Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The Company opened three new stores on October 1, 2016. Total new store costs include $1,500,000 for land, $9,400,000 for buildings, $8,500,000 for equipment,

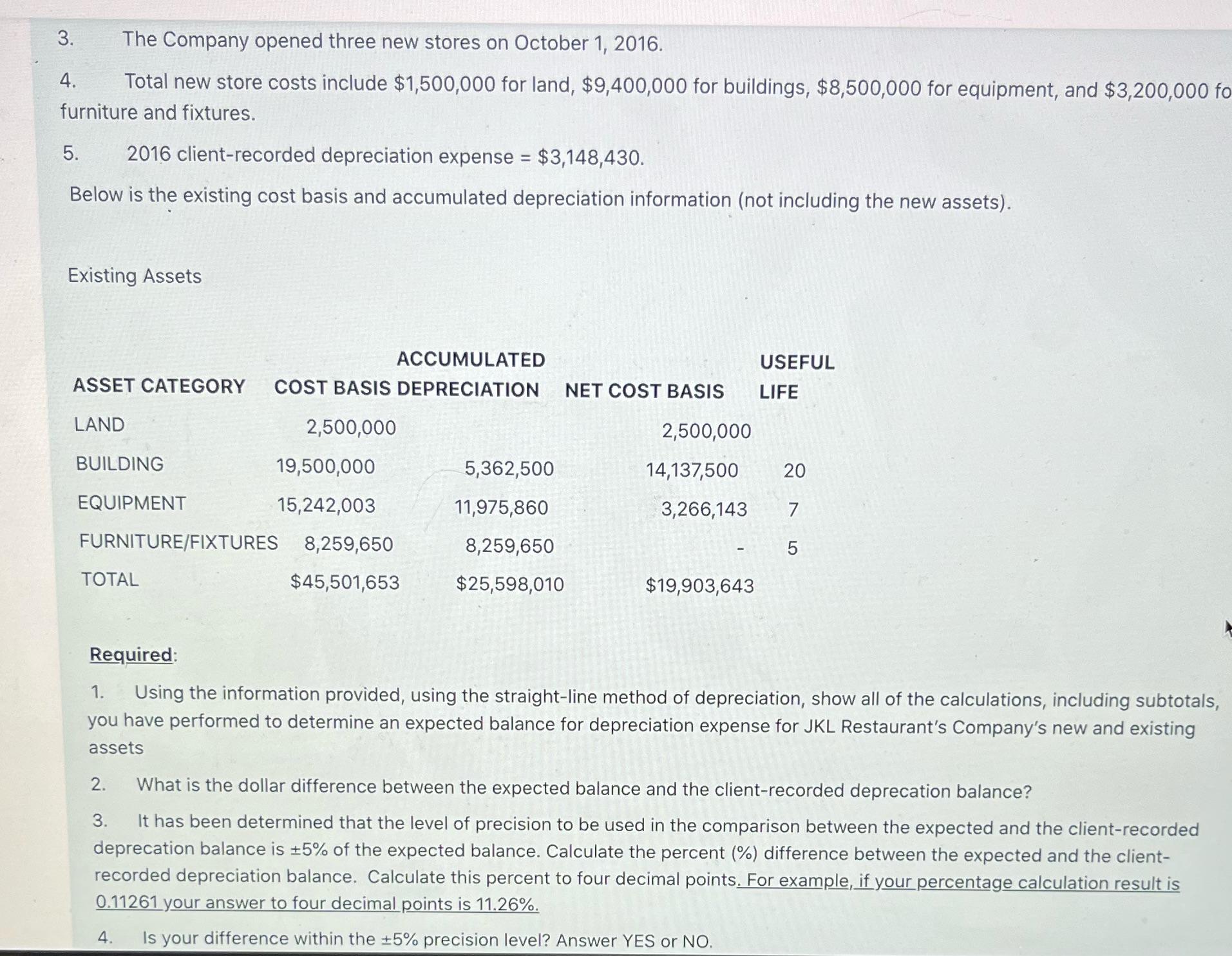

The Company opened three new stores on October 1, 2016. Total new store costs include $1,500,000 for land, $9,400,000 for buildings, $8,500,000 for equipment, and $3,200,000 fo furniture and fixtures. 3. 4. 5. 2016 client-recorded depreciation expense = $3,148,430. Below is the existing cost basis and accumulated depreciation information (not including the new assets). Existing Assets ACCUMULATED ASSET CATEGORY COST BASIS DEPRECIATION NET COST BASIS LAND 2,500,000 2,500,000 14,137,500 20 3,266,143 7 5 BUILDING EQUIPMENT FURNITURE/FIXTURES 8,259,650 $45,501,653 TOTAL 19,500,000 15,242,003 5,362,500 11,975,860 8,259,650 $25,598,010 2. 3. $19,903,643 USEFUL LIFE Required: 1. Using the information provided, using the straight-line method of depreciation, show all of the calculations, including subtotals, you have performed to determine an expected balance for depreciation expense for JKL Restaurant's Company's new and existing assets What is the dollar difference between the expected balance and the client-recorded deprecation balance? It has been determined that the level of precision to be used in the comparison between the expected and the client-recorded deprecation balance is 5% of the expected balance. Calculate the percent (%) difference between the expected and the client- recorded depreciation balance. Calculate this percent to four decimal points. For example, if your percentage calculation result is 0.11261 your answer to four decimal points is 11.26%. 4. Is your difference within the 5% precision level? Answer YES or NO.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the expected balance for depreciation using the straightline method of depreciation we need to add the annual depreciation expenses for e...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started