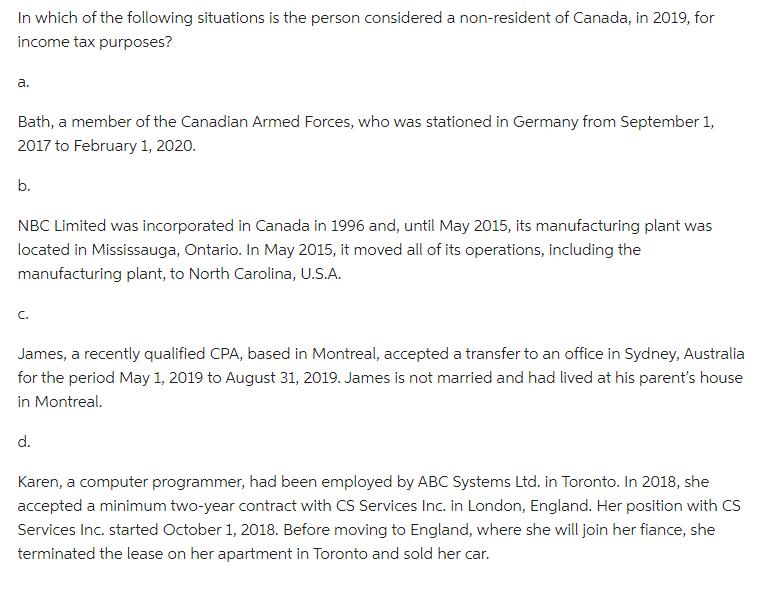

In which of the following situations is the person considered a non-resident of Canada, in 2019, for income tax purposes? a. Bath, a member of the Canadian Armed Forces, who was stationed in Germany from September 1, 2017 to February 1, 2020. b. NBC Limited was incorporated in Canada in 1996 and, until May 2015, its manufacturing plant was located in Mississauga, Ontario. In May 2015, it moved all of its operations, including the manufacturing plant, to North Carolina, U.S.A. James, a recently qualified CPA, based in Montreal, accepted a transfer to an office in Sydney, Australia for the period May 1, 2019 to August 31, 2019. James is not married and had lived at his parent's house in Montreal. d. Karen, a computer programmer, had been employed by ABC Systems Ltd. in Toronto. In 2018, she accepted a minimum two-year contract with CS Services Inc. in London, England. Her position with CS Services Inc. started October 1, 2018. Before moving to England, where she will join her fiance, she terminated the lease on her apartment in Toronto and sold her car.

Step by Step Solution

★★★★★

3.44 Rating (170 Votes )

There are 3 Steps involved in it

Step: 1

The detailed ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started