Answered step by step

Verified Expert Solution

Question

1 Approved Answer

In which of the following situations will a tax preparer likely incur a penalty? The tax position is supported by substantial authority and is not

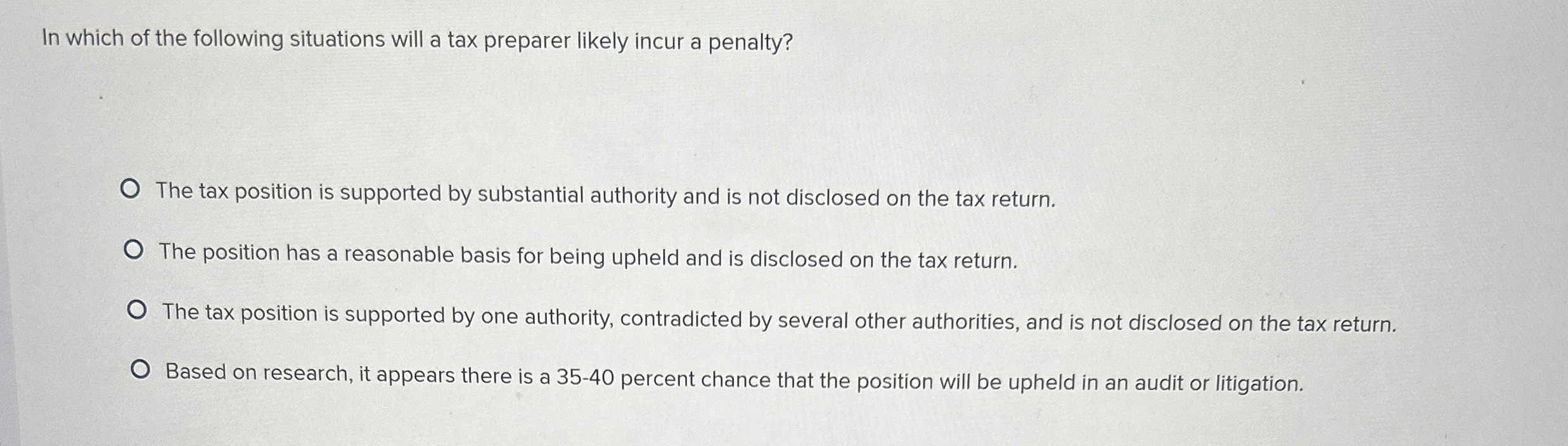

In which of the following situations will a tax preparer likely incur a penalty?

The tax position is supported by substantial authority and is not disclosed on the tax return.

The position has a reasonable basis for being upheld and is disclosed on the tax return.

The tax position is supported by one authority, contradicted by several other authorities, and is not disclosed on the tax return.

Based on research, it appears there is a percent chance that the position will be upheld in an audit or litigation.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started