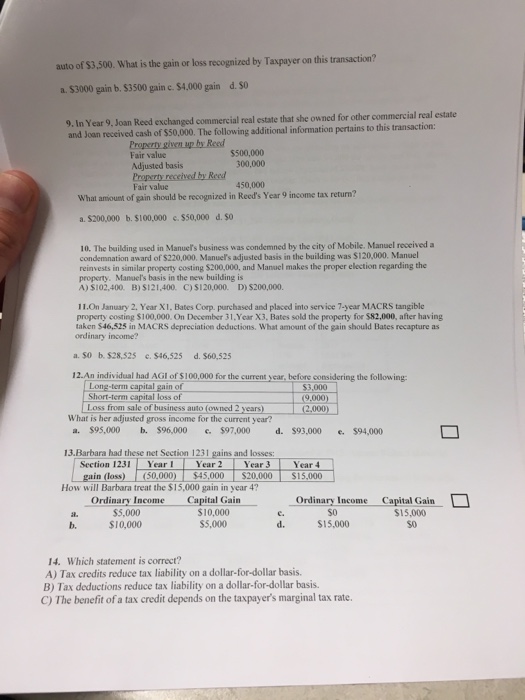

In year 9, Joan Reed exchanged commercial real estate that she owned for other commercial real estate and Joan received cash of $50,000. The following additional information pertains to this transaction: What amount of gain should be recognized in Reed's Year 9 income tax return? a. $200,000 b. $100,000 c. $50,000 d. $0 The building used in Manuel's business was condemned by the city of Mobile. Manuel received a condemnation award of $220,000. Manuel's adjusted basis in the building was $120,000. Manuel reinvests in similar property costing $200,000, and Manuel makes the proper election regarding the property. Manuel's basis in the new building is A) $102, 400. B) $121, 400. C) $120,000. D) $200,000. On January 2, Year XI, Bates Corp, purchased and placed into service 7-year MACRS tangible property costing $100,000. On December 31, Year X3, Bates sold the property for $82,000, after having taken $46, 525 in MACRS depreciation deductions. What amount of the gain should Bates recapture as ordinary income? a. $0 b. $28, 525 c. $46, 525 d. $60, 525 An individual had AGI of $100,000 for the current year, before considering the following: What is her adjusted gross income for the current year? a. $95,000 b. $96,000 c. $97,000 d. $93,000 e. $94,000 Barbara had these net Section 1231 gains and losses: How will Barbara treat the $15,000 gain in year 4? Which statement is correct? A) Tax credits reduce tax liability on a dollar-for-dollar basis. B) Tax deductions reduce tax liability on a dollar-for-dollar basis. C) The benefit of a tax credit depends on the taxpayer's marginal tax rate. In year 9, Joan Reed exchanged commercial real estate that she owned for other commercial real estate and Joan received cash of $50,000. The following additional information pertains to this transaction: What amount of gain should be recognized in Reed's Year 9 income tax return? a. $200,000 b. $100,000 c. $50,000 d. $0 The building used in Manuel's business was condemned by the city of Mobile. Manuel received a condemnation award of $220,000. Manuel's adjusted basis in the building was $120,000. Manuel reinvests in similar property costing $200,000, and Manuel makes the proper election regarding the property. Manuel's basis in the new building is A) $102, 400. B) $121, 400. C) $120,000. D) $200,000. On January 2, Year XI, Bates Corp, purchased and placed into service 7-year MACRS tangible property costing $100,000. On December 31, Year X3, Bates sold the property for $82,000, after having taken $46, 525 in MACRS depreciation deductions. What amount of the gain should Bates recapture as ordinary income? a. $0 b. $28, 525 c. $46, 525 d. $60, 525 An individual had AGI of $100,000 for the current year, before considering the following: What is her adjusted gross income for the current year? a. $95,000 b. $96,000 c. $97,000 d. $93,000 e. $94,000 Barbara had these net Section 1231 gains and losses: How will Barbara treat the $15,000 gain in year 4? Which statement is correct? A) Tax credits reduce tax liability on a dollar-for-dollar basis. B) Tax deductions reduce tax liability on a dollar-for-dollar basis. C) The benefit of a tax credit depends on the taxpayer's marginal tax rate