Answered step by step

Verified Expert Solution

Question

1 Approved Answer

In year B, Pellinore Co. buys some of the outstanding bonds of its subsidiary Sagramore Co. The resulting 'gain on constructive bond retirement and

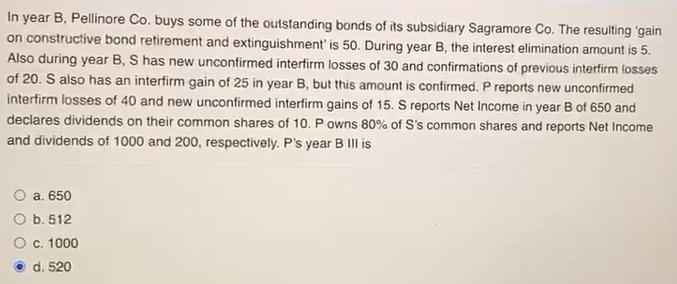

In year B, Pellinore Co. buys some of the outstanding bonds of its subsidiary Sagramore Co. The resulting 'gain on constructive bond retirement and extinguishment' is 50. During year B, the interest elimination amount is 5. Also during year B, S has new unconfirmed interfirm losses of 30 and confirmations of previous interfirm losses of 20. S also has an interfirm gain of 25 in year B, but this amount is confirmed. P reports new unconfirmed interfirm losses of 40 and new unconfirmed interfirm gains of 15. S reports Net Income in year B of 650 and declares dividends on their common shares of 10. P owns 80% of S's common shares and reports Net Income and dividends of 1000 and 200, respectively. P's year B III is a. 650 O b. 512 c. 1000 d. 520

Step by Step Solution

★★★★★

3.49 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

d 520 Pellinore Cos Net Income for year B is c...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started