Answered step by step

Verified Expert Solution

Question

1 Approved Answer

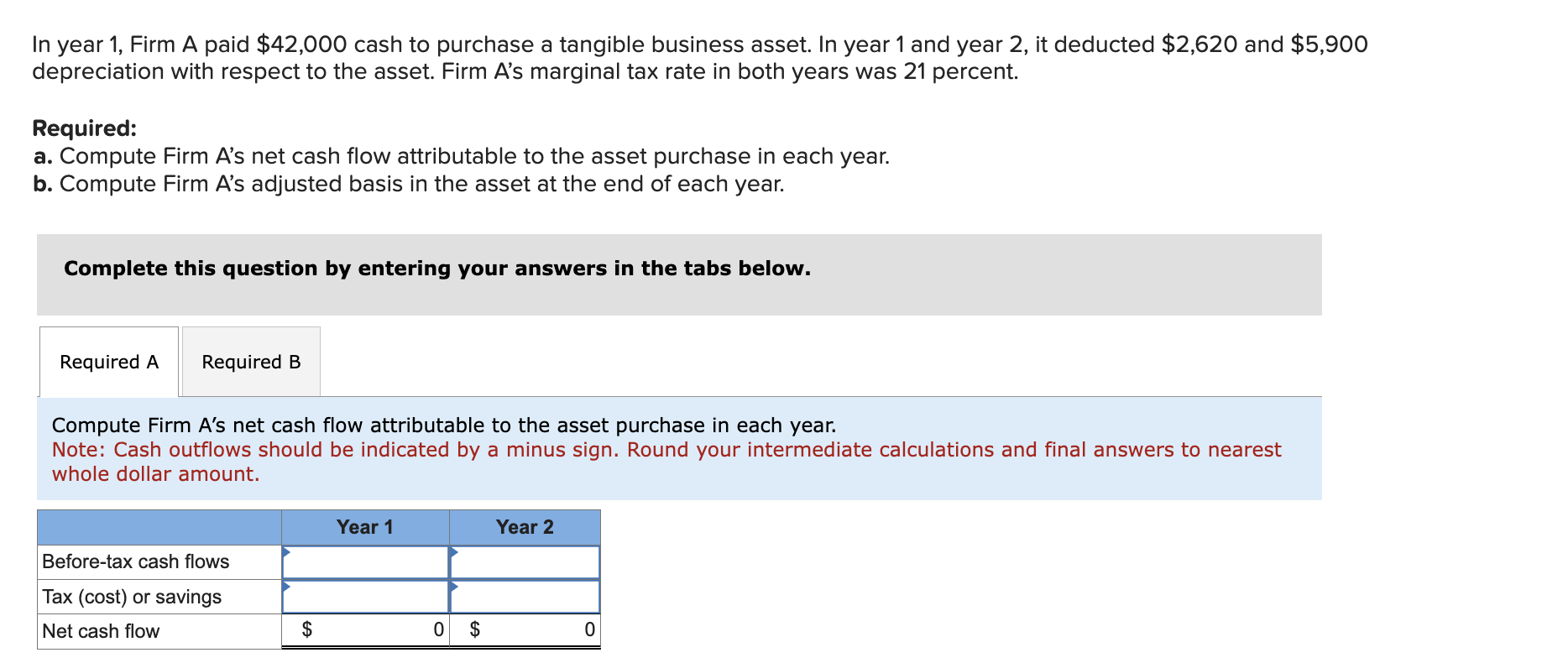

In year 1, Firm A paid $42,000 cash to purchase a tangible business asset. In year 1 and year 2 , it deducted $2,620 and

In year 1, Firm A paid $42,000 cash to purchase a tangible business asset. In year 1 and year 2 , it deducted $2,620 and $5,900 depreciation with respect to the asset. Firm A's marginal tax rate in both years was 21 percent. Required: a. Compute Firm A's net cash flow attributable to the asset purchase in each year. b. Compute Firm A's adjusted basis in the asset at the end of each year. Complete this question by entering your answers in the tabs below. Compute Firm A's net cash flow attributable to the asset purchase in each year. Note: Cash outflows should be indicated by a minus sign. Round your intermediate calculations and final answers to nearest whole dollar amount

In year 1, Firm A paid $42,000 cash to purchase a tangible business asset. In year 1 and year 2 , it deducted $2,620 and $5,900 depreciation with respect to the asset. Firm A's marginal tax rate in both years was 21 percent. Required: a. Compute Firm A's net cash flow attributable to the asset purchase in each year. b. Compute Firm A's adjusted basis in the asset at the end of each year. Complete this question by entering your answers in the tabs below. Compute Firm A's net cash flow attributable to the asset purchase in each year. Note: Cash outflows should be indicated by a minus sign. Round your intermediate calculations and final answers to nearest whole dollar amount Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started